Preface

With its high internet penetration, strong consumer purchasing power, and youthful demographic profile, the United Arab Emirates is rapidly emerging as a new hub in the global gaming industry. Driven by ambitious government initiatives such as the Dubai 2033 Gaming Plan, the market demonstrates immense growth potential, with the stated goal of positioning Dubai as one of the world’s premier gaming centres. The government is actively fostering this ecosystem by introducing dedicated gaming visas, offering tax incentives, and providing financial support, thereby creating an exceptionally attractive business environment for international gaming companies and laying a solid foundation for the sector’s future development.

The gamer community in the United Arab Emirates exhibits distinctive behavioural patterns, deeply shaped by local culture and market conditions.

On the one hand, the strong social traditions rooted in the Majlis – a longstanding Arabic custom of communal gatherings and social bonding – have transformed strategy games (SLGs) with guild systems into virtual spaces for social interaction and status-building, where spending behaviour is heavily community-driven.

On the other hand, a notable trend has emerged: many core high-spending players choose to play on European and American servers in search of better pricing and a more competitive gaming environment. This has given rise to “shadow revenue”, whereby the true scale of the domestic market is significantly underestimated. At the same time, this phenomenon presents a major opportunity for “user repatriation”: by optimising local server performance – such as through partnerships with domestic cloud providers to reduce latency – offering exclusive content, and ensuring competitive pricing, these high-value users could be drawn back, directly unlocking accelerated market growth.

To fully tap into the vast potential within the UAE’s diverse user base, the key lies in accurately aligning with the contrasting payment habits of different player segments. For high-net-worth individuals – who combine strong purchasing power and impulsive decision-making with an acute concern for privacy – the payment experience must strike a balance between two extremes: the ultimate convenience of one-click payments versus the security of prepaid cards, which are protected by a digital firewall, enabling them to spend confidently without exposing sensitive financial details. Meanwhile, for the vast population of expatriate workers and younger users without access to bank cards – another cornerstone of the local market – digital wallets and direct carrier billing (DCB) serve as indispensable gateways to the digital economy.

For gaming companies, success therefore hinges on constructing a multi-dimensional payment matrix that caters both to the top of the pyramid and to the foundational mass market, efficiently converting users’ willingness to pay across all segments into tangible commercial value.

Dubai 2033 Gaming Plan: building a global gaming powerhouse

Policy support and visa facilitation: the UAE’s drive to build a world-class gaming hub

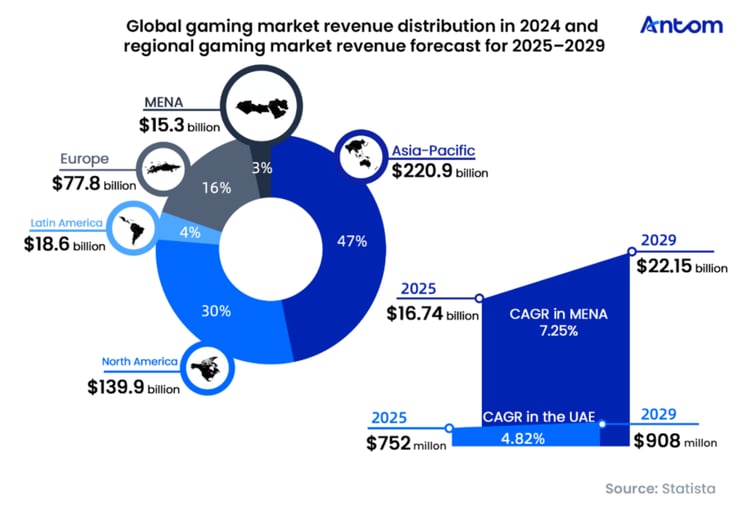

The UAE is rapidly emerging as one of the most dynamic gaming markets in the Middle East and North Africa (MENA) region, ranking second only to Saudi Arabia. Market revenue is projected to reach USD 752 million by 2025, with a forecast compound annual growth rate (CAGR) of 4.82% from 2025 to 2029.

To support its thriving gaming sector, the UAE is actively developing the infrastructure needed to evolve from a gaming market into a comprehensive industry ecosystem. Backed by ambitious government initiatives such as the Dubai 2033 Gaming Plan, the market shows immense growth potential, with the goal of positioning Dubai as one of the world’s leading gaming hubs. Major annual events such as the Abu Dhabi Gaming Festival, Middle East Gaming Con and Insomnia Dubai not only attract large numbers of gamers but also offer international companies excellent platforms for market promotion, brand building, and player interaction. In addition, the introduction of the Gaming Visa, which grants gaming professionals a ten-year residency along with entrepreneurial and lifestyle benefits, further strengthens the local gaming ecosystem.

Although Arabic is the official language of the UAE, English is widely used in daily communication and business activities due to the country’s large expatriate population. This significantly reduces language barriers for international gaming companies entering the market. Overall, the UAE is rapidly establishing itself as a key strategic hub in the global gaming industry, underpinned by policy support, industry development, and an open market.

Uncovering shadow revenue and untapped spending potential in the UAE gaming market

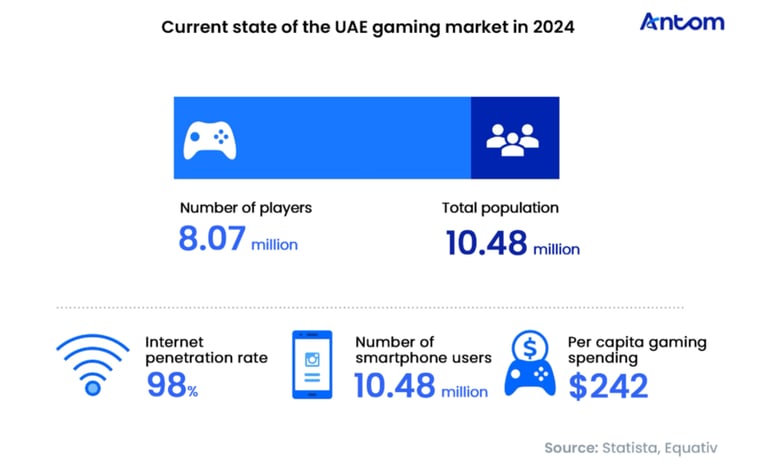

In recent years, the number of gamers in the UAE has been rising steadily, reaching 8.07 million in 2024 – equivalent to 77% of the total population. With an internet penetration rate of 98% and almost universal smartphone ownership, the UAE offers a strong digital foundation for the expansion of mobile gaming. At the same time, UAE players demonstrate strong purchasing power, with average gaming expenditure per person reaching USD 242 in 2024, well above the Middle East and North Africa (MENA) region’s average of $102.4.

However, these figures may underestimate the market’s true scale due to a unique trend: many core, high-spending players choose European and American servers for better pricing and a more competitive environment, giving rise to the “shadow revenue” phenomenon. Yet this also represents a major opportunity for “user repatriation”: by improving local server performance (for example, through partnerships with domestic cloud providers to reduce latency), offering exclusive content and providing competitive pricing, these high-value users could be encouraged to return, directly boosting market growth.