Preface

Leveraging its highly developed digital infrastructure and strategically advantageous geographical location, Singapore has firmly established itself as the digital entertainment hub of Southeast Asia and a critical gateway for global gaming companies seeking to enter the region. Singapore boasts a gamer base of 4.62 million, representing a penetration rate of over 70% of the total population – and, crucially, the market is expanding rapidly. While Singapore’s gamer base is relatively small in absolute terms compared with other major markets, it stands out for its strong spending power: in 2024, average revenue per user (ARPU) reached USD 292, far exceeding the regional average. This high level of spending, supported by the country’s exceptionally high per capita GDP and users’ strong willingness to pay, positions Singapore as one of the world’s fastest-growing and most profitable gaming markets.

Singapore’s gaming population exhibits distinctive age and behavioural characteristics that challenge conventional perceptions. Data reveals that middle-aged players aged 45–54 represent the most engaged cohort, with nearly half playing games on a daily basis. Meanwhile, players aged 55 and above – known as the “silver generation” – record significantly longer single-session playtimes, with almost 40% of players in this segment spending more than two hours per session. This highlights the substantial potential of the emerging “silver economy”.

From a consumer psychology perspective, Singaporean players are deeply influenced by the cultural mindset of kiasu (literally “fear of losing”), making them exceptionally rational and value-driven consumers. Evidence shows that pricing and discounts are their primary motivators for spending, far outweighing considerations such as game progression or enhanced visuals. Their purchasing behaviour is focused on maximising cost-effectiveness, with a clear preference for making transactions when offered explicit discounts, bundled packages, or high-value battle passes rather than engaging in impulsive spending.

When it comes to payments, Singaporean players demand an exceptionally fast and smooth experience, showing minimal tolerance for any form of friction in the process. They prefer seamless, one-click payment journeys and are reluctant to leave the game environment or undergo complicated verification steps. According to 2024 data, digital wallets have become the dominant online payment method in Singapore, followed closely by credit cards, while the country’s unique nationwide Real-time Payments (RTP) system, PayNow, is being adopted rapidly.

Antom enables merchants to access Singapore’s complete payment ecosystem through a one-stop solution, helping them unlock the market’s full potential. In addition, Antom has introduced its Scan to Link solution, designed to address common challenges players face when linking payment methods across PCs, consoles and smart TVs, such as operational complexity and low success rates. By simply scanning a QR code, users can complete the linking process, boosting payment success rates by around 20% and significantly enhancing the cross-device payment experience.

Singapore’s gaming market: small in size, big in regional influence

A digital entertainment hub driving Southeast Asia’s gaming growth and leading in player spending power

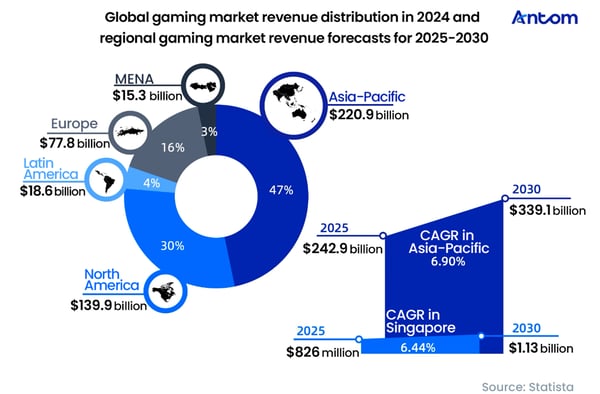

As one of Southeast Asia’s leading digital entertainment hubs and one of the fastest-growing gaming markets globally, Singapore has established itself as the entry point of choice for international gaming companies expanding into the region. Benefiting from a highly digitalised social environment and a strategically advantageous geographical location, the country offers unparalleled conditions for market entry. The Singapore gaming market is projected to reach USD 826 million in 2025, with an estimated compound annual growth rate (CAGR) of 6.44% between 2025 and 2029.

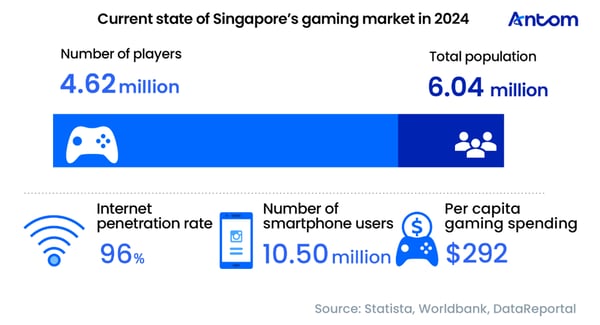

Singapore’s gaming market continues to expand, with its player base growing steadily. Out of a total population of approximately 6.04 million, 4.62 million are gamers, representing a penetration rate of over 70%. Although the overall population is relatively small, the market stands out due to its high per capita GDP and advanced digital infrastructure. Furthermore, Singapore leads Southeast Asia in gaming expenditure: its gamers are characterised by a strong willingness to pay and a high ARPU. In 2024, average annual spending per player reached $292, far above the regional average for Southeast Asia.

Policy incentives draw global giants as local leaders rise alongside regional powerhouses

The prosperity of Singapore’s gaming market is no coincidence – it stems from proactive government guidance and systematic planning. Unlike many countries where the government acts merely as a passive regulator, Singapore’s authorities – through agencies such as the Infocomm Media Development Authority (IMDA) – take on the role of a “guild master” within the gaming industry ecosystem. They not only provide financial grants and supportive policies but also strategically entice global gaming giants such as Ubisoft, Riot Games, and Tencent to establish studios locally. At the same time, they mentor and support domestic independent developers while promoting the professionalisation of eSports. This deliberate, top-down approach has positioned the gaming industry as a vital pillar of the nation’s broader digital economy strategy.

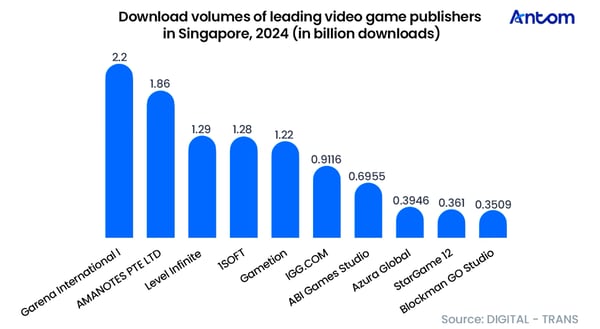

As a testament to the strength of this institutional framework, Singapore’s 2024 game download rankings reveal a diverse landscape where domestic champions coexist alongside regional heavyweights. Garena International I leads the chart with an impressive 2.2 billion downloads, followed closely by AMANOTES PTE LTD, a Vietnamese publisher known for its music games. Other companies on the list, such as 1SOFT, IGG.COM, and ABI Games Studio, hail predominantly from Asia, further underscoring Singapore’s strategic importance as a regional gaming hub.

Garena’s success is largely driven by Free Fire, a tactical battle-royale mobile game developed by the company. Specifically optimised for lower-end smartphones in emerging markets, the game features a compact installation package, which has enabled it to build a massive user base across regions such as Latin America, Southeast Asia and India.