With its rapidly growing digital economy, tech-savvy population, and a wealth of untapped potential for merchants expanding cross-border, the Southeast Asian market presents tremendous opportunities. Indeed, the Southeast Asian e-commerce market is currently experiencing rapid expansion, valued at nearly USD $100 billion and sustaining an annual growth rate at over 10%.

The key trends, challenges, and strategies that can help ambitious businesses navigate and capitalise on this dynamic market include:

- Streamlining cross-border e-commerce payments

- Introducing new payment methods, and understanding their benefits

- Choosing a reliable payment partner to implement an effective payment strategy – an important determinant of success in cross-border expansion.

This exclusive in-depth report provides a strategic analysis of the Southeast Asian payment market, offering essential insights for businesses seeking to expand in the region.

Key insights

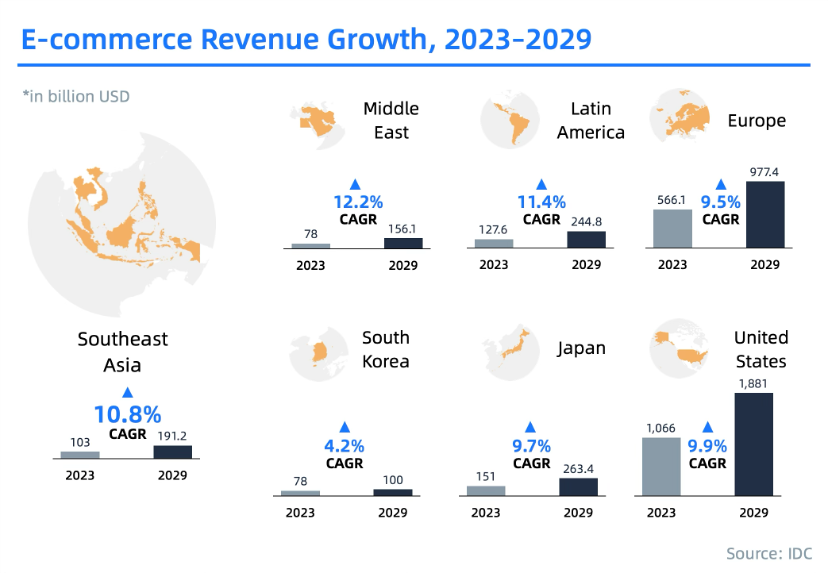

- The Southeast Asian e-commerce market is experiencing significant growth, with an estimated compound annual growth rate of 8% from 2023 to 2029, making it one of the world's most dynamic markets.

- Southeast Asia is undergoing a rapid digital payment transformation. Digital payments account for 87% of total e-commerce transactions, and this share is expected to rise to 94% by 2028.

- Digital wallets have become the preferred method for online shopping, particularly in Indonesia, Vietnam, and the Philippines.

