Key Insights

While Southeast Asia’s digital economy approaches the USD 1 trillion milestone, the region’s SaaS sector still accounts for less than 7% of the APAC market

In 2024, Southeast Asia’s digital economy reached a Gross Merchandise Value (GMV) of $263 billion and is expected to approach $1 trillion by 2030, with e-commerce remaining the core growth driver. Currently, the region’s Software as a Service (SaaS) market represents less than 7% of the Asia-Pacific total – despite its GDP accounting for about 9.6% of the region’s overall GDP – suggesting that, compared with China, Japan, and India, Southeast Asia’s SaaS sector remains in its early stages with considerable room for expansion.

Cloud service pricing in Southeast Asia around 30% higher than in other parts of Asia

Many Asian SaaS providers bring transferable experience in e-commerce operations, supply chain management and fintech, which can be applied to Southeast Asian markets. Furthermore, cultural similarities enable these players to enter the region quickly. They often start by serving cross-border sellers, then expand into local enterprises and brands to deepen market penetration. Notably, cloud service pricing in Southeast Asia is typically around 30% higher than in other parts of Asia, while operating costs remain relatively low, resulting in higher profit margins and strong commercialisation potential.

Average SaaS spending per employee rose 2.5-fold, with software and services now accounting for half of all emerging-sector investment

Average SaaS spending per employee in Southeast Asia increased from $3.79 in 2020 to $13.47 in 2025, a 2.5-fold increase, reflecting the accelerated pace of enterprise digitalisation. Meanwhile, the share of software and services in emerging industry investment grew from 28% in the second half of 2023 to 50% in the first half of 2024, underscoring its rise as a key pillar of the region’s digital economy.

Singapore accounts for nearly 31% of Southeast Asia’s SaaS market, with POS and retail emerging as the leading use cases

As a strategic hub and testing ground, Singapore accounts for 30.9% of Southeast Asia’s SaaS market. Its high level of digital maturity and large base of replicable benchmark clients make it a preferred entry point for providers looking to enter the region. Meanwhile, Indonesia, Thailand, and Malaysia also demonstrate strong growth potential. General-purpose SaaS applications are mainly concentrated in Point of Sale (POS) systems (27.5%) and Human Resource Information Systems (HRIS), while vertical SaaS solutions are dominated by retail (43.8%), logistics, and financial services.

Islands of cloud: Southeast Asia emerges as a major testing ground for international SaaS providers

Since 2015, as domestic SaaS markets in Asia have become increasingly saturated and competitive, many providers have turned to overseas expansion in search of new growth. Fuelled by the rise of cross-border e-commerce and the internationalisation of related supply chains, SaaS companies have entered a phase of large-scale globalisation. Among international markets, Southeast Asia has emerged as a key entry point and strategic hub for global SaaS players – thanks to its geographic connectivity, cultural diversity, strong digital economy growth, and supportive policy environment.

This raises several key questions: What gives Southeast Asia its strategic edge? How are SaaS providers building user bases in the region? And which industries and sectors are seeing the fastest adoption?

Setting sail for Southeast Asia: the region at the forefront of global SaaS expansion

E-commerce growth and digital transformation fuel soaring SaaS demand

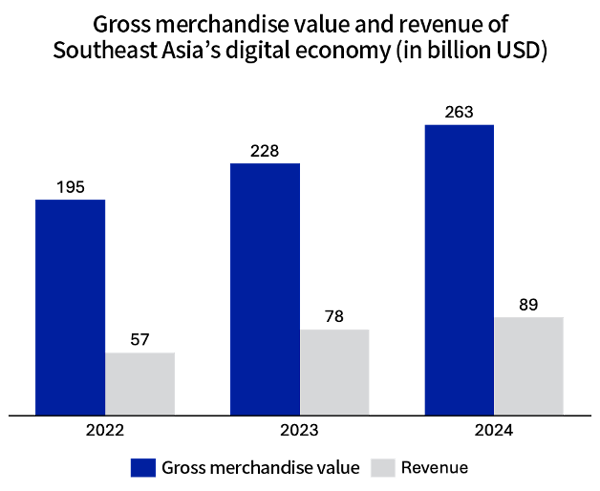

Southeast Asia’s digital economy is experiencing unprecedented growth: consistently growing at double-digit rates, it is expanding rapidly in both transaction value and revenue. According to the e-Conomy SEA 2024 report, the region’s digital economy reached a Gross Merchandise Value (GMV) of nearly $200 billion in 2022, rising to $263 billion in 2024 – an increase of around 15% year on year – and is on track to exceed $1 trillion by 2030.

