Preface

Global e-commerce is entering a mature and opportunity-rich phase, with the market projected to approach USD 5 trillion by 2030. Instead of competing on traffic alone, merchants are now competing on experience, where social commerce is reshaping product discovery and digital wallets account for more than half of global e-commerce transactions. As cross-border shopping becomes mainstream and payments shift from friction to flexibility, checkout has become a decisive driver of conversion and lifetime value. This report explores how these changes are redefining global commerce and what merchants must prepare for in the next decade of growth.

Key Insights

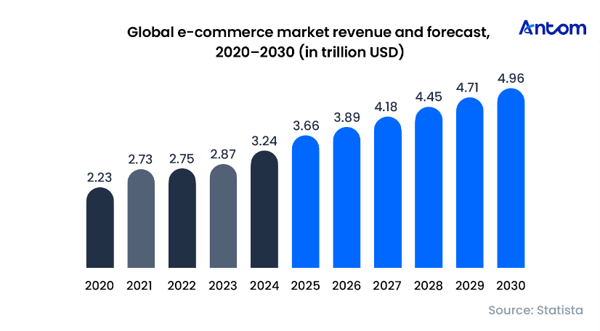

- In the post-pandemic era, the global e-commerce market is forecast to reach nearly $5 trillion by 2030, growing steadily at a 6.29% CAGR.

- Competition has shifted beyond product and price to the entire customer journey — from discovery and decision to checkout and post-purchase service.

- Social commerce is becoming mainstream, expected to represent 17.11% of global e-commerce by 2025.

- Around 70% of consumers worldwide now shop through social media platforms.

- Cross-border e-commerce is expanding rapidly, driven by consumers’ pursuit of lower prices (51%), with the global market expected to exceed $1.2 trillion by 2025.

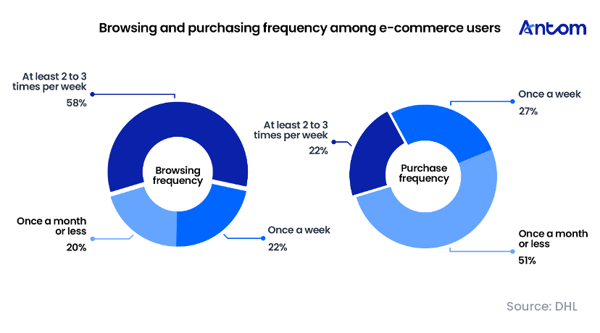

- A major conversion challenge has emerged: users show high browsing but low purchase frequency, with the payment stage now the biggest friction point (missing methods, security concerns, complex flows).

- Digital wallets make up 53% of global e-commerce payments, emerging as the dominant payment method.

- Buy Now Pay Later (BNPL) raises conversion rates and order value by easing payment pressure, while instant bank transfers (A2A) are gaining traction in markets such as Europe and Latin America.

Global e-commerce landscape: trends and regional dynamics

After a brief period of post-pandemic adjustment, the global e-commerce market is entering a phase of more mature and sustainable growth. According to Statista, the market is expected to reach $3.66 trillion by 2025 and expand steadily at a compound annual growth rate (CAGR) of 6.29% between 2025 and 2030, approaching the $5 trillion mark by 2030. This trajectory reflects a structural shift from the pandemic-driven surge to steady expansion supported by the market’s own momentum. While online shopping habits have become firmly established, future growth will be powered by a dual dynamic: emerging markets with significant room for digital penetration, and mature markets that continue to innovate in areas such as cross-border trade, social commerce, and AI. Together, these forces are pushing global e-commerce towards its next major milestone.

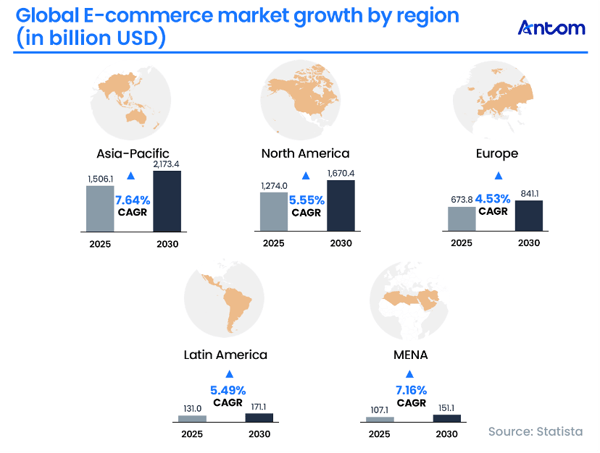

Growth patterns show clear regional divergence. The Asia-Pacific region stands out as the primary engine of expansion, with a CAGR of 7.64% driven by scale and the mobile-first, socially vibrant ecosystems of Southeast Asia. Close behind is the Middle East and North Africa (MENA), another high-potential region, with a CAGR of 7.16%. In comparison, mature markets such as North America (5.55%) and Europe (4.53%) are transitioning from user acquisition to “value-deepening”, focusing on service excellence and higher spend per user. The industry is being driven by parallel growth engines: rapid digital adoption in emerging markets and value-driven innovation in mature economies.

