Key Insights

- Strong purchasing power and the dominance of IP collaborations

Japan is the third-largest gaming market in the world, with revenue expected to surpass USD 50.9 billion by 2025. Despite a relatively small population, over 70% of players have paid for games, and average spend per player stands at an impressive $807, far above the average per-player spend of $154 in the Asia-Pacific region. This high-income, highly active player base makes Japan a fiercely competitive arena for global gaming companies. Meanwhile, new trends have emerged amidst this competitive landscape: AR/VR technology driving future growth, a surge in game-streaming audiences, and the accelerating rise of anime IP-based games.

- Strong demand for immersive single-player experiences presents great opportunities for RPG publishers

While Japanese gamers are predominantly casual to moderate users, they are extremely active. Furthermore, Japan’s gaming market stands out for having a relatively high proportion of older players, with the 40–59 age group making up nearly half of the total. Japanese players exhibit a preference for low social interaction, low competition, and high immersion, prioritising personal pace and deep experiences. In terms of game genres, role-playing games (RPGs) are highly popular, supported by strong IPs that sustain player spend. While mobile is the preferred gaming platform, consoles still attract almost one-third of players due to the strength of domestic console brands. PC gaming is rising sharply, with new Steam users in the country growing by more than 150% since 2019.

- Deep engagement drives spending while word-of-mouth shapes purchasing decisions

Mobile games dominate lower-spend categories, but Japanese players are more willing to invest heavily in console and PC titles that offer richer content and deeper experiences. This split reflects a broader consumption pattern: mobile games for daily entertainment, and console/PC games for higher-value engagement. Purchasing decisions are strongly shaped by social factors – from friend recommendations and gaming platforms such as Steam, to social media and promotional campaigns – underlining the pivotal role of peer influence in driving spend.

- Digital wallets and web-based direct payments improve both cost efficiency and player experience

Payment channels are diversifying rapidly, with web-based direct payments and e-wallets such as PayPay gaining strong traction. Developers are cutting costs by building their own direct payment platforms, while also offering discounts and greater convenience to players. Local digital wallets including PayPay and LINE Pay are now widely used in gaming, reflecting broader adoption across Japan. Antom’s partnership with PayPay – the country’s leading e-wallet – further streamlines the process, delivering smoother, more accessible payment experiences for players.

Innovation and content diversity drive Japan’s rise as a global gaming leader

The world’s third-largest gaming market

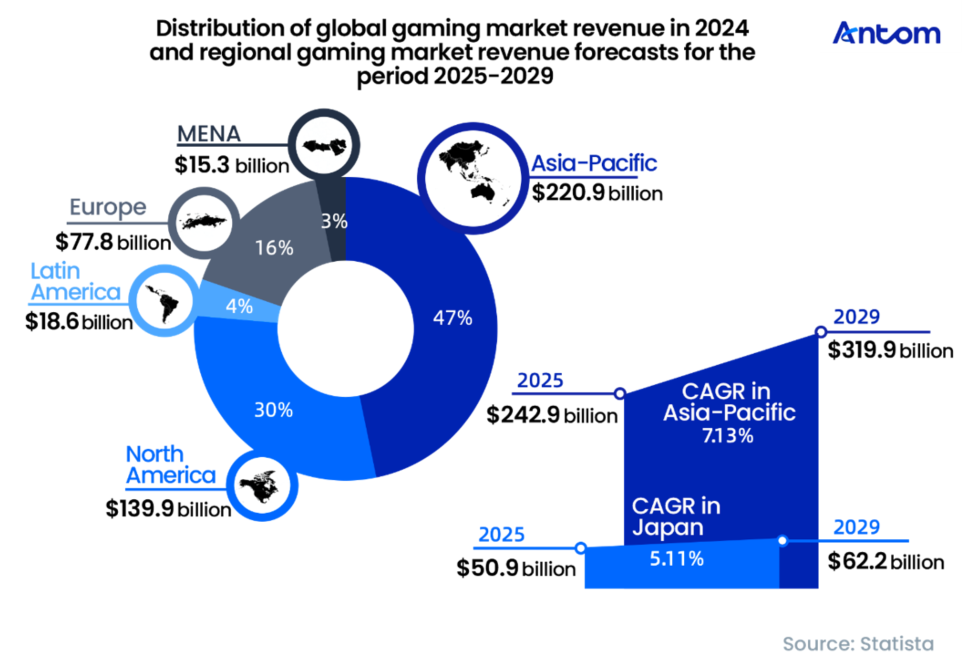

Although Japan has a relatively small population, it is the third-largest gaming market globally, behind China and the United States. According to Statista’s forecast, Japan’s gaming market revenue will reach USD 50.94 billion by 2025, with an estimated compound annual growth rate (CAGR) of 5.11% from 2025 to 2029.

