Key Insights

The Southeast Asian short drama market is booming, with Indonesia ranking No. 2 in global downloads in 2024, but monetisation remains underdeveloped.

The Southeast Asian short drama market is still in its early, fast-growing “blue ocean” phase, demonstrating immense commercial potential. In 2024, the region became the world’s leading market for short drama app downloads. However, in-app purchase revenue and revenue per download (RPD) remain far below those of mature Western markets, highlighting significant room for further development.

A large and youthful population offers a powerful demographic dividend, with an average age of 30.9—significantly younger than in Western countries.

Southeast Asia has a population of more than 600 million, with a high proportion of young people fuelling strong demand for digital entertainment. This large and youthful demographic lays a solid foundation for short drama consumption. With clear preferences for lightweight, bite-sized content, younger audiences make short dramas an especially appealing entertainment format with enormous growth potential.

Social media penetration exceeds 70%, with short videos emerging as one of the core forms of content consumption.

Southeast Asia’s social media penetration exceeds 70%, with average daily usage surpassing three hours. Users are accustomed to fragmented content consumption on mobile devices. With short runtimes and fast pacing, short dramas align perfectly with “watch anytime, anywhere” habits, positioning them as a vital part of digital entertainment consumption.

There is strong interest in Asian drama themes, resulting in high content acceptance and user retention.

Southeast Asia shares deep cultural, linguistic, and historical ties with broader East Asia, making such film and drama content more relatable and emotionally resonant for local audiences. By combining localised adaptations with original short dramas, platforms have significantly boosted user retention and engagement, creating a virtuous cycle for the ecosystem.

E-wallets exceed 40% of e-commerce payments in several countries, supporting rapid growth in mobile payments and driving short drama growth.

Southeast Asian users favour diverse payment methods, with rapid adoption of e-wallets and mobile payment systems supporting frequent, low-value transactions. Compared to traditional credit card payments, e-wallets are better aligned with local payment habits and infrastructure, providing the foundation for short drama platforms to build efficient, sustainable monetisation models.

Southeast Asia’s short drama boom: from niche content to a global growth engine

Southeast Asia’s short drama market: nascent but poised for explosive growth

Since 2018, some Asian short video production teams have been targeting Southeast Asian Chinese communities on platforms such as YouTube and Facebook, mainly with low-cost dramas dubbed or subtitled in Chinese. Meanwhile, locally produced UGC short dramas also started to emerge, often focusing on low-budget romance or comedy—for example, Indonesia’s RCTI+ collaborated with Viddsee to introduce local short films. Video platforms such as iQIYI and Youku have also gone global, expanding into the Southeast Asian market.

In 2021, the industry entered an exploratory phase, as short drama platforms such as ReelShort and FlexTV began testing the waters in the Southeast Asian market. At the same time, local platforms such as Indonesia’s HiShort and Vietnam’s FPT Play Mini also started to follow suit. The business model of “several free episodes followed by paid unlocking” gradually gained traction.

From 2023 onward, the Southeast Asian short drama industry entered an explosive growth phase. According to Data.ai, the regional short drama market exceeded USD 300 million in 2023, with an annual growth rate of 150%. Genres have diversified beyond light, fast-paced feel-good dramas to horror, BL, and social realism. Platforms across the region, such as WeTV, Vidio, and iQIYI Thailand, have all increased investment in short dramas, driving the industry toward greater maturity and diversity.

The world’s top market for short drama downloads: Southeast Asia takes the lead

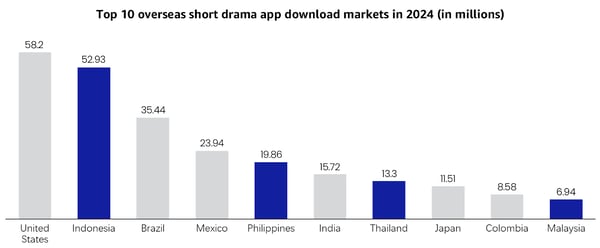

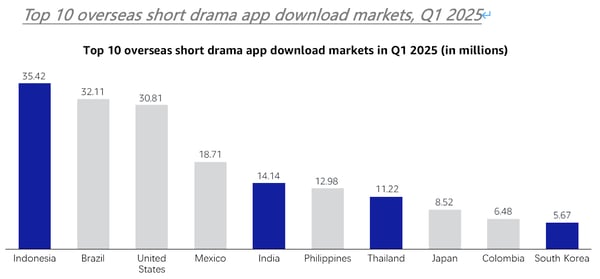

Globally, Southeast Asia has emerged as the largest regional market in terms of short drama app downloads. In 2024, Indonesia ranked No. 2 worldwide with more than 50 million downloads, second only to the US The Philippines, Thailand, and Malaysia also entered the global top 10. By Q1 2025, Indonesia climbed to No. 1 globally with 35.42 million downloads, accounting for nearly 13% of the global market. The Philippines and Thailand ranked sixth and seventh, with 12.98 million and 11.22 million downloads, respectively.

