Key Insights

Europe leads global tourism with 756 million international arrivals, though growth of 6.4% lags behind other regions

Europe remains the world’s largest tourism destination, welcoming 756 million international arrivals and maintaining a clear scale advantage. However, performance varies across regions. Southern Europe is leading the recovery, while Central and Eastern Europe recorded the fastest growth last year but have yet to return to pre-2019 levels. Traditional destinations such as Spain, Italy, France and Germany continue to anchor the market, while emerging hotspots including Serbia, Bulgaria and Montenegro are rising rapidly, creating a more diversified market landscape.

1.16 billion trips by EU residents with an average spend of EUR 485 per trip

Europe boasts one of the world’s most active inbound, outbound and domestic travel markets. Combined with its mature holiday system, this provides a stable consumption base. The premium segment favours bespoke and luxury experiences, while the mass market values affordability and short-haul travel. Together, these segments form a dual-engine model in which the mass market ensures volume and the high-end market drives value.

178 million air passengers as low-cost carriers dominate short-haul routes

In 2024, total flight volumes across Europe recovered to over 96% of 2019 levels. Statista data shows that the region recorded approximately 178 million air passengers in 2024, a figure expected to surpass 225 million by 2030. Europe’s top ten airlines reflect a mix of low-cost and full-service carriers. Budget airlines such as Ryanair and easyJet dominate the regional short-haul market, while traditional players including Lufthansa and Air France-KLM leverage their hub networks to retain an advantage on intercontinental routes.

Two international OTA giants hold 85% of the market

The European online travel agency (OTA) sector is led by global giants Booking and Expedia, which together control around 85% of the hotel-booking market. Local and niche players complement them in specific areas such as rail, holiday packages and low-fare flights. For cross-border firms entering Europe, direct competition can be challenging; localisation, strategic partnerships and compliant payment innovation provide more practical routes to differentiation.

Europe: the world’s largest tourism destination and a major outbound source market

Europe, with its rich cultural heritage and mature tourism ecosystem, has long occupied a central role in the global travel market. Drawing on deep historical roots, highly diversified resources and strong regional connectivity, it continues to attract travellers across all spending levels. In recent years, the market has been transformed by digitalisation, growing demand for sustainable travel and increasingly segmented consumer behaviour.

Looking ahead, Europe’s tourism industry faces key questions: how to balance tradition with modernity, scale with sustainability, and standardisation with personalisation? How will local groups and international platforms compete and collaborate? And how can ecosystem partners respond to ever-evolving consumer expectations?

Europe’s travel industry stabilises and evolves amid shifting global tourism trends

The industry shows a steady and comprehensive recovery, with regional differentiation emerging

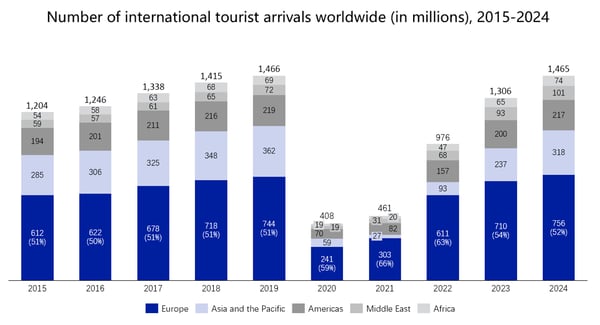

Europe continues to be the world’s largest tourism destination, consistently accounting for more than half of global international arrivals. According to UN Tourism, Europe welcomed about 756 million international visitors in 2024, a historic high surpassing 2019 levels, alongside similar recoveries in the Middle East and Africa. While total arrivals paint an optimistic picture, Europe’s growth rate remains modest compared with other regions. In 2024, international arrivals to Europe increased by 6.4% year-on-year, the slowest among the five major regions, trailing the Asia-Pacific’s 33.7% and Africa’s 13.5%.