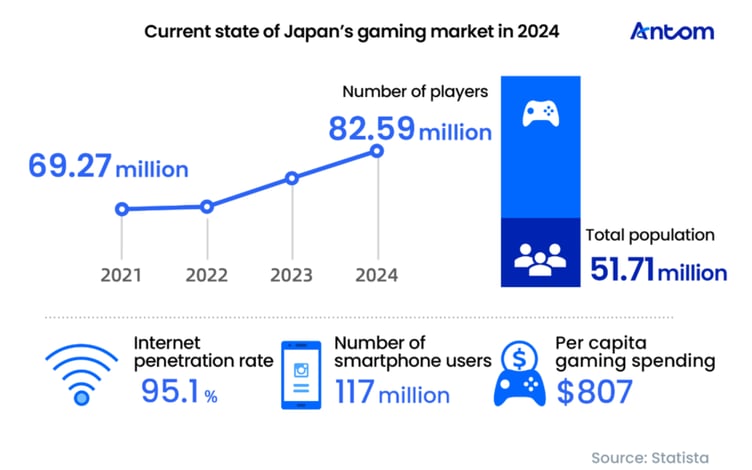

Japan is one of the world’s most influential gaming markets, with player numbers continuing to rise in recent years – from 69.27 million in 2021 to 82.59 million in 2024, representing 67.1% of the total population. Per capita spending on gaming is also among the highest globally, standing at USD 807 – far exceeding the Asia-Pacific average of $154, underscoring Japanese gamers’ strong spending power. The country has an internet penetration rate of 95.1% and 117 million smartphone users, allowing the mobile gaming market to thrive at an accelerated pace.

Innovation, content diversity and enhanced interactivity fuel new growth

Japan’s gaming market is facing the dual challenge of intense competition and shifting consumer preferences. In response, leading developers are diversifying their product portfolios to attract a broader audience and sustain growth. Three key trends are shaping the next phase of the industry:

- Expansion of the AR/VR market: according to data from the Japan External Trade Organization (JETRO), Japan’s AR/VR market expenditure grew from USD 1.29 billion in 2018 to $1.78 billion in 2019, and reached $3.42 billion in 2023. The growing popularity of VR gaming has further fuelled market demand, with players increasingly using headsets, controllers, smart glasses, and sensor-equipped gloves for more immersive gaming experiences. AR/VR technology is set to become a major growth engine for Japan’s gaming sector.

- Rapid growth in game streaming audiences: by 2027, Japan’s game streaming user base is expected to grow to 3.4 million – a rate that far outpaces other live streaming categories (1.1 million). This rapid growth signals that game streaming is becoming a critical component of Japan’s gaming ecosystem. As live content diversifies and interactive experiences improve, game streaming not only provides more monetisation opportunities for content creators but also offers players a richer entertainment experience, further driving the industry’s activity and commercial potential.

- The rise of anime IP-based games: games based on Japanese anime IPs are rapidly rising in popularity, and anime IP collaborations are becoming increasingly central to developers’ operational strategies. Popular IPs like Naruto frequently release adapted mobile games, boosting licensing revenue. Additionally, targeted IP collaborations can help expand market reach and increase engagement with younger users aged 10–30. For example, The Quintessential Quintuplets has proven especially popular among young men, while Tokyo Revengers has attracted a large female following, broadening the user base and deepening engagement.

With ongoing technological advances, greater content variety and expanding interactive platforms, Japan’s gaming market is continuing to attract new players, reinforcing its leading position globally. For developers and publishers seeking overseas growth and looking to build a larger base of core players, Japan represents one of the most promising and attractive opportunities worldwide.