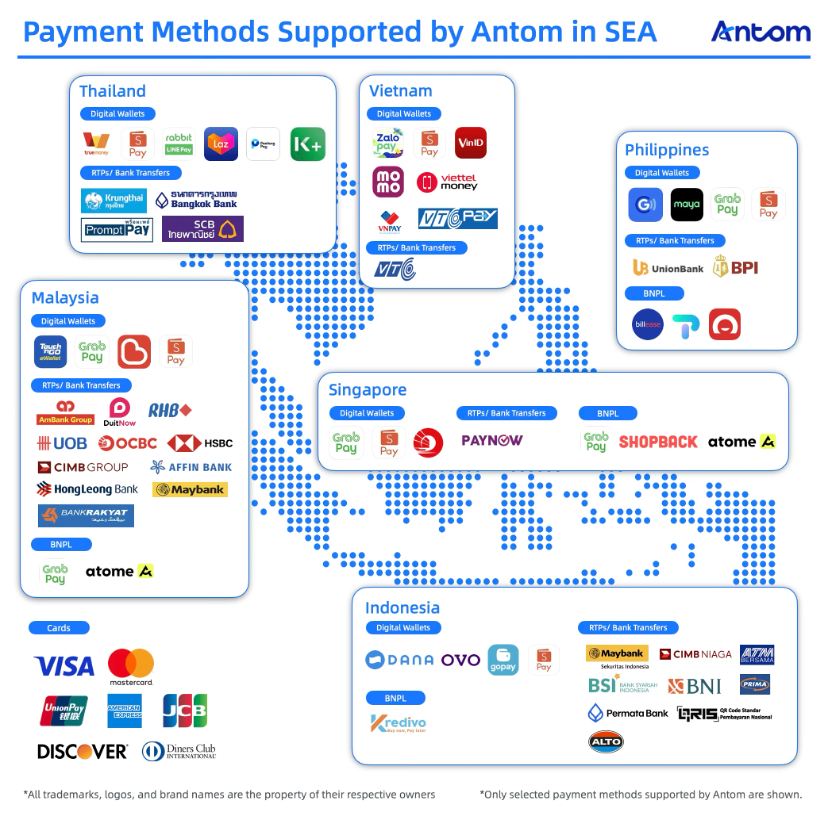

- Antom provides one-stop, vertical-specific digital payment solutions to all mainstream digital wallets in Southeast Asia, streamlining cross-border payments and enabling rapid market entry and business growth.

- Buy Now, Pay Later services are gaining momentum in Southeast Asia, with the user base projected to reach 145 million by 2028. This new payment method is particularly popular among non-credit card holders and young consumers (with a median age under 35).

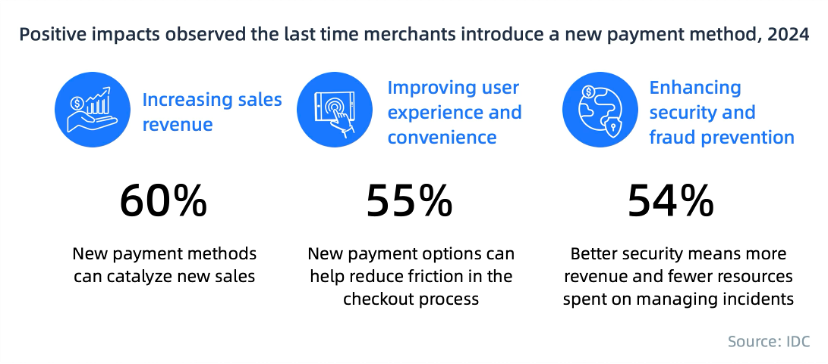

- Introducing new payment methods can yield significant commercial benefits. 60% of merchants report revenue growth, 55% see faster checkouts, and 54% note improved security and fraud prevention.

- Over half of merchants face challenges when expanding cross-border business, such as fraud prevention, payment system integration, and high transaction fees.

Overview of Southeast Asia

SEA’s immense potential lies with a rapidly growing population and an expanding community of internet users. Internet penetration rates are soaring, meaning the digital landscape in SEA is ripe for exploration. However, economic disparities and varying financial service demands across these countries present unique opportunities and challenges. As the working-age population continues to grow and the service sector dominates the economy, SEA's import and expenditure patterns reveal a diverse range of consumer needs. Let’s take a closer look.