Top 10 overseas short drama app download markets, 2024

Source: Diandian Data, iResearch

Top 10 overseas short drama app download markets, Q1 2025

Source: Diandian Data

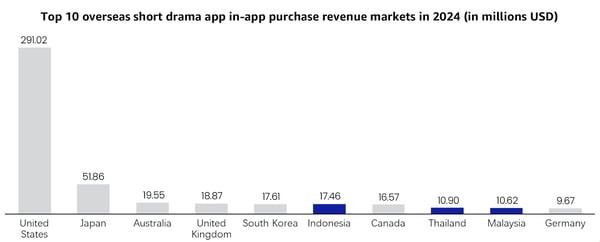

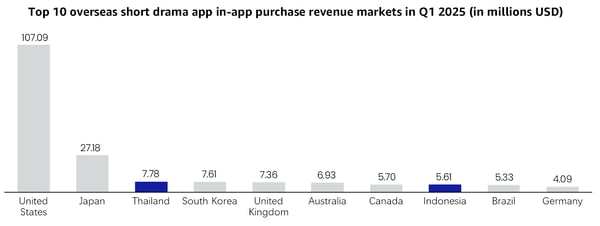

In terms of revenue, Southeast Asia’s short drama in-app purchase (IAP) market is also experiencing rapid growth. In 2024, Indonesia, Thailand, and Malaysia recorded cumulative annual IAP revenues of USD 17.46 million, $10.90 million, and $10.62 million, respectively—placing them among the world’s top 10 markets. By Q1 2025, Thailand reached $7.78 million, ranking among the global top three, while Indonesia reached $5.61 million, ranking eighth.

Top 10 overseas short drama app in-app purchase revenue markets, 2024

Source: Diandian Data, iResearch

Top 10 overseas short drama app in-app purchase revenue markets, Q1 2025

Source: Diandian Data

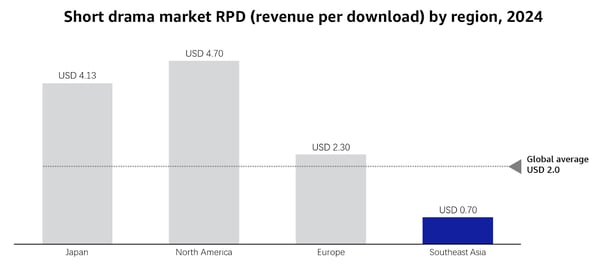

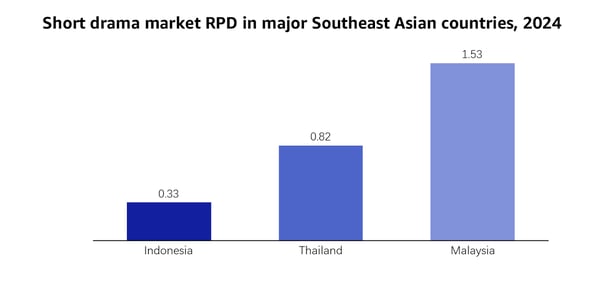

Despite Southeast Asia’s strong performance in downloads and revenue rankings, the region still lags globally in terms of revenue per download (RPD). According to Data.ai, Southeast Asia’s average RPD was only $0.70 in 2024—well below the global average of $2.00, and far behind North America ($4.70) and Japan ($4.13). Among Southeast Asian countries, Malaysia achieved the highest RPD at $1.53, followed by Thailand ($0.82), while Indonesia was only managed $0.33. This highlights significant room for improvement in both user willingness to pay and monetisation efficiency.

Short drama market RPD by region, 2024

Source: Diandian Data

Short drama market RPD in major Southeast Asian countries (in USD), 2024

Source: Netmarvel, iResearch