Key Insights

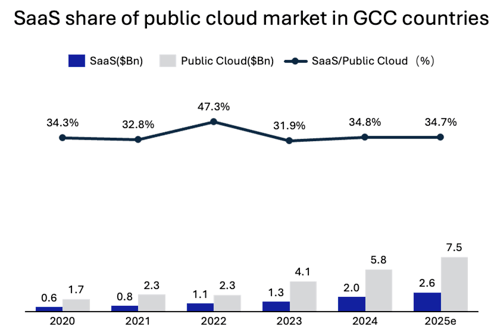

Global cloud providers compete in the Middle East, with SaaS accounting for over one-third of the public cloud market

Global cloud leaders are accelerating their expansion in the Middle East. AWS has announced a USD 5.3 billion investment to establish a new cloud region in Saudi Arabia, while Microsoft has partnered with Dubai-based telecom operator to build a $545 million hyperscale data centre. Google Cloud, Alibaba Cloud and Huawei Cloud have also set up regional nodes across Saudi Arabia and the UAE. In the Middle Eastern public cloud market, SaaS accounts for more than one-third of total share, standing out from other regions where IaaS remains dominant.

SaaS market growing at over 29% annually, with GCC countries’ share rising to 38% as the core growth engine

The SaaS market in the Middle East and North Africa is expanding rapidly, with projected revenue reaching $6.8 billion in 2025 and a CAGR of 29.3%. GCC countries are growing even faster at 34.4%, with their share rising from 30.9% to 38.1%, making them the primary driver of regional digital transformation. Saudi Arabia and the UAE together account for 57% of the market, while Qatar — with a CAGR above 30% — has emerged as the most dynamic growth hub among the region’s emerging markets.

Banking and financial demand leads the market, with large enterprises accounting for 60–65% and preferring private cloud deployment

The banking and financial services sector contributes around 20% of SaaS market share. Large enterprises account for 60–65% of overall demand, while SMEs, growing at 21%, are becoming a key source of incremental growth. Private cloud continues to be the preferred deployment model, while hybrid configurations are expanding quickly, offering enterprises a balance between flexibility and control.

High compliance, high costs and low localisation present the three core challenges of the Middle Eastern SaaS market

Strict data-sovereignty regulations have pushed up compliance and infrastructure costs. High bandwidth and labour expenses, combined with a price-sensitive customer base, limit market penetration. At the same time, linguistic, religious and business-cultural differences add to localisation complexity, making standardised products difficult to replicate directly. To achieve sustainable growth, SaaS providers need to balance compliance, localisation and cost efficiency.

The cloud war in the Middle East: global giants build data centres across the desert

Driven by national digital agendas and the need for energy-sector transformation, the Middle East has entered a critical phase of digital development. Once viewed as a “digital desert,” the region has become a strategic battleground for global cloud service providers. AWS, Microsoft and Google, together with Chinese players such as Alibaba Cloud and Huawei Cloud, are making substantial investments across Saudi Arabia, the UAE and other core markets.

Amid this wave of cloud-infrastructure expansion, the region’s SaaS market shows distinctive characteristics: SaaS accounts for over one-third of public cloud services, far higher than the global average. As Gulf economies scale up their digital ambitions and enterprise demand accelerates, key questions follow: what kind of SaaS ecosystem will take shape in this high-growth landscape, and under strict compliance requirements and a distinct cultural context, which products and services are best positioned to succeed?

The Middle East becomes a key battleground as global cloud leaders race to establish presence

AWS, Microsoft, and Google accelerate their regional expansion

The Middle East has become a strategic market for the world’s leading cloud service providers. Global players such as AWS, Microsoft Azure, and Google Cloud are rapidly building regional data centres and availability zones in Saudi Arabia, the UAE, and Doha to better serve clients in government, finance, and energy sectors.

In June 2019, Microsoft opened its first Middle Eastern data centres in Abu Dhabi and Dubai, offering Azure and Office 365 cloud services. In December 2024, Microsoft announced the completion of three new data centres in Saudi Arabia, expected to go live in 2026. In April 2025, Dubai telecom operator du (Emirates Integrated Telecommunications Company) announced a partnership with Microsoft to construct a hyperscale data centre valued at AED 2 billion (approximately $545 million).

Microsoft launches two new cloud regions in the UAE, June 19, 2019

Source: Microsoft News Center

In July 2019, Amazon Web Services launched its first Middle Eastern region in Bahrain. In August 2022, AWS opened a new cloud region in the UAE to support the nation’s digital transformation and economic diversification. In May 2024, AWS announced a $ 5.3 billion investment to build a new cloud region in Saudi Arabia, scheduled for launch in 2026.