Internet penetration

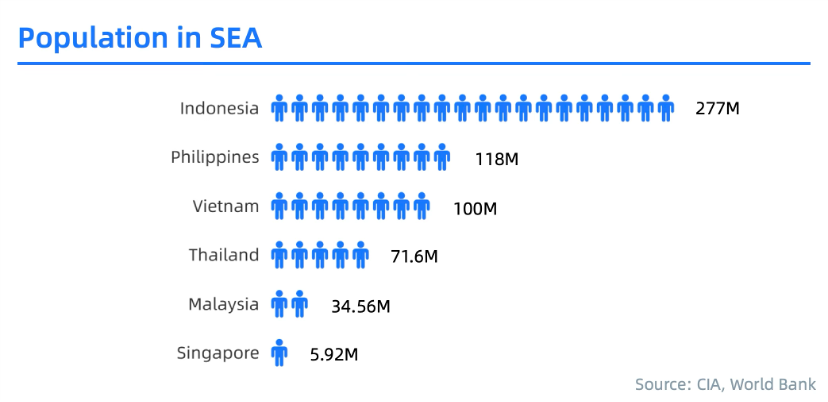

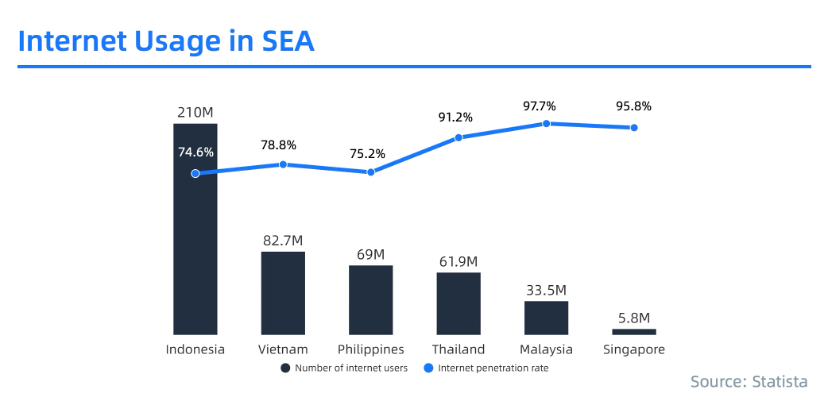

Southeast Asia (SEA) has a rapidly growing population and an expanding community of internet users. Indonesia is the largest market in the region, with 277 million people in 2023, followed by the Philippines and Vietnam.

Internet penetration highlights the digital potential of these markets. Indonesia leads with 210 million internet users, while Malaysia and Singapore, despite smaller populations, boast over 95% internet penetration.

Economic and financial disparities

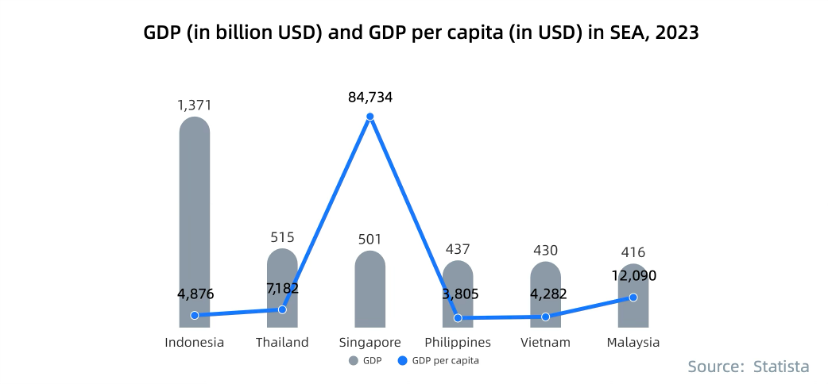

Countries in SEA show significant economic disparities. In 2023, Indonesia leads with a gross domestic product (GDP) of $1.37 trillion, followed by Thailand and Singapore. Singapore's per capita GDP reaches $84,734, far ahead of others, which mostly ranges between $3,000 and $12,000.

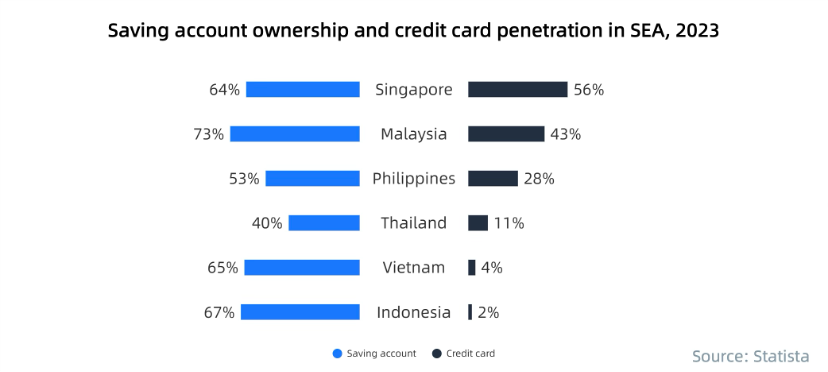

These countries also have varying financial service demands. Malaysia and Singapore lead in savings account and credit card use, respectively. Indonesia and Vietnam have low credit card adoption rates despite high savings account ownership.

