Key Insights

Japan’s inbound tourism has hit a new record, surpassing 2019 by 15.6%, while South Korea has recovered to over 90%

The combination of a weak currency and Japan and South Korea’s broad appeal — spanning culture, nature, and shopping — has reaffirmed their status as top global destinations and strengthened their role in the East Asian tourism landscape. Improved price competitiveness is encouraging travellers to stay longer and spend more in Japan, with average stay length rising from 8.2 to 11.5 days and per-capita spending increasing by around 37% compared with 2019.

South Korea’s international passenger traffic reaches a record 46.03 million

With international routes fully restored, South Korea handled 46.03 million international passengers in the first half of the year, surpassing 2019 for the first time. Stronger hub connectivity between Japan and South Korea, together with an expanded transit network, is improving global accessibility and driving demand for transit and short-stay travel — opening new opportunities for accommodation, retail, and destination services. Capacity on China–Japan–South Korea routes remains below 85% of 2019 levels, leaving meaningful room for recovery in the medium to long term.

Over half of Japanese consumers book flights directly with airlines online; leading OTA dominates the market

Japanese consumers rely heavily on airline direct channels, with more than half purchasing tickets via airline websites or mobile apps. Local OTAs serve as complementary channels, and Rakuten Travel stands out due to its integration with its e-commerce ecosystem and loyalty programme. In South Korea, however, channel usage is more fragmented, and the share of airline direct sales is lower than in Japan.

Japan’s medical tourism market nears USD 6 billion; 140,000 foreign visitors travel to South Korea for aesthetic treatment

Japan attracts high-net-worth visitors with precision health screening and advanced medical services, with its medical tourism market expected to reach $5.98 billion in 2025. South Korea, by contrast, is known for cost-effective dermatology and cosmetic procedures, which account for nearly 70% of inbound medical aesthetic visits. The combination of functional medical spending with leisure and shopping gives both Japan and South Korea a sustained competitive edge in global medical and aesthetic tourism.

Japan and South Korea: popular destinations driven by exchange-rate advantages and distinctive appeal

As two of East Asia’s most mature outbound and inbound tourism markets, Japan and South Korea have long held significant positions in the regional travel landscape. Japan continues to attract visitors from across demographic groups, supported by its distinctive cultural and natural assets, strong infrastructure, and high service standards. South Korea, meanwhile, has built differentiated competitiveness around the Korean Wave, shopping and entertainment, and medical aesthetics.

With ongoing consumption upgrades, deeper digitalisation, and evolving policy environments, both markets are entering a new phase of growth. How should industry players approach opportunities in payments, tax refunds, and service innovation? And can Japan and South Korea further strengthen and expand their presence in the global tourism industry?

How Japan and South Korea are reshaping regional travel growth

Accelerated inbound tourism recovery: Japan reaches record visitor arrivals; South Korea rebounds to above 90%

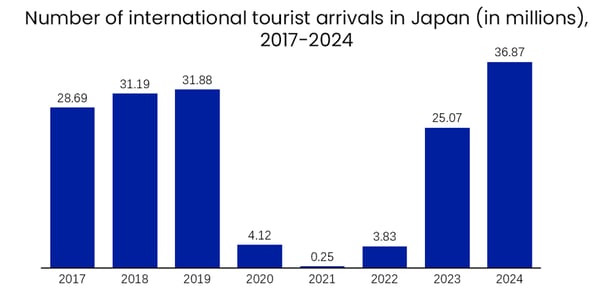

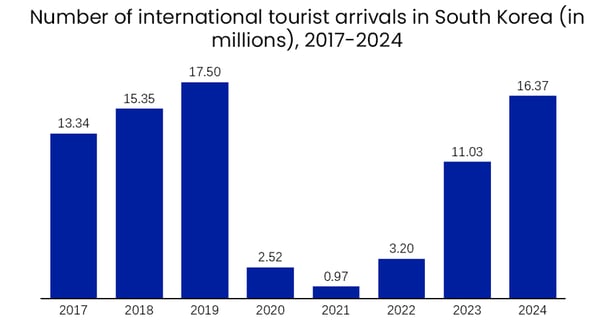

Since 2024, Japan and South Korea have re-established themselves among the world’s most attractive destinations, with inbound tourism fully recovering and maintaining strong momentum. Japan has been the standout performer, receiving 36.87 million foreign visitors over the year. This not only returned to the previous peak but surpassed the 2019 level by 15.6%, setting a new record. The weak currency effect, combined with diverse cultural, natural, and shopping attractions, has further strengthened Japan’s global competitiveness. South Korea’s rebound has been similarly swift. In 2024, it hosted 16.37 million foreign visitors, recovering to 93.5% of pre-pandemic levels. With a mix of popular culture, city leisure, and island holidays, the South Korean tourism market has warmed rapidly and is again appearing on many travellers’ preferred lists.

