Preface

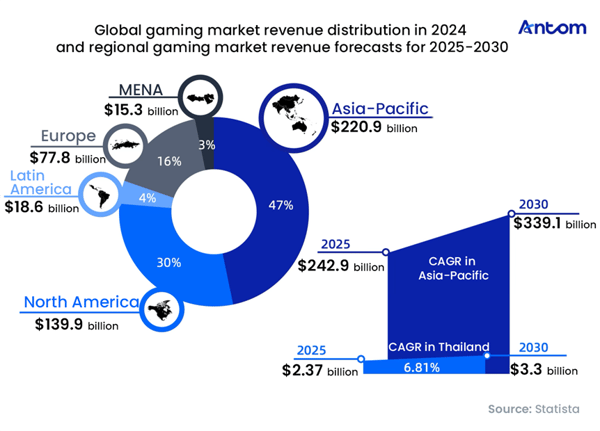

Thailand has emerged as a strategic hub within Southeast Asia’s gaming landscape, showcasing its strong commercial potential to the world. As the region’s second-largest gaming market, it continues to expand steadily. Market revenue is projected to reach USD 2.37 billion by 2025, with a compound annual growth rate (CAGR) of 6.81% over the following four years.

What truly sets Thailand apart from other markets worldwide is its players’ strong willingness to pay: nearly half (49%) are paying users, and per-capita spending stands at USD 393 – the highest in Southeast Asia. This combination of high engagement and strong monetisation value highlights Thailand as a mature market with both a broad user base and significant spending depth, demonstrating robust commercial potential.

Success in Thailand’s gaming market often hinges on a specific formula: positioning Key Opinion Leader (KOL) marketing at the heart of operations, and leveraging Facebook marketing in recognition of its undisputed dominant position. In Thailand, Facebook functions as far more than a social media channel – it is the centre of players’ digital lives. Over 70% of gamers discover new titles through Facebook via KOL livestreams and trusted recommendations. The platform also sustains a game’s performance post-launch: official fan pages serve as the main source for news and updates, while numerous player-run Facebook groups have become key hubs for guild recruitment, tip-sharing, and community activities. Together, they play a crucial role in user retention.

This deep reliance on local ecosystems extends to content creation. The success of the Thai horror game Home Sweet Home is a prime example: it proves that stories rooted in Thai mythology and culture can generate strong market appeal, reminding publishers that cultural resonance is essential to winning over local players.

Effective monetisation in Thailand also requires a nuanced understanding of its distinctive payment landscape. With relatively low credit card penetration, the country’s payment ecosystem is built around bank transfers and digital wallets. Bank transfers are mainly processed via the PromptPay system, while TrueMoney Wallet holds the largest market share among digital wallets, covering a wide range of gaming payments.

Despite these diverse options, Thai players still face several challenges: payment failures and cumbersome processes are their biggest pain points, and lengthy redirection steps often disrupt the user experience. For game developers, integrating mainstream local payment methods and streamlining the payment flow are therefore critical to boosting revenue and player satisfaction.

Thailand’s gaming market: high engagement and top spending make it Southeast Asia’s commercial powerhouse

Top-spending market in Southeast Asia

As one of Southeast Asia’s most important gaming markets, Thailand ranks second in the region by market size, behind only Indonesia. Market revenue is projected to reach USD 2.37 billion by 2025, with a compound annual growth rate (CAGR) or 6.81% between 2025 and 2030.

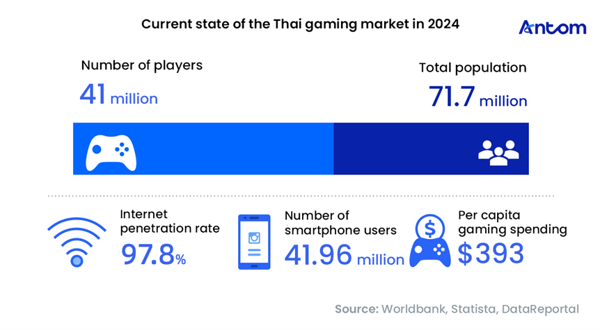

In 2024, Thailand’s player base reached 41 million, while the widespread adoption of smartphones and high-speed internet has created a solid digital foundation for more gaming accessibility. Thai players also show strong willingness to pay: 49% are paying users, and average spend per player stands at $393 – the highest in Southeast Asia. This combination of high engagement and high monetisation value underscores Thailand’s maturity as a gaming market. With both broad user reach and deep spending capacity, it has already proven its robust commercial potential.

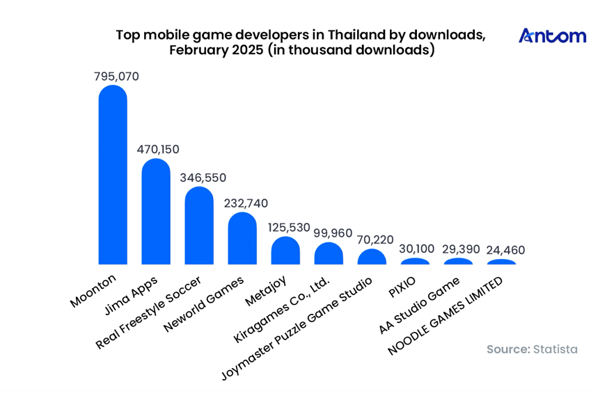

Market leaders: Moonton and Garena

In Thailand – and globally – the developer Moonton stands as a powerhouse in the mobile gaming industry. In 2024, it topped the list of game publishers in Thailand. Fuelled by the phenomenal success of its flagship MOBA game Mobile Legends: Bang Bang, Moonton has become one of the world’s top mobile game developers. Leveraging the maturing global eSports ecosystem, the game has attracted hundreds of millions of players with its rich in-game activities. In Thailand, it is the most formidable competitor of Realm of Valor (RoV), developed by Garena. The two titles go head-to-head in the MOBA segment and jointly dominate the field.

Nonetheless, to fully understand Thailand’s gaming landscape, it is essential to recognise Garena’s unique role. More than a traditional publisher, Garena functions as the very infrastructure and rule-setter of the country’s gaming and eSports ecosystem. It holds two trump cards: RoV and Free Fire. The former is often regarded as Thailand’s national mobile game and a cultural phenomenon in its own right, while the latter captures a vast user base through strong reach in lower-tier markets.

Garena’s strength lies not only in its distribution capabilities but also in its creation of a complete closed-loop ecosystem around its best-selling titles. It has its own distribution platform and payment channels and has built an eSports empire from the ground up, spanning community tournaments to top professional leagues.