Key Insights

In 2024, South Korea ranked as the world’s fourth largest short drama market, projected to exceed USD 1.5 billion.

The South Korean short drama market is experiencing rapid expansion. In 2024, the country ranked as the world’s fourth largest, accounting for 3.24% of global revenue. In-app purchase income reached $7.612 million, with the market valued at around $490 million. It is projected to surpass $1.5 billion in the coming years, emerging as a promising new blue ocean in the global arena.

This growth is fuelled by three core strengths: a mature film and television industry, highly efficient short drama production cycles, and diversified monetisation models. These advantages are drawing international platforms and investors—especially from China—to scale up their presence in the Korean market.

Subscription Video on Demand (SVOD) dominates South Korea’s streaming landscape, with 72% user penetration and strong payment intent.

Korean users’ readiness to pay for quality content provides a strong foundation for short drama monetisation. More than 30% of residents subscribe to at least one digital service, with 72% of these users paying for SVOD platforms. Many platforms adopt a “first five episodes free, then pay or watch ads” model, with a minimum top-up of $4.99, well suited to the local habit of small, frequent purchases. South Korea’s mature payment ecosystem further supports the fast-growing short drama economy.

Technology boosts efficiency and experience in Korea’s short drama market.

South Korea’s advanced tech infrastructure is transforming its short drama industry. With a world-leading 5G penetration rate of 93%, viewers enjoy cinematic-quality visuals and immersive vertical-screen experiences. AI innovation has shortened production cycles and reduced costs by over 70%. TikTok, which reaches 60% of the Korean market, amplifies short drama visibility through algorithmic recommendations and social virality. Backed by these technologies, high-density storytelling and instant interaction have become core strengths of Korea’s global competitiveness. Meanwhile, payment methods continue to evolve. Through Antom’s global payment solutions, businesses can integrate all major Korean payment methods in one step, ensuring compliance, stability, and a smooth, friction-free experience.

Card and digital wallet payments account for 90% of Korea’s e-commerce transactions, key to improving payment success rates.

In 2024, card payments and digital wallets made up nearly 90% of Korea’s e-commerce transaction value. About 64% of Koreans use credit cards—far above the Asian average of 13% and global average of 19%—showing strong reliance on this method. Whether facing the complexities of cross-border payments or limited local options, Antom helps applications integrate mainstream local payment methods, creating a faster, smoother, and more reliable payment experience that boosts success rates.

South Korea’s short drama boom: powering the next wave of global entertainment

Rapid growth of the South Korean short drama market: emerging as a new global blue ocean

The South Korean short drama industry has seen remarkable growth in recent years, becoming a major force in the global market. Since its emergence in 2023, the number of platforms in South Korea has risen to 89 (as of January 2025). This expansion is driven by both the innovative efforts of local brands—such as Vigloo, Shortcha, PulsePick, and Topreels—and the strong presence of Chinese cross-border platforms, including Dramabox (Dianzhong Tech), ShortMax (Jiuzhou Culture), and Reelshort (Crazy Maple Studio). Together, these players have secured a significant share of the South Korean short drama market.