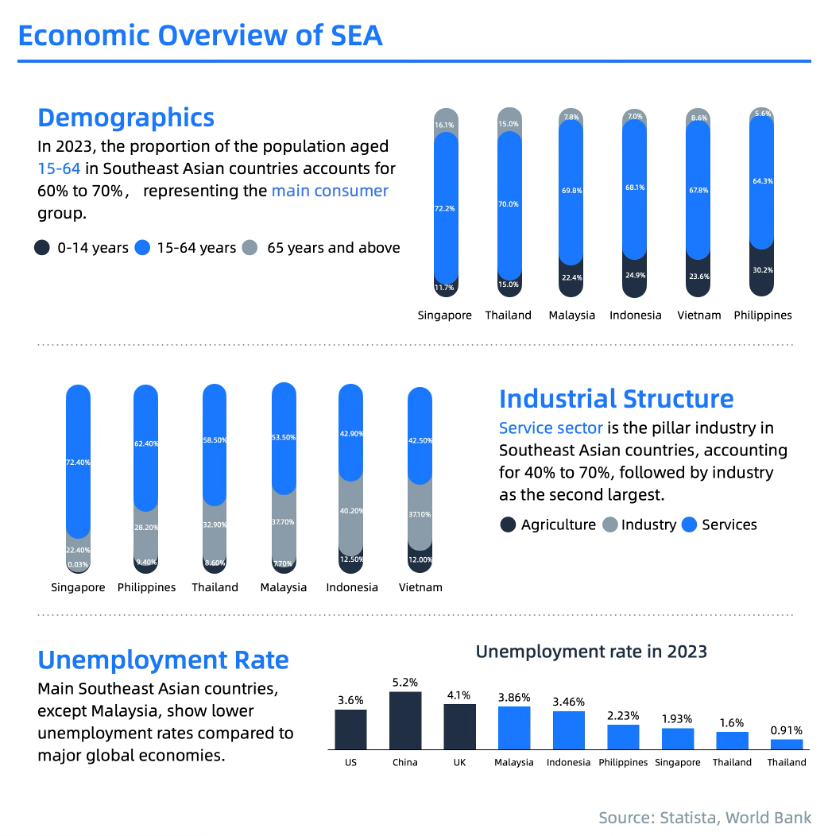

In 2023, SEA's working-age population (15 to 64 years old) makes up 60% to 70% of the total, forming its core consumer base. Singapore and Thailand have aging populations (over 15% aged 65+), while Vietnam and the Philippines will benefit from younger demographics.

The service sector dominates SEA’s economy, with Singapore leading at 72.4% as the financial hub. Indonesia and Vietnam maintain relatively high industrial sector shares.

2023 unemployment rates in these countries reflect stable employment. Thailand has the lowest at 0.91%, while Malaysia stands out with a higher rate of 3.86%.

SEA's imports also vary widely. Singapore leads with $423.5 billion import value of goods as a major free trade hub. Vietnam's manufacturing boom fuel raw material imports, while Malaysia's industrial base and growing middle class sustain strong import growth.

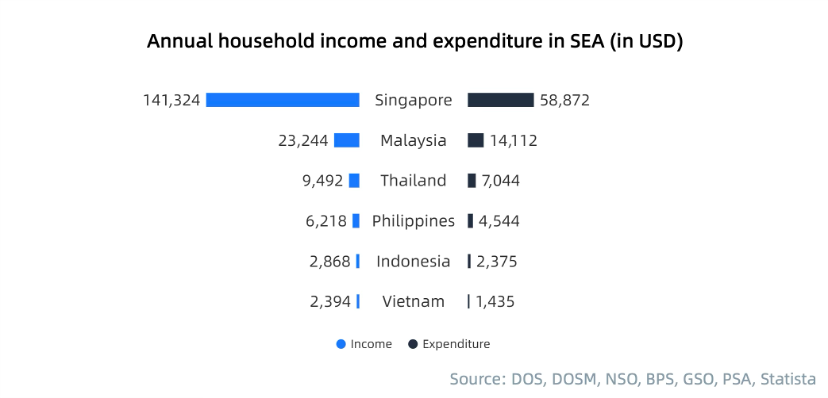

SEA's household income and expenditure highlight economic gaps. Singapore leads with $141,324 income and $58,872 spending. Wealth management thrives in markets like Singapore and Malaysia, while Vietnam and Indonesia focus on basic payments and microcredit, offering varied opportunities for financial services.

E-commerce trends in SEA

In 2023, Indonesia leads the SEA e-commerce landscape with $63 billion in transactions. Despite Singapore's smaller e-commerce volume, its per capita spending reaches $1,200, reflecting high consumption relative to its population size.

According to Statista, the e-commerce market in SEA is set to grow at a 10.8% compound annual growth rate (CAGR) from 2023 to 2029, surpassing Europe, South Korea, and Japan.

