Key Insights

Europe and the US are the world’s largest AI markets, with the US projected to exceed USD 143 billion by 2031

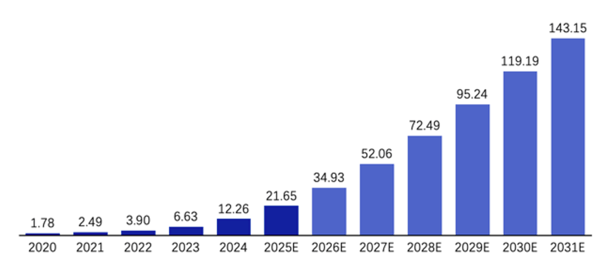

The US consistently holds about one-third of the global generative AI market, making it one of the most mature markets for generative AI commercialisation. Its market size is expected to expand from $2.5 billion in 2021 to more than $143 billion by 2031, supported by a well-established industry ecosystem and strong capital investment.

More than 50% of active users are millennials and Gen Z, with younger groups becoming the main force driving the adoption of AI applications

Generative AI users in Europe and the US are highly active in learning, socialising, and work-related scenarios, demonstrating a natural affinity for new technologies and creative ways to apply them. Compared to older demographics, younger generations show significantly higher comfort levels and responsiveness to AI products, making them the leading group driving the spread of AI applications and ecosystem growth.

91% of US advertising agencies and about 67% of European companies already use or are exploring AI-driven marketing, indicating high-growth prospects in the content creativity sector

With the rise of cross-border e-commerce and global digital marketing, businesses need to continuously produce large volumes of personalised, multilingual content to reach diverse cultural and consumer groups. The application of AI in advertising, video, and multilingual content generation is rapidly gaining traction, enabling brands to deliver multilingual, rapidly iterative creative output at lower costs. Platforms such as Runway, Synthesia, and Canva are key catalysts of industry innovation.

AI investment scale in Europe and the US continues to surge, positioning the region as a priority market for global AI companies

In 2024, private AI investment in the US reached $109.1 billion, accounting for approximately 75% of the global total, and has given rise to an ecosystem centred around Microsoft, Google, and Amazon. At the same time, the US has established a safety and transparency-oriented regulatory framework through initiatives such as the Blueprint for an AI Bill of Rights and the Executive Order on the Safe, Secure, and Trustworthy Development and Use of Artificial Intelligence. The European AI sector (primarily Western Europe) is also developing rapidly, with investment projected to reach $250 billion by 2029, more than 90% of which will be concentrated in Western Europe. The Europe-US AI market represents a model characterised by capital-driven growth combined with institutional safeguards, offering significant market opportunities for the future development of AI enterprises and forming a highly competitive landscape for globally oriented AI companies.

Europe and the US: high priority markets for AI innovators

Europe and the US are core engines of global artificial intelligence (AI) development, especially in the field of generative AI, where technological breakthroughs are combined with commercialisation opportunities. With some of the world’s most mature consumer bases and application environments, Europe and the US are not only the frontier of technological innovation but also key target markets for AI companies looking to expand internationally. Which high-potential sectors are emerging in the Europe-US market? How should generative AI vendors approach market entry? What challenges and opportunities might they face as they expand globally?

