Preface

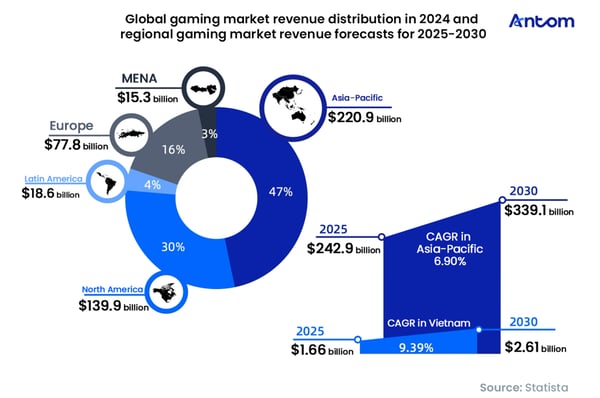

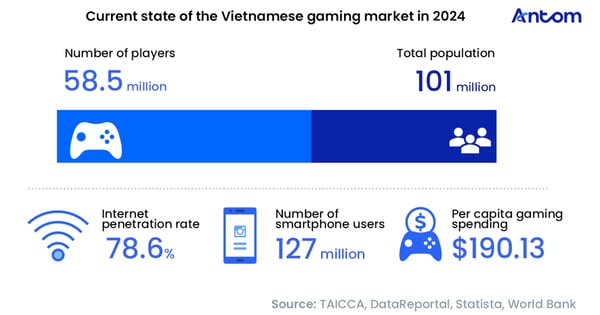

Vietnam has rapidly evolved from a regional market into a key growth engine in the global gaming landscape, with a compound annual growth rate (CAGR) of 9.39% – well above the Asia–Pacific average. Underpinning this explosive growth is the country’s huge player base of 58.5 million – more than half of its population – and a phenomenally high volume of Google Play game downloads, which ranked first globally in 2024. Together, these factors have contributed to Vietnam’s rise as one of Southeast Asia’s most dynamic digital entertainment ecosystems.

The defining feature of Vietnam’s gaming market is the overwhelming dominance of mobile gaming, along with a clearly tiered payment structure. Mobile gaming dominates, accounting for 86.6% of all gamers, and mobile users generate an Average Revenue Per User (ARPU) of USD 53.8 – almost 15 times higher than that of PC games – making them the market’s key monetisation driver.

In terms of user structure, the market presents two distinct opportunities, driven by casual players on one hand and hardcore players on the other: nearly half of casual users play for no more than three hours per week, forming a broad base for the advertising-driven monetisation model of hyper-casual games. Meanwhile, over 11% of hardcore players exhibit a highly pragmatic “pay-for-better-performance” mindset, with more than 70% of in-game purchases focused on items and currencies that directly enhance combat power. This practical spending mindset has fuelled the success of hardcore genres such as Massively Multiplayer Online Role-Playing Games (MMORPGs) and Simulation Games (SLGs) – games centred on measurable in-game progression – which have become the market’s main revenue source. It has also enabled gaming companies, which have a deep understanding of this culture, to capture a 53.4% market share by leveraging culturally resonant themes such as martial arts and the Three Kingdoms.

Within the gaming payments ecosystem, Vietnamese players’ top-up behaviour is closely tied to local payment solutions. Digital wallets have become the dominant method for in-game payments, accounting for 41% of online gaming transactions. Among them, the two domestic giants, MoMo and ZaloPay, serve over 36 million active users, delivering a seamless experience for small-value, high-frequency in-game purchases. Bank transfers and cash top-up cards play an important complementary role, catering to user groups that prefer large-value top-ups and offline channels. By deeply integrating Vietnam’s mainstream gaming payment methods, Antom offers a one-stop localised solution for gaming companies expanding overseas, ensuring that every player segment’s spending potential is effectively converted into revenue.

Vietnam’s gaming surge: a young, connected audience and rising monetisation drive strong long-term growth

Vietnam emerges as Asia–Pacific’s new mobile gaming engine

The Vietnamese gaming market is projected to achieve a CAGR of 9.39% between 2025 and 2030 – well above the Asia–Pacific average of 6.90%. This strong performance underscores Vietnam’s transformation from a developing market into a key growth engine within the global gaming industry.

Vietnam is home to more than 58.5 million gamers, representing over half of its population. The market’s rapid growth is fuelled by a large, youthful demographic and a high level of digitalisation. Crucially, players’ willingness to pay also continues to rise, with per-capita gaming spend reaching USD 190.13. This makes Vietnam one of

the most competitive markets in the Southeast Asian region, offering sustainable growth opportunities for both local and international gaming publishers and developers.

Local developers continue to build momentum as global capital flows in

Vietnam’s active player base and rapidly advancing game production capabilities are attracting attention from global investors. In 2023, Vietnam had around 35,000 developers and 400 game companies. In 2024, Google Play game downloads in Vietnam reached 6.1 billion – ranking first globally and equating to more than 11,600 downloads per minute. This impressive scale not only provides fertile ground for local teams to experiment and grow but also positions Vietnam as a key springboard for international firms expanding across Southeast Asia.

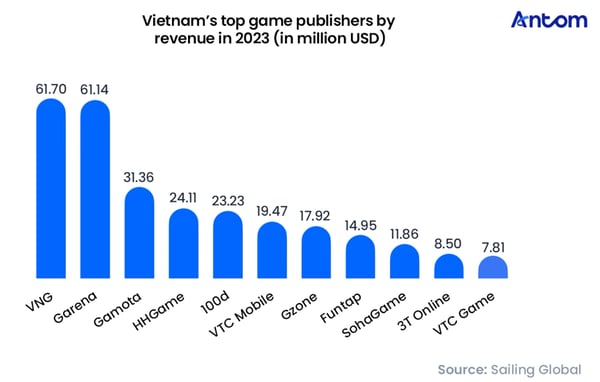

According to 2023 data, VNG ranked first among Vietnam’s video games publishers with revenues of USD 61.7 million. As its largest domestic internet technology company, VNG is often described as “Vietnam’s Tencent”. Its strengths extend beyond game distribution to its closed-loop ecosystem: it integrates with Zalo – Vietnam’s national social platform – and ZaloPay – the country’s leading digital wallet – which enhance customer acquisition, retention and monetisation, creating a powerful platform with a strong competitive edge.

International developers typically adopt one of two market-entry strategies. The first is a direct-competition model, exemplified by Garena, which builds a comprehensive local ecosystem – including eSports – based on its strong regional presence and flagship titles, competing head-to-head with local giants. The more common approach is the agency model, under which overseas developers license their titles to established local publishers such as VNG or Gamota. This model leverages local partners’ compliance credentials, payment networks, and operational expertise, helping foreign companies navigate Vietnam’s strict game-licensing regime and accelerate commercialisation while minimising risk and cost.