Table 1. Top 10 short drama apps in South Korea by downloads in 2024

| Brand |

APP |

Developer |

Country |

Downloads (10,000s) |

|

ShortMax |

SHORTMAX LIMITED |

China |

125.96 |

|

TVING |

Tving Co Ltd |

South Korea |

114.57 |

|

ReelShort |

NewLeaf Publishing |

China |

66.87 |

|

MoboReels |

MOBOREADER TECHNOLOGY USA CO LTD |

South Korea |

56.07 |

|

DramaBox |

STORYMATRIX |

China |

52.74 |

|

Vigloo |

Spoonlabs, Inc. |

South Korea |

26.47 |

|

GoodShort |

GoodNovel |

Singapore |

26.29 |

|

FlexTV |

YUDER PTE.LTD. |

China |

23.97 |

|

iQIYI |

iQIYI |

China |

21.75 |

| SnackShort |

PopCulture Studio |

China |

12.62 |

Source: Diandian Data

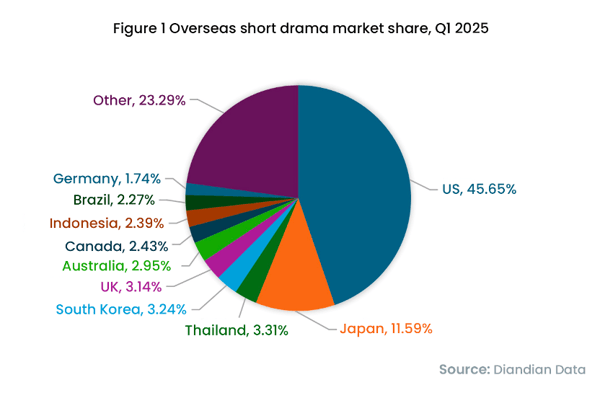

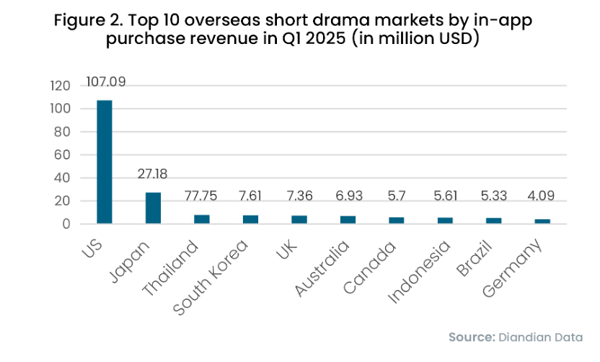

From a global perspective, South Korea’s short drama market is showing strong momentum. According to data from Kakao Ventures, the global short drama market reached $9.7 billion in 2024, with South Korea’s market estimated at $490 million, underscoring the country’s growing importance in the global short drama landscape. In addition, Q1 2025 data from Diandian shows that South Korea ranked fourth worldwide, accounting for 3.24% of the global market, with in-app purchase revenue of $7.61 million.

Figure 1. Overseas short drama market share in Q1 2025

Figure 2. Top 10 overseas short drama markets by in-app purchase revenue in Q1 2025 (in million USD)

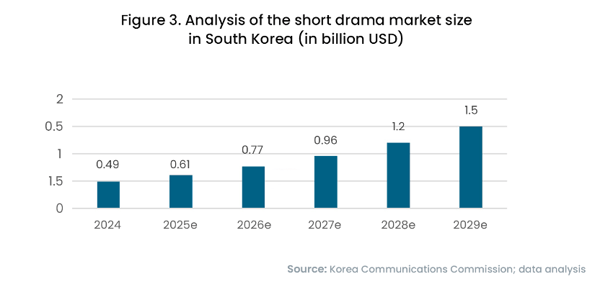

According to the Korea Communications Commission (KCC), the proportion of Korean users watching short dramas rose sharply from 58.1% in 2023 to 70.7% in 2024. The market is expected to expand more than threefold in the next five years. Considering the average annual growth rate of around 25% in major markets such as China, the United States, and Japan, the Korean short drama market is projected to reach $1.5 billion by 2029.

Figure 3. Analysis of the short drama market size in South Korea (in billion USD)

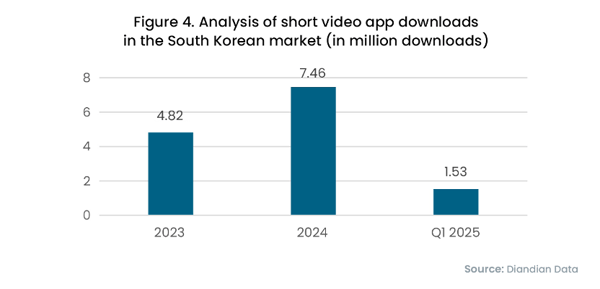

App Store data shows that downloads of short video apps in South Korea increased from 4.82 million in 2023 to 7.46 million in 2024. In the first quarter of 2025 alone, downloads reached 1.53 million. Given that the country’s population is only around 52 million, these numbers highlight Koreans’ enthusiasm for short-form video and the market’s rapid growth.

Figure 4. Analysis of short video app downloads in the South Korean market (in million downloads)

Backed by a mature film and television ecosystem, fast and efficient content production cycles, and diversified monetisation models, Korea’s short drama industry is entering a period of accelerated growth from within and beyond. It has become a new blue ocean for global short drama expansion, attracting major international platforms and investors, including those from China.

South Korea’s mature film and TV industry and government support ensure efficient, high-quality short drama growth

The development of South Korea’s short drama market is rooted in its mature film and television industry ecosystem. Traditional K-dramas’ high production standards have been successfully carried over into the short drama space, maintaining the same attention to detail in scripting, acting, and visual quality. Many short drama production teams come from Korea’s drama, advertising, and music video industries, forming a “star plus professional team” model that delivers premium content. This industrial strength also supports rapid iteration and local adaptation. For instance, producers draw inspiration from the fast-paced storytelling of short dramas while incorporating local cultural elements, ensuring both high quality and production efficiency and enhancing viewer appeal.

At the same time, strong policy support from the Korean government has provided a solid foundation for the sector’s rise. Since adopting its “Culture-Oriented Nation” strategy, the government has identified cultural industries as a national pillar through laws such as the Basic Law on the Promotion of Cultural Industries and the Cultural Industry Vision for the 21st Century. Short dramas, as an emerging content format, have been incorporated into the broader “K-Culture” framework, benefiting from related policy incentives. South Korea has also built a joint public–private funding system, including the Information Promotion Fund and the Cultural Industry Promotion Fund. The Seoul Metropolitan Government, under its Regulations on Fostering and Supporting the Cultural Content Industry, provides financial support for short drama producers through rental subsidies and technology grants.

Operating under a unique “light regulation and industry self-discipline” model, South Korea’s short drama industry enjoys a creative edge over more restrictive markets. With minimal government intervention, creators have greater freedom to experiment, turning the Korean market into a testing ground for innovative themes and formats that attract both Chinese and global participants.