Revenue has also surged, growing from $57 billion in 2022 to $78 billion in 2023, and is projected to reach $89 billion in 2024. This growth is driven by rapid improvements in internet penetration, digital payment infrastructure, and the continued digitalisation of consumer behaviour.

Gross merchandise value and revenue of Southeast Asia’s digital economy, 2022–2024

Source: Google, Temasek Holdings, Bain & Company

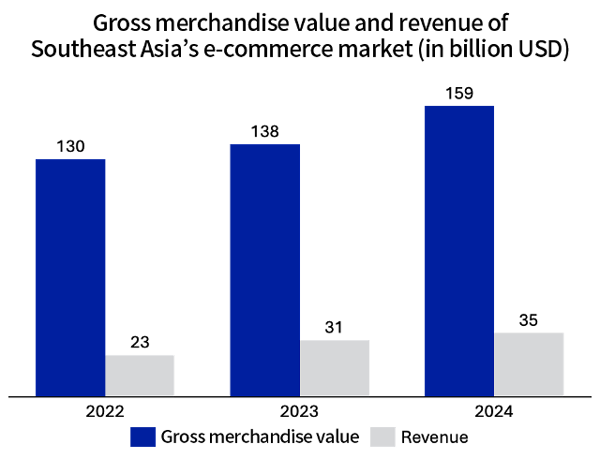

E-commerce remains the core engine of Southeast Asia’s digital economy. The region’s e-commerce GMV rose from $130 billion in 2022 to $138 billion in 2023, and is forecast to reach $159 billion in 2024. Similarly, revenue increased from $23 billion in 2022 to $31 billion in 2023 and is projected to reach $35 billion in 2024. The rapid growth of major platforms such as Lazada, Shopee and Tokopedia has not only boosted front-end transactions but also generated significant demand for mid- and back-end digital solutions. Small and medium-sized merchants now face complex operational challenges – from multi-platform management to order processing, inventory control and cross-border logistics – driving strong demand for SaaS tools that deliver process automation and data-driven decision-making.

Gross merchandise value and revenue of Southeast Asia’s e-commerce market, 2022–2024

Source: Google, Temasek Holdings, Bain & Company

In addition, the rapid growth of digital finance and logistics is further amplifying demand for SaaS solutions. With the growing adoption of digital wallets, cross-border payments and supply chain financing, enterprises increasingly require integrated management systems such as Enterprise Resource Planning (ERP) and Customer Relationship Management (CRM), alongside intelligent customer service and digital marketing automation tools. These SaaS solutions enable process automation and help businesses navigate an increasingly complex operational environment.

Against this backdrop, Antom’s infrastructure-level SaaS services play a vital supporting role. Antom supports a broad range of international and local payment methods – including digital wallets, bank cards and online banking – enabling enterprises to offer customers trusted and familiar payment channels and deliver outstanding payment experiences that drive business growth.

Furthermore, the continuing expansion of internet access also provides a vast user base for SaaS adoption. According to Statista, Southeast Asia boasted over 500 million internet users as of 2024, with penetration rates exceeding 70% in major countries and mobile internet users exceeding 440 million. This growth not only signals a vast potential market but also reflects rising digital maturity among consumers and the accelerating digital transformation of enterprises. As more businesses and individuals rely on digital tools, SaaS applications are extending beyond e-commerce into finance, logistics, education and other sectors, forming a cornerstone of Southeast Asia’s digital economy.

Transferable expertise gives global SaaS players a competitive edge in Southeast Asia

Southeast Asia’s economic trajectory and business culture share many similarities with other rapidly developing digital markets, creating a favourable environment for global SaaS expansion. Many international providers – especially those from other parts of Asia – have initially entered the region by supporting cross-border e-commerce merchants, before progressively integrating into local ecosystems and serving domestic enterprises and brands. This gradual approach allows for deeper market penetration and sustained growth, while cultural familiarity and regional proximity help reduce localisation and marketing costs compared with Western markets.

From a profitability perspective, Southeast Asia also offers attractive profit margins for international SaaS providers. In more mature markets, enterprise clients often demand extensive customisation; combined with high service costs, such demands result in lower average net profit margins. By contrast, Southeast Asia’s SaaS market remains less saturated, and businesses show greater acceptance of standardised SaaS products that require less customisation. At the same time, while operating costs in the region remain comparatively low, cloud service pricing is typically higher than in many mature markets, enabling providers to achieve healthier gross margins and stronger returns on investment.

Having been tested in highly competitive home markets, many SaaS companies now bring proven capabilities in e-commerce enablement, digital marketing, supply-chain management, and fintech. These experiences and scalable solutions are readily transferable to Southeast Asia’s fast-growing digital economy, helping local enterprises accelerate digitalisation and achieve sustainable growth.