Key Insights

Smartphone penetration exceeds 70%, and over half of AI users are willing to pay

As of 2025, Southeast Asia’s population stands at around 700 million, with 60% in the under‑35 age group, and a median age of only 30.9 years, reflecting a distinctly youthful demographic profile. Smartphone penetration exceeds 70%, and social-media coverage reaches 61.5%, making users highly reliant on digital lifestyles. At the same time, digital wallets and mobile payments are gaining widespread adoption; in Vietnam, for instance, 55% of AI users are willing to pay for premium services. The combination of demographic dividends, digital infrastructure, and supportive commercial environment together drive a strong demand for generative AI in the Southeast Asian market.

Major social media content creators see annual growth rates exceeding 50%, deepening reliance on AI tools

The creator economy in Southeast Asia is growing rapidly, with over 20 million content creators in the region. The number of creators on YouTube and TikTok is growing by more than 50% each year. This vast creator community increasingly depends on generative AI tools for multilingual content production, localised short-video scripts, virtual idols, and personalised digital humans, and is a key driver for this market’s development.

Fragmented payment systems and wide income disparities call for flexible pricing and local integration

Southeast Asian countries each have their own dominant local payment methods, such as GoPay in Indonesia, Touch ‘n Go in Malaysia, Momo in Vietnam, TrueMoney in Thailand, etc., while international credit cards and PayPal usage remains limited. Meanwhile, the per capita GDP gap within the region is substantial, with Singapore’s GDP exceeding Laos’ by over 30 times. To achieve scalable growth in markets with differing purchasing power, generative AI tools expanding overseas must integrate diverse local payment methods and adopt flexible, tiered-pricing and value-added models.

Over 1200 local languages and dialects: AI tools should enhance multilingual coverage and localised comprehension

Southeast Asia, a region of extreme linguistic diversity, spans four major language families and more than 1200 languages, with Indonesia alone having over 700 local languages. Local users also frequently mix multiple languages, posing higher demands on AI natural language understanding and generation. Generative AI tools need to accurately adapt to the local contexts to strengthen user engagement. Multilingual support and understanding of cultural context have become critical success factors for the localisation of AI tools in Southeast Asia.

The rapidly growing AI market in Southeast Asia

With the global surge of generative AI, companies developing AI tools are increasingly exploring overseas markets to find new growth opportunities. Southeast Asia, home to about 700 million people—around 60% of whom are young and with a median age of just over 30—is one of the world’s most promising digital consumer groups. The region boasts a smartphone penetration rate exceeding 70%, social media coverage over 60%, and rising adoption of digital wallets and mobile payments. Together, these factors have created a mobile-first and increasingly mature digital ecosystem. Meanwhile, Southeast Asian governments are actively implementing strategies such as “Smart Nation” and “Digital Economy Blueprints”, providing a supportive policy environment for AI applications. Benefiting from a combination of demographic dividends, improving infrastructure, and growing user demand, Southeast Asia is emerging as both a frontier for generative AI innovation and a launchpad for global expansion. What are the core advantages of the Southeast Asian market? How should AI companies expand into the region? And what challenges and opportunities lie ahead?

A young, digitally native population creates a blue-ocean opportunity

Young people make up around 60% of the population, serving as the main driver of market growth

Southeast Asia is emerging as one of the fastest-growing digital economy markets globally. Its unique demographic structure, rapidly developing digital infrastructure, and highly open cultural environment create exceptionally favourable conditions for the adoption of generative AI tools.

As of early September 2025, the region has a population of approximately 700 million people, with a median age of only 30.9 years. Users aged 35 and below, due to their high acceptance of new technologies and strong appetite for digital consumption, account for about 60% of the population and serve as the primary driver of market growth. This demographic advantage directly translates into a natural acceptance of and enthusiasm for digital technologies and AI tools.