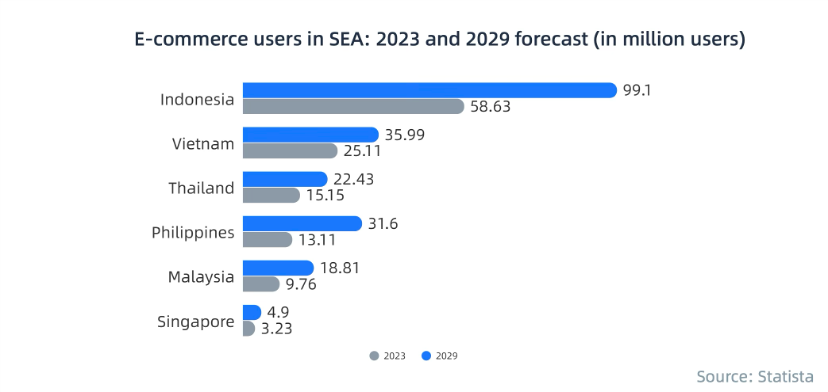

So where are the key pockets of growth? Indonesia leads with user growth from 58.63 million in 2023 to 99.10 million by 2029. Vietnam, Thailand, and the Philippines also show strong growth, driven by a booming digital economy.

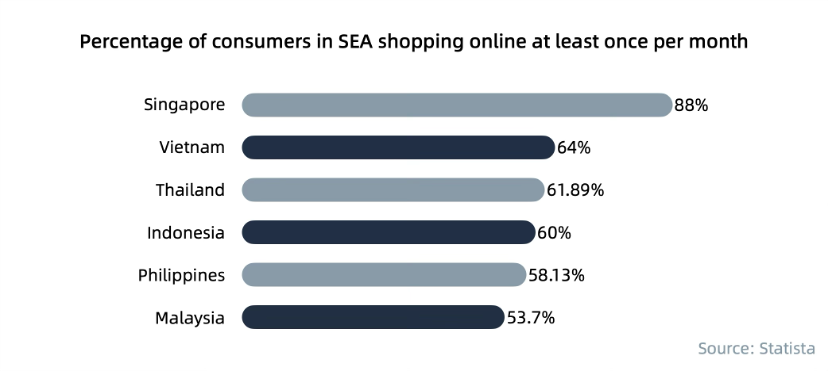

Meanwhile, the importance of e-commerce in the daily lives of Southeast Asians becomes increasingly pronounced. 88% of Singaporeans shop online at least once a month, while other countries in the region have rates above 50%.

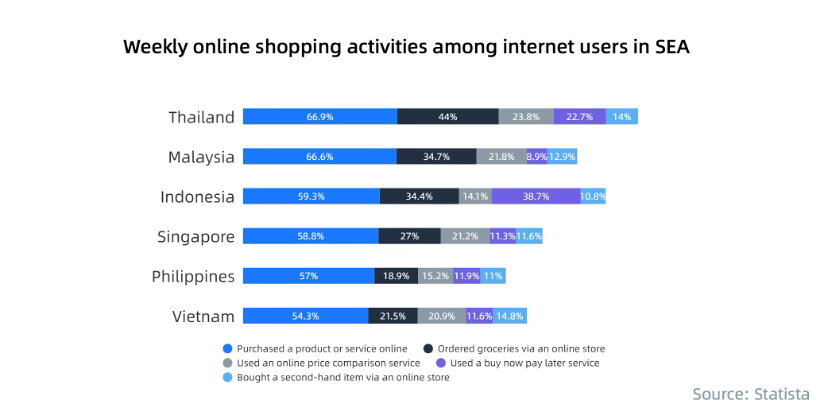

In addition, consumers in SEA actively shop online for services and products, with Indonesian consumers preferring to use Buy Now Pay Later (BNPL) services.

