Key Insights

Latin America’s SaaS market expected to exceed USD 30 billion by 2030, with Brazil holding a 44% share

Latin America’s software-as-a-service (SaaS) sector is entering a period of rapid adoption, with a projected compound annual growth rate (CAGR) of around 25% from 2024 to 2030, well above the global average. Brazil, underpinned by its advanced cloud infrastructure and strong innovation ecosystem, accounts for close to half of the region’s market and remains its primary growth engine. It continues to be the main entry point for SaaS companies expanding into Latin America.

Small and medium-sized businesses emerge as the core user group, with 75% planning to increase cloud spending

More than 98% of enterprises in Latin America are small and medium-sized enterprises (SMEs), and their strong demand for digital transformation – combined with existing capability gaps – creates a substantial market opportunity. SaaS, with its cost-effective, subscription-based and easily deployable model, provides SMEs with an affordable route to digitalisation. According to IDC, 75% of SMEs plan to increase their cloud spending, and this segment is expected to remain the most stable and sustainable driver of growth for SaaS providers.

As SaaS becomes more industry-specific and financially embedded, it evolves from a functional tool into essential business infrastructure

The rapid growth of e-commerce and fintech is pushing SaaS deeper into industry-specific use cases and increasing enterprise demand for integrated, intelligent solutions. Today, more than 40% of vertical SaaS providers offer embedded payment and credit features, making their software an integral part of the companies’ operations, which strengthens user retention and improves profitability. This marks a broader shift in the industry value chain as SaaS evolves from standalone functional tools into essential operational infrastructure.

Average CAC payback of 6 to 12 months highlights Latin America’s SaaS efficiency advantage

Research indicates that 60% of Brazilian SaaS companies recover their customer acquisition costs (CAC) within six months, with leading firms achieving payback at a pace roughly one-third faster than their US counterparts. The capital-constrained environment pushes companies to focus more on maintaining a healthy cash flow and return on investment, making Latin America one of the most efficient regions in the world for SaaS capital returns.

Unveiling Latin America’s cloud landscape: a long-overlooked digital goldmine

Over the past decade, as enterprises expand their digital transformation efforts, the global SaaS industry has also evolved, shifting from a focus on technology to use cases. Meanwhile, emerging markets that once lacked the necessary foundations for large-scale SaaS adoption are now developing favourable conditions for such a transformation, supported by improved infrastructure, policy momentum and more mature business models. Latin America is one of the most prominent examples of this shift.

With increasing internet penetration, growing investment in cloud computing, the establishment of electronic payment systems and the rise of local technology enterprises, the region is undergoing a critical transition. Having started from less favourable conditions, Latin America is now laying a far stronger foundation for SaaS adoption.

While the region presents compelling opportunities, several questions merit close attention: Is this a short-term window or evidence of longer-term growth? How will local innovation intersect with international expertise? And which types of businesses are best positioned to benefit first from this structural transformation?

A region on the rise: Latin America emerges as the next frontier in global SaaS growth

Latin America’s SaaS growth surpasses the global average as the region enters an early expansion phase

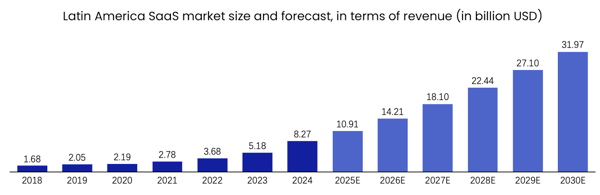

In recent years, Latin America’s SaaS industry has moved firmly into the global spotlight. According to Statista, the region’s SaaS market was valued at approximately $8.3 billion in 2024 and is projected to reach $31.9 billion by 2030, representing a CAGR of 24.88%. This growth rate not only exceeds the global average but also outpaces mature markets such as East Asia and Europe, reflecting the region’s strong momentum in digital transformation.