High internet and smartphone penetration, with widespread social media adoption

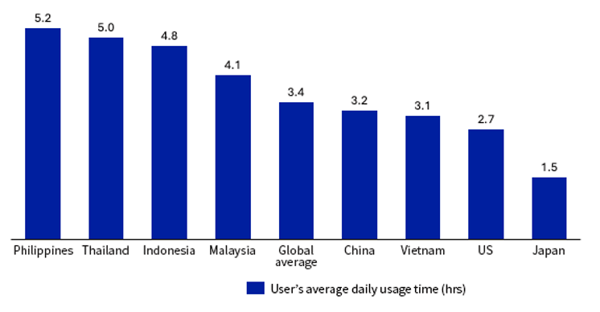

The rise of the digitally native generation is a notable feature of the Southeast Asian market. The region’s smartphone penetration rate exceeds 70%, and as early as 2020, internet users aged 16-64 in Indonesia, Vietnam, and the Philippines were spending around 5 hours a day online via mobile devices, ranking among the top five globally. Furthermore, according to Meltwater and We Are Social's “Digital 2025” report, the social media penetration rate across the Southeast Asian region reached 61.5%, accounting for 10.2% of the world’s total social-media users. This highly digitalised living environment keeps Southeast Asian users highly curious about and receptive to new technologies. They are accustomed to mobile-first digital experiences and are willing to try new apps and services, providing fertile ground for the rapid spread of generative AI tools. It is worth noting that Southeast Asian users skipped the PC internet era and jumped directly into the mobile internet age. This leapfrog development makes them more receptive to AI innovations designed for mobile devices.

Average daily mobile internet usage time among internet users aged 16-64 in four Southeast Asian countries, compared with the global average, 2020

Source: Global Web Index

Rising digital wallet adoption, and users willing to pay for quality AI services

The adoption of digital wallets and mobile payments continues to rise in Southeast Asia, fuelled in particular by local payment solutions like GoPay in Indonesia, GrabPay in Singapore, and Touch ‘n Go in Malaysia. Digital payments have become the preferred choice for younger users, whose spending habits tend to be fragmented and involve smaller transaction amounts, a pattern that aligns well with the micropayment needs of generative AI content. According to a TN Global survey, more than 55% of AI users in Vietnam are willing to pay for premium services, with this willingness particularly prominent in the 18-24 age group. A relatively mature payment ecosystem has significantly lowered the barriers to commercializing AI tools, providing innovative enterprises with sustainable business models.

Furthermore, Southeast Asian governments have launched digital-economy development plans, such as Thailand’s “Thailand 4.0” strategy, Singapore’s “Smart Nation 2025” initiative, and Malaysia’s “National Digital Policy”. These policies provide strong support for AI innovation and foster a favourable atmosphere for AI applications.

Decoding Southeast Asian AI consumer behaviour

Saving time, learning support, and creative generation are the three core needs

Southeast Asian users are characterised by clear usage motivations. A survey of Vietnamese users shows that the primary purposes of using AI are to save time (67%), assist learning (60%), enhance creativity (51%), and improve accuracy (48%). This pragmatic orientation directly influences their choice of AI functions and payment decisions. Unlike users in Europe and America who focus more on entertainment and exploration, Southeast Asian users expect AI tools to solve practical efficiency challenges in daily life, thus requiring AI tool providers to pay more attention to practical functions and delivering immediate value.

In Southeast Asia, young, highly educated groups are the main consumers of AI tools. Taking Vietnamese users as an example, the usage rate among 18-24-year-old AI users is as high as 86%, with 40% of users using AI daily. 92% of the student population has been exposed to and uses AI in their studies, followed by office workers and business owners. Differences in education level are also reflected in usage: those with an undergraduate degree or higher are more inclined to adopt AI, with an adoption rate of 78% for undergraduates and 84% for those with higher degrees; daily usage rates are also at the highest level among these two groups. This user structure provides clear guidance for market entry strategies — targeting students and young white-collar workers as the breakthrough point, achieving early penetration through educational scenarios.