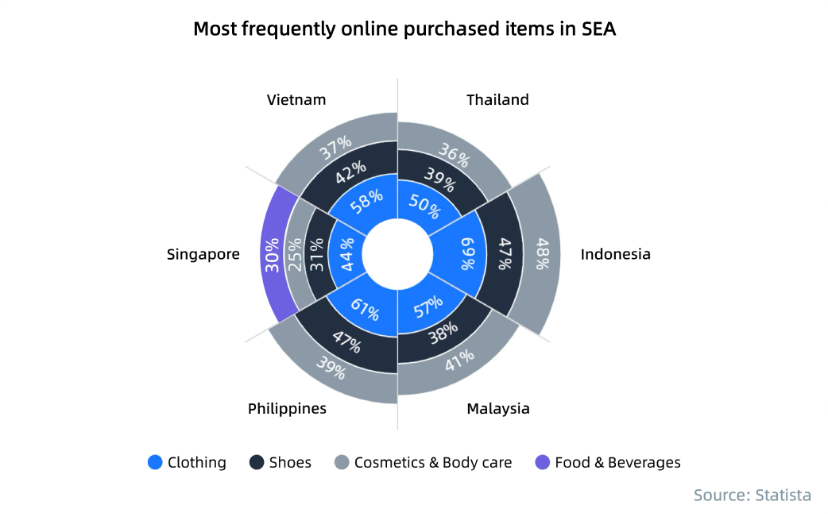

Top of people’s shopping lists are clothing, shoes, and cosmetics & body care, while Singaporeans also show a high demand for food and beverages.

Perhaps unsurprisingly, global merchants are increasingly attracted to the flourishing Southeast Asian e-commerce market. As such, the importance of cross-border trade to Southeast Asian merchants and consumers alike cannot be understated.

Cross-border e-commerce markets in SEA

The cross-border e-commerce market in SEA is expected to reach $14.6 billion by 2028, growing 2.8 times from 2023, with the Philippines leading at 5.8 times growth.

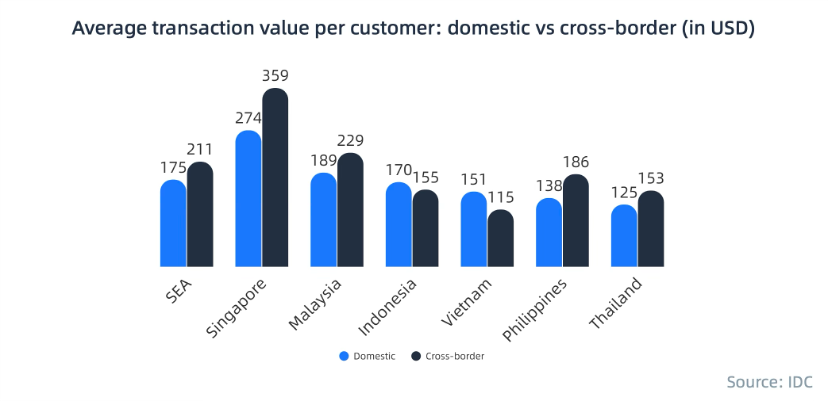

IDC reports that cross-border e-commerce spending per consumer in SEA surpasses domestic levels. Singapore has the highest disparity, with per capita expenditure on cross-border transactions exceeding domestic purchases by 21%, with similar trends in Malaysia, the Philippines, and Thailand.

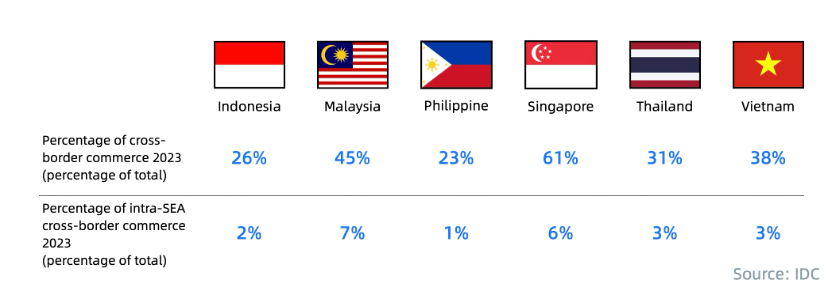

Cross-border e-commerce accounts for 61% of Singapore's total transactions, 45% in Malaysia, and 38% in Vietnam. Intra-SEA transactions remain low, led by Malaysia (7%) and Singapore (6%).

The e-commerce market in SEA features prominent regional platforms like Shopee and Lazada that dominates market share. Meanwhile, high mobile shopping penetration (75-95%) drives cross-border e-commerce growth.

To successfully expand in SEA, merchants should be prepared to leverage cultural similarities, robust trade infrastructure, and preferential tariffs while adapting to local payment preferences, which can vary from region to region.

