Key Insights

120 million international arrivals; Mexico and Brazil generate over 75% of regional travel output

In 2024, the travel and tourism industry in LAC (Latin America and the Caribbean) contributed approximately USD 714 billion to the regional economy, representing 10% of total GDP. One in every 11 jobs in the region is linked to the sector. However, the market remains highly uneven, with a small number of countries capturing the majority of revenue and transactions.

US and Canadian visitors make up over 80% of Mexico’s inbound tourists; Asia-Pacific travellers arrivals to Brazil grow 35% YoY%

Latin American destinations are primarily driven by intra-regional travel and US visitors. North American travellers are considered high-value due to their strong spending power and demand during peak seasons. The Asia-Pacific market, led by China, is emerging as a fast-growing segment. By Q3 2025, Asia-Pacific travellers arrivals to Brazil had already surpassed the full-year total of 2024, making China one of Brazil’s fastest-growing source markets.

LCC capacity reaches 16.4 million seats, growing at twice the rate of FSCs

Scheduled commercial aviation capacity in Latin America hit a record 41.2 million seats in June 2025. While full-service carriers (FSCs) account for around 60% of the market, capacity expansion is led by low-cost carriers (LCCs), which reached 16.4 million seats—double the growth rate of FSCs.

Medical tourism reaches $10.3 billion; 6.9 million visits to Mexico for medical travel

Driven by medical costs, specialised expertise and geographic proximity, medical tourism has become a high-value niche market in Latin America. The sector is expected to grow from $10.3 billion in 2024 to $41.3 billion by 2032, with an average annual growth rate of 18.9%.

Latin America: a diverse and fragmented market with rising potential

Latin America is emerging as a high-potential destination in global tourism, attracting international visitors and investment through its unique culture, natural resources, and open-policy environment. From Mexico’s beach resorts and Brazil’s Carnival to adventure tourism in Chile and Peru, the region shows strong momentum in “experience + culture” products. Favourable exchange rates, visa facilitation, and the expansion of digital payments are further driving consumption upgrading and internationalisation. However, market fragmentation, inconsistent branding, and structural barriers continue to create uncertainty. How can international players navigate differing policies and currencies? Can local culture and global brands work in synergy? And amid rapid digitalisation, how can overseas companies build truly localised operations?

Current landscape and recovery momentum of Latin America’s travel industry

Rapid rebound in inbound travel, with domestic tourism as the foundation

According to the WTTC, in 2024 the travel and tourism industry in LAC (Latin America and the Caribbean) contributed approximately $714 billion to the regional economy, representing 10% of total GDP. The sector supported around 28.2 million jobs, meaning one in every 11 jobs in the region is tied to tourism. International visitors spent $144.4 billion, providing an essential source of export revenue for many countries. The WTTC forecasts that by 2035, the sector’s contribution will rise to $944.8 billion, supporting 35.4 million jobs.

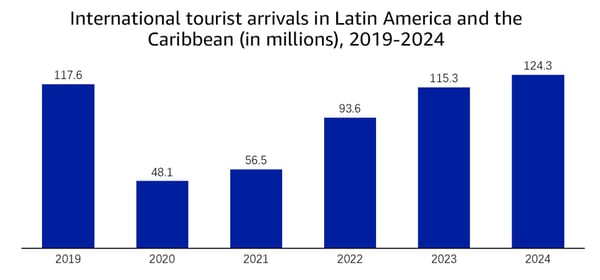

Inbound tourism in Latin America is showing strong recovery and growth. UN Tourism reports that international arrivals in 2024 have fully recovered and surpassed 2019 levels, with momentum continuing into 2025. Brazil illustrates this trend clearly: in Q1 2025, it received 3.74 million international visitors, a year-on-year increase of nearly 48%. In August alone, arrivals reached approximately 576,000, marking the highest level ever recorded for the month. Argentina is another standout performer. Trip.com data shows that since 2025, inbound orders to Argentina have risen 168% year-on-year, while inbound travel to Brazil and Chile has also grown by more than 80%. Intra-regional travel remains a key driver: more than 60% of Brazil’s international visitors come from within Latin America. Countries across the region continue to advance tourism recovery through regional cooperation, with a strong emphasis on improving air connectivity to support multi-destination travel.

