Preface

In recent years, the e-commerce sectors in Brazil and Mexico have grown rapidly, driven by a young consumer base, widespread mobile internet access, and the expansion of both domestic and international e-commerce enterprises. Between 2025 and 2029, both markets are expected to maintain double-digit compound annual growth rates (CAGR) in e-commerce retail sales.

Within Latin America’s e-commerce ecosystem, Argentina’s Mercado Libre and the US-based Amazon are the two dominant platforms. In addition to local and US-based giants, a new wave of Asian e-commerce platforms, including AliExpress, Temu, and Shopee, has been accelerating its market penetration across the region. Competition in Latin America’s e-commerce sector is expected to intensify, creating a more diversified platform landscape. Consumers across the region share similar online shopping preferences: in both Brazil and Mexico, affordable electronics and fashion and beauty products are particularly popular.

The rapid growth of e-commerce has brought both opportunities and challenges for Latin America’s logistics infrastructure. At present, the logistics systems supporting e-commerce remain underdeveloped, with weak infrastructure and limited parcel-tracking capabilities still constraining the shopping experience. However, these challenges also create opportunities for international logistics providers with advanced technologies and management expertise. Leading Asian logistics enterprises such as Cainiao, J&T Express, and Lalamove are actively expanding their presence in Latin America, advancing the globalisation of logistics services.

In the coming years, as Latin America’s e-commerce market continues to expand, logistics networks across the region are expected to undergo profound transformation, becoming a key driver of industrial upgrading. Meanwhile, cross-border logistics systems will continue to improve, delivering faster and more reliable services for international e-commerce.

Logistics industry in Latin America: potential, preferences, and bottlenecks

Economic and demographic advantages supporting the rapid growth of e-commerce

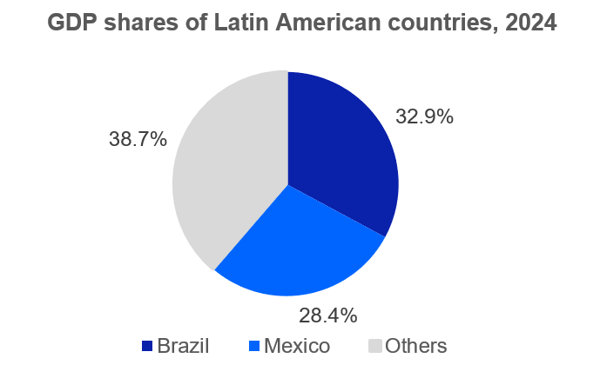

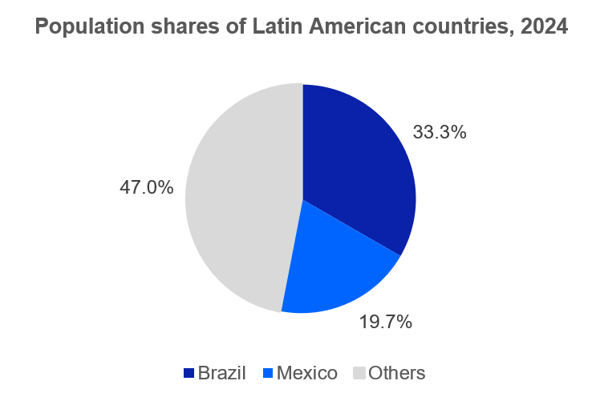

Brazil and Mexico are the largest and second-largest economies in Latin America respectively. According to Statista, in 2024 Brazil’s GDP reached USD 2,331.4 billion and Mexico’s GDP stood at $2,017 billion, with the two countries together accounting for around 61.3% of the region’s total GDP. From a demographic perspective, Brazil is the most populous country in Latin America with over 200 million people, followed by Mexico with about 130 million. Together, they represent roughly 52% of the region’s total population. Their strong economic performance and large population base provide a solid foundation for the development of consumer-related industries.

Source: Statista, iResearch

Source: Statista, iResearch

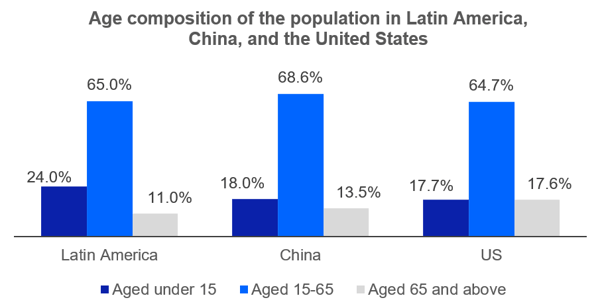

The rapid growth of the e-commerce sector is also supported by a relatively young consumer base, widespread mobile internet access, and the accelerated expansion of both domestic and international e-commerce enterprises across the region. Latin America’s median age is 30.97 years, and the share of people aged 0–14 is higher than that in major global economies. In 2023, internet penetration reached 86.6% in Brazil and 83.2% in Mexico. This young demographic structure, combined with high internet connectivity, has strengthened consumers’ engagement with digital channels.

Source: Statista, iResearch

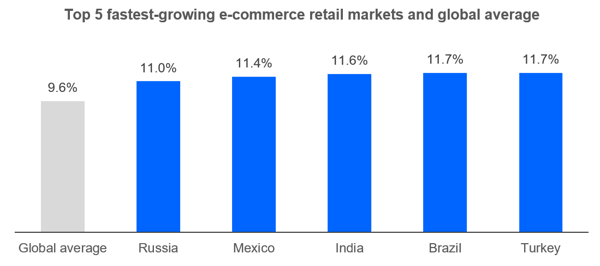

Against this backdrop, both domestic and cross-border e-commerce markets are expanding rapidly across the region. According to Statista, the total value of Latin America’s e-commerce retail market reached $319 billion in 2024. As two of the region’s most developed economies, Brazil and Mexico are projected to maintain double-digit compound annual growth rates in e-commerce retail sales between 2025 and 2029, at 11.7% and 11.4% respectively, exceeding the global e-commerce growth rate.

Source: Statista, iResearch