Latin America SaaS market size and forecast, 2018–2030

Source: Statista

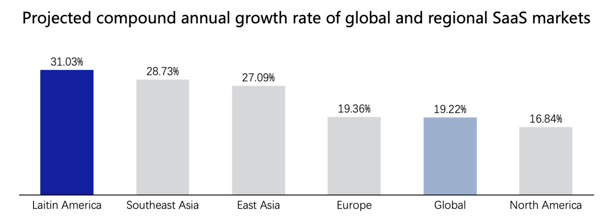

Projected CAGR of global and regional SaaS markets, 2024–2030

Sources: Statista, iResearch

The high growth rate of the Latin American SaaS market is closely linked to its stage of development. SaaS penetration in the region remains relatively low, meaning many enterprises are still in the process of moving from on-premises systems to the cloud. As a result, market expansion is driven largely by first-time adoption, whereas in mature markets growth tends to come from competition among established providers. This early adoption phase is also fuelling rising demand for process standardisation, efficiency management and data visualisation. As adoption deepens, SaaS is becoming more tightly integrated into business operations, shifting from a supportive add-on to a core part of how companies run. This reflects a long-term structural trend rather than a short-lived rebound, giving the region’s SaaS growth a solid and sustainable foundation.

Brazil remains the core growth engine as Mexico and Colombia gain momentum

Looking at the region as a whole, Latin America’s SaaS market is currently centred on Brazil but is gradually shifting towards a more multipolar structure.

Each major economy has its own industrial profile, level of digital readiness and policy environment, and their complementary strengths form a multi-layered growth engine for the region’s SaaS ecosystem.

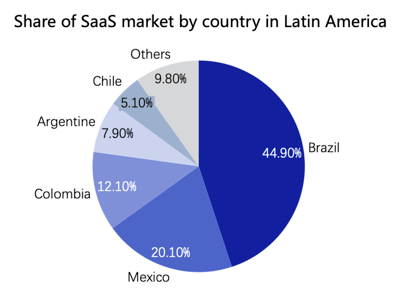

Share of SaaS market by country in Latin America, 2024

Source: Grand View Research

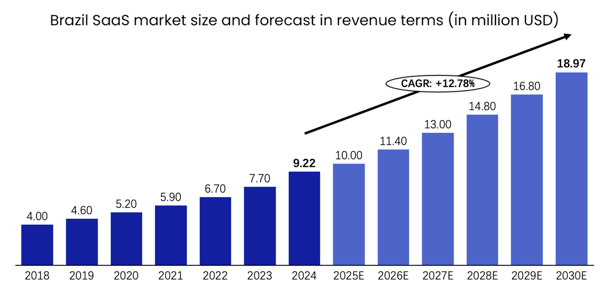

Brazil is not only the largest market within Latin America’s SaaS sector but also the primary driver of overall growth. In 2024, Brazil accounted for about 44.9% of the market, with a market size of approximately $9.22 million, leading the region in number of enterprises, capital investment and cloud infrastructure. More importantly, Brazil’s growth momentum remains strong. By 2030, its market size is expected to reach about $18.97 million, with a CAGR of 12.78% between 2025 and 2030, pointing to a steady growth trajectory and reinforcing its position as the region’s most reliable growth engine.

Brazil SaaS market size and forecast, 2018–2030

Source: Grand View Research

Meanwhile, Mexico is emerging as the second most important growth engine of Latin America’s SaaS sector, accounting for about 20% of the market in 2024. It offers several major advantages, including a large economy, rapidly developing manufacturing and cross-border e-commerce sectors and close ties to the North American industrial chain. Together, these factors are driving strong demand for SaaS that helps with process management, supply chain coordination, payments and marketing automation. In addition, Mexico’s comparatively high levels of digitalisation and international integration make it an attractive market for both global SaaS providers and local innovators.

Colombia, which accounts for around 12% of the market, and Argentina, with an 8% share, from the region’s middle tier, where SaaS adoption is growing across industries such as finance, retail, logistics and the public sector. Colombia has made rapid progress in cloud infrastructure and its start-up ecosystem in recent years, making it a popular testing ground for SaaS providers in the region. Argentina, meanwhile, has produced several local SaaS companies with regional influence, supported by high educational levels and a strong pool of tech talent. Although Chile represents only about 5% of the Latin American market, it ranks among the top in digitalisation, policy transparency and enterprise SaaS spending. By prioritising certain industries such as finance, energy and education, Chile has carved out a differentiated position as a smaller market with strong, well-developed SaaS penetration.