Key Insights

- Saudi Arabia significantly outpaces MENA in gaming spending, with per capita spending three times the regional average

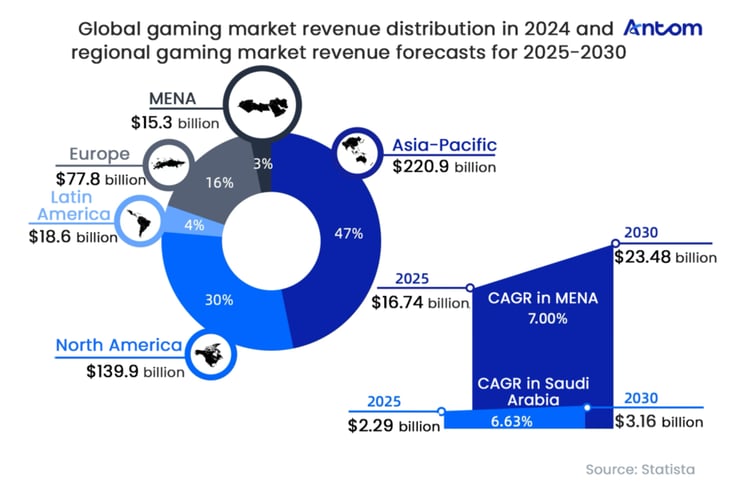

Saudi Arabia is the largest gaming market by revenue in the Middle East and North Africa (MENA). In 2023, it accounted for 57.6% of total revenue in the MENA gaming market. Its market size is projected to reach USD 2.29 billion by 2025, with a compound annual growth rate (CAGR) of 6.87% from 2025 to 2029.

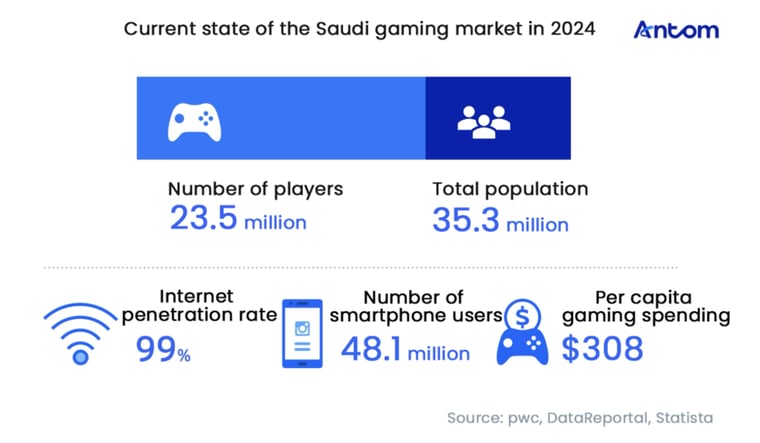

In 2024, Saudi Arabia had 23.5 million players, representing a penetration rate of 63%. The per capita gaming spending stood at $308 – significantly higher than the MENA average of $102.4 – demonstrating strong consumer spending potential.

- 80% of players are frequent online gamers, underscoring Saudi Arabia’s commitment to becoming a global eSports hub

Saudi Arabia’s eSports market is growing rapidly, with Gamers8 now established as one of the world’s largest eSports events. In line with the Vision 2030 initiative, Saudi Arabia is seeking to position itself as a global hub for eSports and gaming. The sector already makes a significant contribution to GDP and is an important source of employment. Looking ahead, Riyadh, the Saudi capital, will host the inaugural Olympic Esports Games in 2027.

Furthermore, a youthful population, a hot climate, high levels of internet penetration are together driving extended time spent online and strong user engagement, with eight in ten people playing games every week.

- Hardcore players under 35 drive revenue growth through heavy in-game spending

Saudi players show a strong willingness to pay, with spending power particularly concentrated on PC, where there is a notably high proportion of big-spending users. Mobile games, by contrast, reach a broader audience, with the free-to-play (F2P) model and in-app purchases dominating the market. Overall, revenue growth is driven by a core cohort of hardcore players – mainly under 35 – who show high levels of loyalty and a readiness to pay repeatedly for high-value items, limited-edition skins and long-running events.

- Card payments dominate, but local alternatives are key to improving success rates

In Saudi Arabia’s gaming market, debit and credit cards remain the dominant payment methods. Meanwhile, alternative options such as mobile carrier billing, digital wallets, and prepaid top-up cards offer convenient top-up options for minors and unbanked users. To maximise conversion, games companies should prioritise support for local payment methods, while also optimising payment cost structures and strengthening risk management systems to improve both payment success rates and the overall user experience.

Saudi Arabia: shaping the future of global gaming beyond the Middle East

The Middle East’s gaming frontrunner: a new engine for global growth

The overall gaming market in the Middle East and North Africa (MENA) region has maintained rapid growth in recent years, establishing itself as one of the fastest-growing markets globally. Saudi Arabia is the highest-revenue market in MENA, accounting for 57.6% of the Middle East gaming market in 2023.

Saudi Arabia’s gaming market revenue is expected to reach $2.29 billion by 2025, with a forecast compound annual growth rate (CAGR) of 6.63% from 2025 to 2030. As the core market in the region, it continues to expand in scale and demonstrates substantial growth potential. The country not only dominates the Middle East market, but is also increasing its influence in the global gaming industry, attracting growing interest from international investors as well as games developers and publishers.

Saudi Arabia’s eSports festival Gamers8 has become one of the world’s largest gaming events. Bringing together top players and audiences from around the globe, it has given a major boost to the local eSports ecosystem.

In addition, the inaugural Olympic Esports Games will be held in 2027 in Riyadh, the Saudi capital. This not only underscores Saudi Arabia’s leadership in the global esports arena but also highlights the deeper integration between eSports and traditional sports, injecting fresh momentum into the future development of the industry.

In 2024, Saudi Arabia had 23.5 million players, with a player penetration rate of 67%. As a country with advanced digitalisation and widespread mobile internet use, it boasts 22.55 million smartphone users and an internet penetration rate of 99%. This robust digital ecosystem lowers barriers to spending while encouraging higher levels of player spending. The per capita gaming spend in Saudi Arabia stands at $308, well above the MENA average of $102.4.