Challenges and solutions in cross-border e-commerce payment

Challenges of cross-border payments

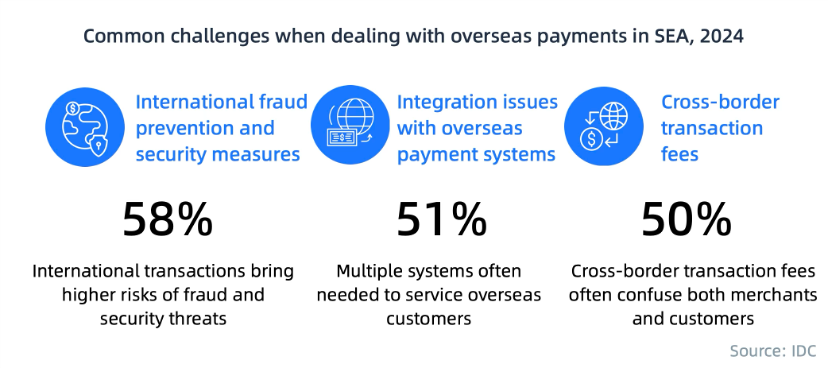

In SEA, merchants face three major payment challenges:

- 58% of merchants cite international fraud prevention and security measures as their top concerns. Dealing with international payments brings associated risks of fraud, which could result in revenue loss and a significant strain on time and resources. For merchants, clawing back funds from a fraud case is often a prolonged and drawn-out process. Antom's intelligent risk control engine blocks fraudulent transactions and reduces chargebacks with graph computing, deep learning algorithms, and real-time decisions based on the global risk control network.

- 51% of merchants struggle with integrating multiple overseas payment systems. The payment options remain highly diverse and localised in SEA, and merchants often need to integrate several systems to cater to diverse customer needs. Antom provides one-stop digital payment solutions that cover hundreds of global and local methods with customised services tailored to merchants.

- 50% of merchants are concerned about the fees associated with cross-border transactions. These fees, including foreign exchanges (FX) and interchange fees, can impact merchant profitability and complicate sales forecasting due to currency fluctuations. Antom's AI-driven FX forecast model and currency hedging services can proactively avoid merchants' losses from currency fluctuations.

How to address these challenges

There are three key steps that can help merchants navigate these cross-border payment challenges:

- Develop a comprehensive payment strategy

- Introduce new payment methods

- Select a reliable payment service partner

1. Develop a comprehensive payment strategy

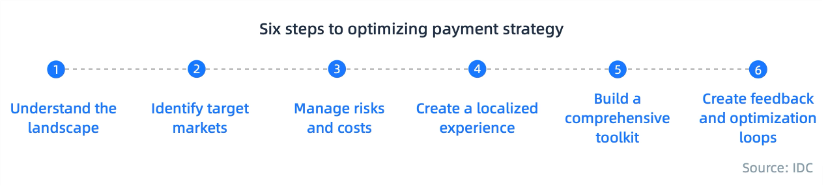

Merchants need to develop systematic solutions to address these challenges, as shown in the diagram below.

- Understand the landscape

Understand the business landscape and potential opportunities in the overseas markets you are considering. Examine multiple sources to understand the potential for cross-border commerce, the competition and how they are operating, and the payment options offered. - Identify target markets

Choose your target markets and segments for the services and goods you will be selling. Understand their preferences and how they purchase. Engage payment partners with experience in those markets to support you, allowing you to cater to customer preferences promptly. - Manage risks and costs

Assess the risks and costs (e.g., FX fees, fraud and chargeback risks, regulatory changes). Scrutinise your current payments stack for adaptability and risk mitigation, ensuring it meets current and future needs. - Create a localised experience

Ensure transparency in payment options, currency conversions, and other fees. Use payment partners' technologies to optimise the cross-border purchasing experience and enhance localisation options. - Build a comprehensive toolkit

Explore ways to scale up operations as the business grows, ensuring technical architecture can support evolving needs with an emphasis on security and customisation capabilities. - Create feedback and optimisation loops

Gather and assess customer feedback and foster a culture of continuous optimisation and improvement. Work with your payment partners to monitor operations and keep up to date with the latest trends and technologies for continuous improvement.

2. Introduce new payment methods

Expanding into SEA brings with it one key need – the acceptance of a diverse range of different payment methods, which can vary from country to country. IDC's 2023 study highlights three key benefits for merchants after adopting new payment options:

- 60% of merchants have seen increasing sales revenue by introducing new payment methods. IDC's 2023 research reveals that adding new payment options can, on average, increase revenue by 7%. BNPL can make higher-value purchases more manageable by spreading the payment in instalments, which is especially attractive to uncarded consumers.