Number of international tourist arrivals in Japan, 2017-2024

Source: Statista, Japan National Tourism Organization (JNTO)

Number of international tourist arrivals in South Korea, 2017-2024

Source: Statista, Korea Tourism Organization (KTO)

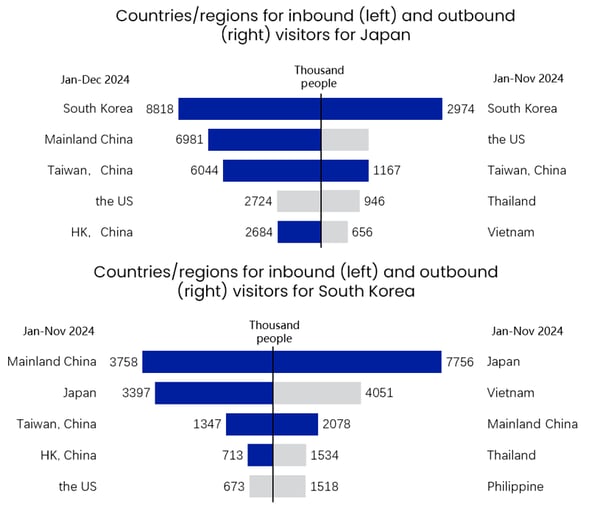

Notably, China, Japan, and South Korea are not only the most important outbound source markets in Asia-Pacific but also core markets for one another, with highly active intra-regional travel. In 2024, China and South Korea were Japan’s two largest inbound sources, while China and Japan remained South Korea’s top two. Outbound flows were similarly dynamic, with over 2.9 million Japanese visiting South Korea and almost 7.8 million South Koreans travelling to Japan.

Countries/regions for inbound and outbound visitors for Japan and South Korea, 2024

Source: JNTO, KTO, Haize Capital

Differentiated positioning of sub-regional city clusters, each with distinct visitor profiles

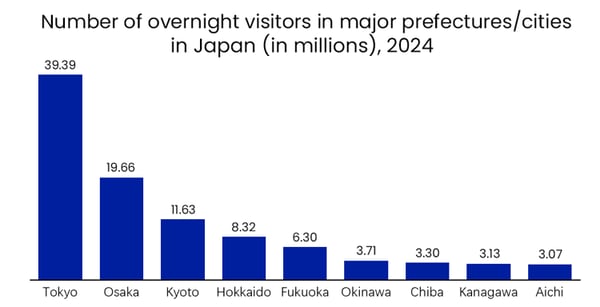

While inbound tourism continues to surge in both markets, the roles and positioning of different city clusters have become more defined. Major metropolitan areas remain the primary draw, while resort and culture-oriented destinations appeal to distinct visitor groups. According to World Economic Forum data, Japan’s five major prefectures (Tokyo, Osaka, Kyoto, Hokkaido and Fukuoka) account for around 73% of nationwide overnight stays, highlighting a high concentration of core destinations. Tokyo continues to attract high-spending and younger visitors with its global shopping, dining and cultural offerings. Osaka appeals to families and travellers seeking depth, combining an approachable urban atmosphere with easy access to Kyoto and Nara. Hokkaido remains a year-round resort favourite, with winter skiing and summer nature tourism drawing visitors from East Asia, Europe and North America.

Number of overnight visitors in major prefectures/cities in Japan, 2024

Source: JNTO

Japanese and South Korean cities in the world's top 100 cities

Source: Euromonitor

South Korea’s concentration is even higher. Reports indicate that around 80% of international visitors to South Korea in 2023 visited Seoul. As the country’s gateway city, Seoul attracts young travellers from China, Japan and Southeast Asia with fashion, K-pop culture and urban experiences. Busan, with its coastal positioning and port-city identity, is a key node for Japan–Korea routes and cruise tourism. Jeju Island maintains strong appeal as a resort destination, drawing FIT and family travellers with its natural landscapes and visa-free policy — particularly from China and Southeast Asia.