Google Cloud entered the Middle Eastern market through a joint venture with Saudi Aramco in 2020 to provide cloud services in Saudi Arabia and the wider region. In March 2023, Google Cloud launched its Doha region in collaboration with Qatar’s Ministry of Communications and Information Technology and the Qatar Free Zones Authority to meet rising cloud demand across the Middle East.

Alibaba Cloud, Huawei Cloud, and Tencent Cloud rapidly catch up

Amid ongoing economic diversification across the Gulf region, Alibaba Cloud, Huawei Cloud, and Tencent Cloud are expanding their presence through partnerships with regional telecom operators. Chinese cloud providers are becoming major forces in the Middle Eastern cloud ecosystem.

In 2016, as part of Dubai’s “Smart City” initiative, Alibaba Cloud opened its first Middle Eastern data centre in Dubai, extending its cloud services across the region. In May 2023, Alibaba Cloud established a joint venture with Saudi Telecom and eWTP Capital and launched two data centres in Riyadh in June to serve the Saudi market. In 2025, Alibaba Cloud opened its second data centre in Dubai and announced a three-year plan to invest RMB 380 billion (about $52.7 billion) in data infrastructure.

Alibaba Cloud opens its second data centre in Dubai, October 14, 2025

Source: Aletihad

Huawei Cloud officially established its Middle Eastern division in 2020 and announced a $400 million investment over five years in September 2023, opening a data centre in Riyadh. In May 2024, Huawei launched a public cloud node in Cairo, becoming the first provider to establish such a presence in Egypt. Riyadh now serves as Huawei’s central hub for the region, with 10 CDN nodes covering the UAE, Saudi Arabia, Iraq, Qatar, Oman, Kuwait, and Bahrain.

Tencent Cloud began its Middle Eastern operations in 2021 with a data centre in Bahrain, followed by the creation of a regional business team. It entered a strategic partnership with Mobily, Saudi Arabia’s second-largest telecom operator, to deliver secure, flexible cloud solutions. In February 2025, Tencent Cloud opened its first data centre in Saudi Arabia, aiming to expand services aligned with local innovation needs.

SaaS takes the lead in the Middle Eastern cloud market and grows the fastest amid fragmented competition

While the global cloud market has seen the fastest growth in IaaS, with global year-on-year growth reaching 33.9% and SaaS representing the smallest share, the Middle East presents a different pattern. SaaS accounts for about one-third of public cloud service revenue in the region, significantly higher than the global average.

SaaS share of public cloud market in GCC countries

Source: Statista

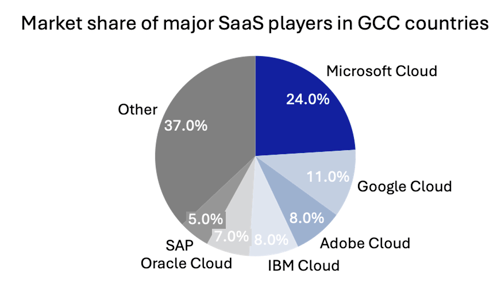

The Middle Eastern SaaS market remains relatively fragmented. Oracle, SAP, Salesforce, Microsoft, and Workday dominate foundational cloud layers and enterprise-level SaaS, driving IaaP, PaaS, and high-value applications. They hold leading positions and partner closely with regional champions such as du, G42, e&, and STC. Strategic agreements have set regional investment benchmarks, illustrated by Microsoft’s AED 2 billion infrastructure plan with du, AWS’s $1 billion expansion agreement with e&, and Oracle’s cross-border bank deployment with Mashreq.

Market share of major SaaS players in GCC countries

Source: Statista

Meanwhile, local SaaS innovators are rising rapidly, leveraging deep understanding of local culture, language, and regulatory environments to capture niche markets. In e-commerce enablement, Salla in Saudi Arabia now serves more than 68,000 active merchants, while Zid supports thousands of local sellers and has become a key platform for digital retail operations. In financial and payment SaaS, Mamo Pay in the UAE provides Sharia-compliant payment and collection solutions for small and medium enterprises and has established a stable foothold among local financial clients. In HR and payroll management, Bayzat and FlexxPay in the UAE offer payroll automation, employee benefits administration, and earned-wage access, strengthening their localised advantage.

Major SaaS enterprises in the Middle East

Source: Statista