Number of international tourist arrivals worldwide, by region, 2015-2024

Source: UN Tourism,Statista

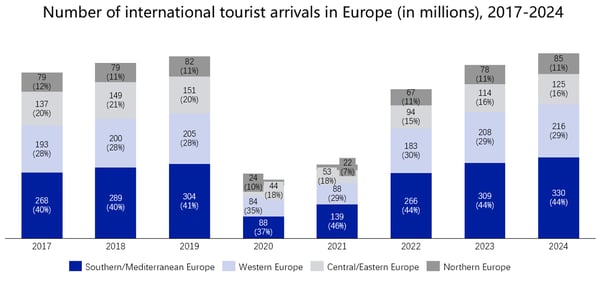

The recovery of Europe’s tourism market has been uneven, with clear differences across subregions. Southern and Mediterranean Europe—the continent’s main tourism hubs—have rebounded fastest since 2020, posting a compound annual growth rate of 39% in international arrivals. Western Europe ranks second and has already returned to 2019 levels. Central and Eastern Europe recorded the highest year-on-year growth in international visitors in 2024, though arrivals there remain below pre-pandemic levels.

Number of international tourist arrivals in Europe, by region, 2017-2024

Source: UN Tourism,Statista

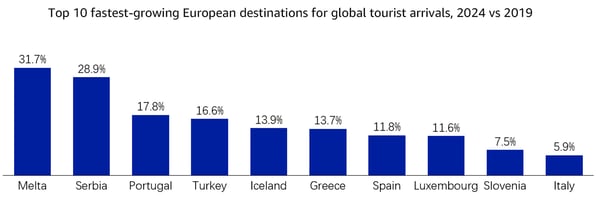

Traditional tourism powerhouses such as Spain, Italy, France and Germany continue to drive the overall recovery. In 2024, these four countries accounted for 61.6% of total overnight stays in the EU, led by Spain with 500 million and Italy with 458 million. At the same time, several non-traditional destinations, including Serbia, Bulgaria and Montenegro, are showing strong growth potential. This trend suggests that while classic destinations remain dominant, travellers are increasingly seeking out emerging markets that offer better value and distinctive experiences.

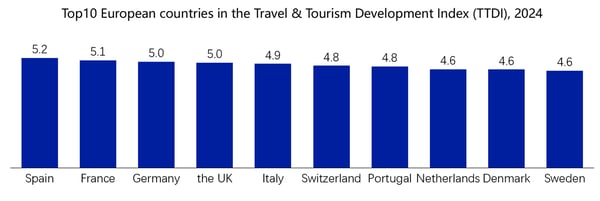

Destination theming gives each country a clear identity

Europe’s competitive edge as a destination is shifting from broad multi-country sightseeing towards themed, in-depth experiences. Each country has developed its own clear positioning based on its natural and cultural assets. Italy and France lead with art and cultural heritage; Spain attracts value-conscious travellers with sun, beaches and lively festivals; Greece, with Santorini’s romantic appeal, remains a favourite for honeymoons. Northern Europe focuses on pristine nature and sustainable tourism — Iceland’s Northern Lights and Norway’s fjords draw high-spending outdoor enthusiasts — while Croatia has broken through by leveraging film and television IPs. The Czech Republic and Hungary, meanwhile, appeal to heritage lovers seeking medieval architecture and affordability.

Top 10 European countries in the Travel & Tourism Development Index (TTDI), 2024

Source: World Economic Forum

|

“A major focus of the ‘Tourism Year’ is promoting lesser-known European destinations to Asian travellers… We are not Paris, we are not Switzerland. We will work with Luxembourg and France’s Champagne region to promote ‘Ardennes’ tourism.” —Dominique André, Overseas Market Manager, Wallonia Belgium Tourism Board |

Thematic tourism is extending to regional and experiential levels. In Southern Europe, “slow travel” has taken hold — Spain’s Camino de Santiago is evolving into a spiritual journey, while Tuscan cooking courses and Provence farm stays appeal to immersive lifestyle seekers. In the north, “aurora hunting”, icebreaker expeditions and luxury Arctic cruises target premium travellers. Copenhagen and Stockholm promote green mobility, while London and Berlin are introducing AI-guided tours to enhance their smart-city credentials. This thematic diversification helps reduce homogeneity and supports a multi-layered destination ecosystem across Europe.

Top 10 fastest-growing European destinations for global tourist arrivals, 2024 vs 2019

Source: European Travel Commission, TourMIS,Statista