Key Insights

A steadily expanding mature market, with console gaming anchoring the highest commercial valueAs the world’s third-largest gaming market, Europe is experiencing robust growth at a pace exceeding the global average – its total market size is expected to reach USD 120 billion by 2030. Together, the United Kingdom, Germany and France account for nearly half of the market, making them the strategic focus for international developers. Unlike other regions, Europe’s gaming revenues are anchored in the console segment. Although mobile platforms have the broadest user reach, console players demonstrate the highest average revenue per user (ARPU) and the strongest purchase intent, positioning the console segment as the key arena for blockbuster success.

Rational, value-driven spending: gaming as a positive lifestyle choice

European players are mature and rational value-driven consumers. Their spending decisions are shaped mainly by perceived content value, price incentives and social engagement rather than impulse buying. They tend to be cautious about randomised monetisation models such as loot boxes or gacha mechanisms. Gaming has also evolved beyond pure entertainment, becoming a positive lifestyle choice for many European players. As many as 74% of players seek mental challenges through games, while nearly 70% view gaming as a healthy way to relax and relieve stress. Together, these motivations support high levels of consistent engagement.

A market shaped by distinct platform characteristics and dominated by top-tier IPs and service-based titles

European gamers display pronounced platform-specific preferences. Mobile gaming is led by casual and puzzle titles, PC gaming is driven by service-based games and classic nostalgic IPs, and the console market is dominated by premium AAA releases and culturally iconic sports franchises such as EA FC. From Helldivers 2 on PC to evergreen console titles like GTA V, high-quality Games as a Service (GaaS) have become the dominant model across all major platforms, reflecting European players’ strong support for long-term operations and continuous content updates.

Diversified payment methods: the rise of direct top-ups amid platform decentralisation

Europe’s payment landscape is undergoing profound transformation. Digital wallets (33%) have become the most preferred payment method, while the rapid rise of local bank transfer systems such as iDEAL in the Netherlands and BLIK in Poland, along with emerging models like Buy Now Pay Later (BNPL), has created a highly diversified and fragmented payment environment. Driven by both regulatory shifts and market forces, the market is irreversibly shifting towards payment decentralisation and direct top-ups via official websites. For gaming companies, this presents a strategic opportunity to bypass platform commissions and improve profit margins. However, it also brings significant challenges around payment conversion loss, global compliance, and technical integration, reinforcing the need to partner with professional payment service providers.

Inside the world’s third-largest gaming market

A rapidly expanding market driven by the UK, Germany and France

In the global gaming landscape, Europe plays a pivotal role. In 2024, the region generated $77.8 billion in gaming revenue, representing around 16% of the global total and ranking third worldwide after Asia-Pacific ($220.9 billion) and North America ($139.9 billion). This position is underpinned by its vast player base and mature industrial ecosystem: Europe is home to hundreds of millions of gamers, over 5,900 development studios and more than 90,000 industry professionals, all of which provide a solid foundation for sustained innovation and growth.

Looking ahead, Europe’s market potential remains strong. Revenue is projected to increase from $84.9 billion in 2025 to $119.7 billion by 2030, representing a compound annual growth rate (CAGR) of 7.11% – slightly above the global average of 7.01%. This indicates that Europe’s growth is gathering momentum, outstripping the global trend and strengthening the region’s role in shaping the industry’s future.

A closer look at Europe’s market structure reveals a strong concentration within a handful of core countries. According to Statista, the United Kingdom is expected to lead in 2025 with a market value of $17.7 billion, followed by Germany and France. Together, these three markets account for nearly half of Europe’s total gaming revenue, forming the continent’s primary growth engine. Notably, although Germany surpasses the UK in terms of player numbers, the UK continues to generate higher revenue, reflecting UK players’ stronger average spending power and higher willingness to pay. Beyond the top three, markets such as Italy, Spain and the Netherlands also play important roles within Europe’s gaming ecosystem, collectively supporting the industry’s ongoing growth.

A closer look at Europe’s market structure reveals a strong concentration within a handful of core countries. According to Statista, the United Kingdom is expected to lead in 2025 with a market value of $17.7 billion, followed by Germany and France. Together, these three markets account for nearly half of Europe’s total gaming revenue, forming the continent’s primary growth engine. Notably, although Germany surpasses the UK in terms of player numbers, the UK continues to generate higher revenue, reflecting UK players’ stronger average spending power and higher willingness to pay. Beyond the top three, markets such as Italy, Spain and the Netherlands also play important roles within Europe’s gaming ecosystem, collectively supporting the industry’s ongoing growth.

Thousands of studios underpin Europe’s strong creative capacity

Thousands of studios underpin Europe’s strong creative capacity

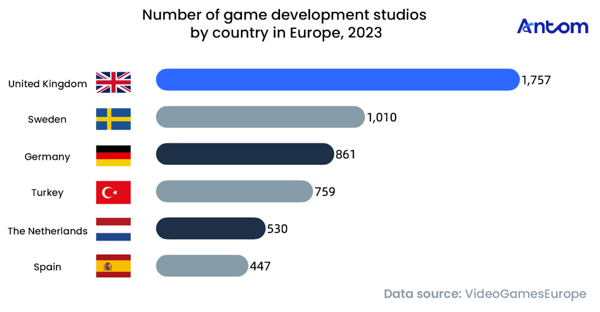

Europe’s gaming landscape is defined not only by the scale of its player base but also by the strength of its content creation capacity. The region has built a diverse and dynamic creative ecosystem, reflected in its extensive base of game studios. According to 2023 data, the UK leads by a wide margin with 1,757 studios – this strong content production capacity continues to bolster its position as Europe’s largest gaming market.

Following closely behind is Sweden, the creative powerhouse of Northern Europe, which hosts 1,010 studios and exerts significant global influence across both independent and large-scale game development. Germany ranks third with 861 studios. Turkey’s rapid ascent is particularly notable: with 759 studios, it has emerged as a key hub for talent and development, especially strong in the mobile gaming sector. Importantly, these studios include not only local creative teams but also regional research and development centres of global giants such as Ubisoft and Electronic Arts (EA). Together, this expanding developer base forms a key driver of Europe’s gaming industry, supporting its resilience and fuelling continuous innovation.