International tourist arrivals in Latin America and the Caribbean, 2019-2024

Source: UN Tourism, Statista

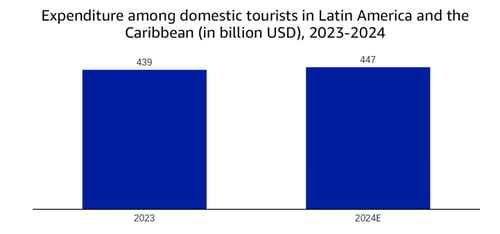

Domestic tourism is the main driver of recovery in most Latin American countries, but trends vary significantly. Major economies such as Brazil and Argentina continue to show strong domestic travel demand, reaching record highs, while Colombia has seen several consecutive months of decline in domestic passenger traffic. This divergence highlights the close link between domestic travel performance, household income levels, and broader economic confidence.

Expenditure among domestic tourists in Latin America and the Caribbean, 2023-2024

Source: WTTC, Statista

Uneven growth behind strong headline numbers; regional imbalance limits competitiveness

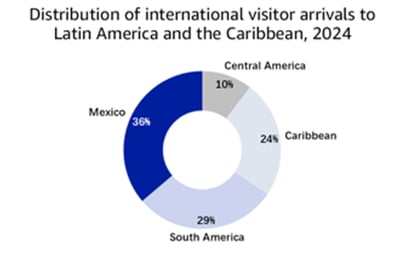

The tourism industry in Latin America shows a clear regional imbalance, with a few markets capturing the majority of revenue and transactions. According to Phocuswright, Mexico and Brazil together account for more than 75% of the region’s total travel economy. In 2024, international arrivals to Latin America and the Caribbean reached 124.3 million, nearly 45 million of which went to Mexico—representing 36.2% of the regional total. In contrast, tourism revenue in Central American inland countries and the northern plateau remains modest; for example, Honduras and Nicaragua each receive fewer than a few million visitors annually.

Distribution of international visitor arrivals to Latin America and the Caribbean, 2024

Source: UN Tourism, Statista

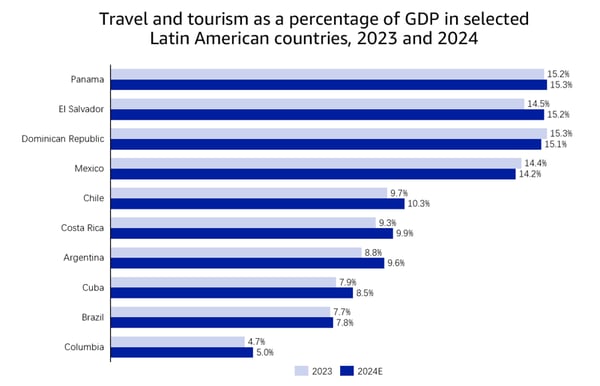

This disparity is also reflected in economic dependence. Small island nations and landlocked countries show significantly higher reliance on tourism and greater volatility. In the Caribbean and parts of Central America, tourism contributes around 15% of GDP, whereas in large South American economies such as Brazil and Mexico—despite their sizeable tourism revenue—the sector typically accounts for less than 10% of GDP. As a result, tourism plays the role of a core economic pillar in some countries and a supplementary industry in others, creating structural differentiation across the region. In essence, Latin America is not a single market but a mosaic comprising: strong, high-volume markets such as Mexico and Brazil; mid-sized markets such as Argentina, Chile, and Colombia; and small, high-dependence, high-volatility markets such as those in the Caribbean and Central America.

Travel and tourism as a percentage of GDP in selected Latin American countries, 2023 and 2024

Source: WTTC, Statista

Regional imbalance is shaped by long-term differences in economic structure, natural resources, transportation networks, and policy capability. Southern and coastal destinations benefit from extensive coastlines, tropical islands, and well-developed holiday infrastructure, supported by dense international air connectivity and favourable visa policies. These factors create strong, sustained appeal for international travellers. Central and northern inland countries, despite their unique ecological and cultural strengths, face persistent challenges related to accessibility, limited infrastructure, and weaker institutional capacity. The gap is widened by unequal levels of policy investment and market scale: large South American economies benefit from a growing middle class and active domestic tourism, while small northern countries remain highly dependent on inbound visitors and are more vulnerable to external shocks such as currency fluctuations or global travel disruptions. Overall, regional disparities in Latin American tourism are unlikely to close quickly. The pattern of “mature south, emerging north” will persist, shaping the region’s long-term landscape and serving as an important consideration for international expansion strategies.