The state of generative AI in Europe and the US: global leaders in AI adoption

Explosive market growth and untapped market potential

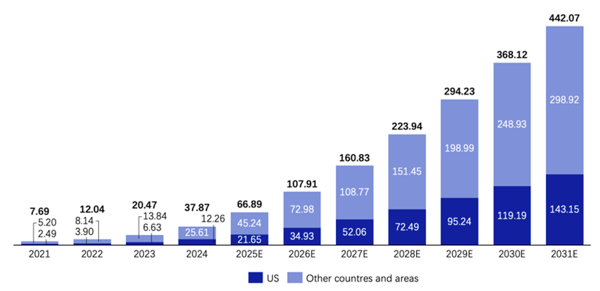

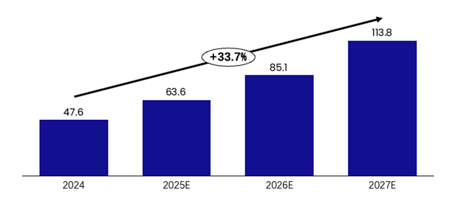

Europe and the US are at the forefront of generative AI adoption, with market maturity and corporate investment levels setting the benchmark for global development. Market forecasts indicate that generative AI will continue to experience explosive growth over the next decade, with the global market size expected to grow from $7.69 billion in 2021 to $442 billion in 2031. Within this, the US consistently accounts for around one-third of the global share, expanding from an estimated $2.5 billion to over $143 billion, with growth peaking at 85% in 2024 before gradually entering a stable growth trajectory. According to IDC’s Worldwide Artificial Intelligence and Generative AI Spending Guide, the European AI and generative AI market size is expected to reach nearly $47.6 billion in 2024, with a compound annual growth rate (CAGR) of 33.7% during the 2022–2027 forecast period, making up about one-fifth of the global AI market.

Global and US generative AI market size and trend forecast (in billion USD), 2021–2031

Source:Statista

US generative AI market size and growth rate (in billion USD), 2021–2031

Source:Statista

European AI market size and growth rate (in billion USD), 2024-2027

Source:IDC

The Europe-US generative AI market is not only experiencing rapid growth in scale but also demonstrates significant potential for generating industry value, establishing itself as the world’s most important frontier for innovation and commercialisation. According to a McKinsey 2023 report, generative AI could deliver $2.6 trillion to $4.4 trillion in annual economic impact across 63 typical use scenarios in various industries such as finance, retail, manufacturing, and healthcare. The US market, with its highly digitalised industrial base and rapid AI adoption, is poised to be one of the main contributors to this value creation.

From text and image generation to multimodal expansion

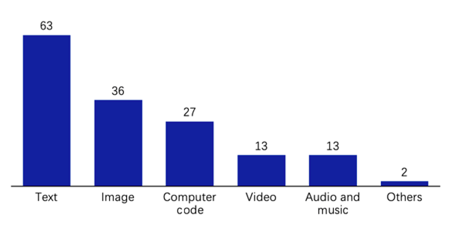

In Europe and the US, generative AI applications have formed a multi-layered landscape, with text generation being the most mature and widely adopted. Since ChatGPT ignited the market at the end of 2022, writing assistants, Q&A systems, and document generation tools have rapidly become standard tools for both individual and enterprise users. Users primarily utilise text generation for tasks like writing emails, creating marketing copy, summarising reports, and drafting legal documents, significantly improving daily work efficiency and knowledge management. For enterprises, text generation is no longer just a support tool but is gradually being embedded into customer relationship management and internal knowledge bases, becoming an integral part of digital operations.

Developing in parallel with text generation is image generation. Thanks to breakthroughs in diffusion models and generative adversarial networks, the US market has seen the emergence of tools focused on image creation, such as MidJourney, Stable Diffusion, and DALL·E. These products are widely used in advertising design, brand marketing, game art, and pre-production creative work for film and television, providing creators with high-efficiency, low-cost solutions. An increasing number of enterprises are integrating AI image generation into their creative workflows to meet the demand for personalised and diversified visual content. Simultaneously, AI-generated images are increasingly used to capture attention on social media and e-commerce platforms, driving a fundamental transformation in the production methods of the visual content industry.

Distribution of content types created by enterprises using generative AI, 2024

Source: McKinsey

Beyond text and image generation, code generation has become an important breakthrough for generative AI in professional fields. Research analysing 80 million commits on GitHub between 2018 and 2024 showed that by the end of 2024, approximately 30.1% of Python functions submitted by US developers were AI-generated, significantly higher than the 11.7% for Asian developers. This difference indicates that the US has formed a relatively mature ecosystem for AI-assisted programming. More notably, when a developer’s AI usage ratio increases to 30%, their quarterly commit volume increases by an average of 2.4%, indicating that AI generation not only lowers the development barrier but also brings quantifiable productivity gains.