- 55% of merchants have observed that new payment options can help reduce friction in the checkout process. One-click and simplified purchase flows enabled by biometrics such as fingerprint, facial recognition, or voice recognition can increase conversion rates and encourage repeat purchases.

- 54% of merchants think better security means more revenue and fewer resources to manage incidents. Payment methods with safeguards such as biometric authentication, virtual cards, and tokenisation can reduce fraud risks. It allows merchants to focus on increasing sales and reducing overall costs.

Three key considerations when introducing new payment methods include:

- 60% of merchants need to seek ways to optimise their transaction fees. Different payment methods incur varying transaction fees that merchants need to absorb. Hence, merchants are inclined to encourage payments via digital wallets and real-time payments with lower fees. This is especially relevant for smaller businesses. However, businesses selling higher-value goods conversely will need to consider payment methods that consumers prefer, such as cards, which offer additional security features and other benefits (e.g., loyalty points) to consumers.

- 59% of merchants consider security and fraud prevention as their high priority. Payment modes that support extra levels of security, such as biometrics and device keys, can help reduce the risk of fraudulent transactions, making these options worthwhile for merchants to support.

- 55% of merchants emphasise user experience and convenience. Well-constructed payment flows smoothen the payment process for customers. This increases conversion rates for merchants.

3. Select a reliable payment service partner

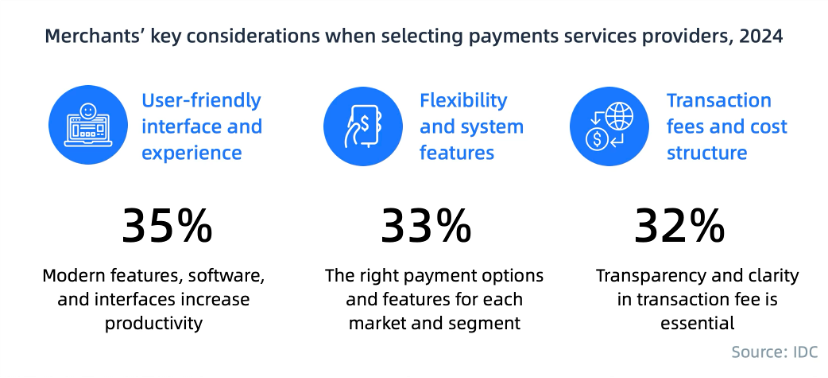

IDC’s 2024 payment survey identifies three core factors that merchants consider:

- User-friendly interface and experience (35%)

Best-in-class interfaces enable faster onboarding of new systems. Features such as consolidated dashboards ease reporting and give merchants a quick overview of their business, allowing them to promptly rectify issues. - Flexibility and system features (33%)

Offering a range of payments for each market, especially popular and localised options, can help merchants capture a bigger share of their target markets and customer segments. Merchants also need the flexibility to easily add or remove payment methods as the market needs change or new options emerge. Systems equipped with features that enhance the pavement experience will be a boon to merchants, such as mechanisms to identify and display a customer's last or most frequently used payment modes. - Transaction fees and cost structure (32%)

Laying out transaction fees with no hidden charges allows merchants to calculate and forecast their budgets and profit margins accurately. While lower fees are important, a consistent and fair fee structure is equally important.

Based on these factors, IDC recommends that merchants prioritise:

- Market experience:

Partners should have deep local market knowledge, comprehensive payment licenses, and robust industry resources. Antom supports over 99% of mainstream payment methods in SEA with a complete licensing framework, ensuring compliance. - Consultative guidance:

Payment partners should offer comprehensive strategic support beyond basic payment services. Antom’s local payment experts help merchants navigate local regulations and local shopper behaviour in the industry without hassle. - Technical strength:

Robust technical capabilities are the foundation of payment services. Backed by Ant Group, Antom provides varied payment products and advanced tools to boost revenue, as well as risk control systems and digital marketing solutions. - Integration capability:

A sound risk management system ensures payment security and business continuity. Antom’s extensive market resources and support for hundreds of payment methods globally enable rapid market coverage.

Antom understands the uniqueness and complexities of payment markets in different countries. Our expertise in t