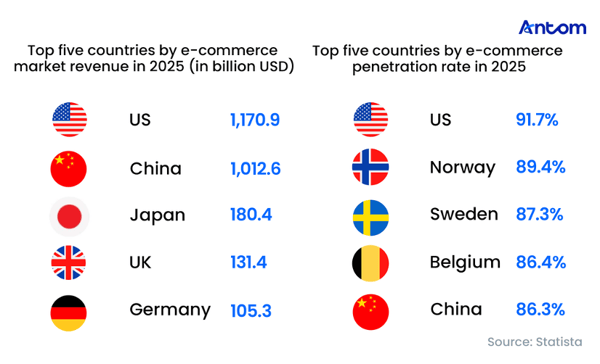

The global market structure also shows a clear “dual-core” pattern. The United States ($1,170.9 billion) and China ($1,012.6 billion) are projected to dominate market revenue in 2025, and both rank among the highest worldwide in penetration — 91.7% in the United States and 86.3% in China. The US model, rooted in a strong retail foundation and a well-established omnichannel platform, demonstrates high scalability. By contrast, China’s model has delivered rapid innovation-led expansion through a mobile-first ecosystem driven by super-apps and live-streaming commerce. Meanwhile, smaller European markets, such as Norway and Sweden continue to demonstrate high maturity, with exceptionally strong user penetration and deeply embedded online shopping habits.

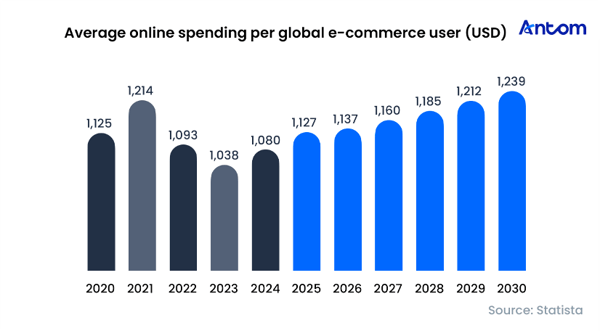

After a brief decline in 2022-2023 caused by high inflation and macro-economic uncertainty, average revenue per user (ARPU) has begun a steady recovery and is projected to surpass its pandemic-era peak by 2030. This “V-shaped rebound” signals a shift in the industry’s growth engine: instead of passive pandemic-led consumption transfer, expansion will now be driven by “value deepening”. ARPU growth is expected to come from deeper integration of e-commerce into everyday life — particularly in high-frequency categories such as online groceries — alongside value-added services such as faster delivery, subscription models, and rising consumer trust in cross-border shopping. This shift from user base expansion to user value enhancement marks the transition of global e-commerce towards a healthier and more sustainable development path.

E-commerce user insights

Global e-commerce users show a clear behavioural pattern of “high browsing, low purchasing frequency”. Around 80% of users browse e-commerce platforms at least once a week, yet fewer than half of them (49%) make a purchase within the same period. The disparity indicates that online browsing has become a daily habit involving research, price comparison and entertainment, while purchase decisions are increasingly cautious. As a result, a significant share of traffic is lost in the final step — from shopping cart to payment. The root cause are familiar friction points such as unexpected shipping costs, customs duties, and limited payment options. Consequently, competition will shift from simply attracting traffic to optimising the entire user journey — enhancing cost transparency, payment flexibility and logistics reliability — to bridge the crucial last mile from consumer desire to decisive action.

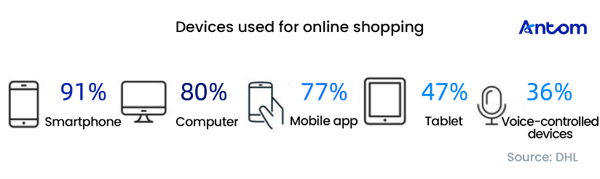

The device landscape confirms that “mobile-first” is now the global default. Smartphones (91%) and mobile apps (77%) remain consumers’ preferred shopping channels, making mobile-native design essential for merchants. Desktop usage, however, remains high at 80%, showing that shopping journeys span multiple devices and require seamless omnichannel integration. Notably, 36% of users now adopt voice control, signalling the rapid emergence of “voice commerce”. When paired with AI technologies, this trend is expected to usher in a new era of conversational shopping. Research by J.P. Morgan further reveals that in emerging markets such as India, Indonesia, and Vietnam, consumers have bypassed the PC era entirely and use smartphones as their primary gateway to both the internet and commerce.

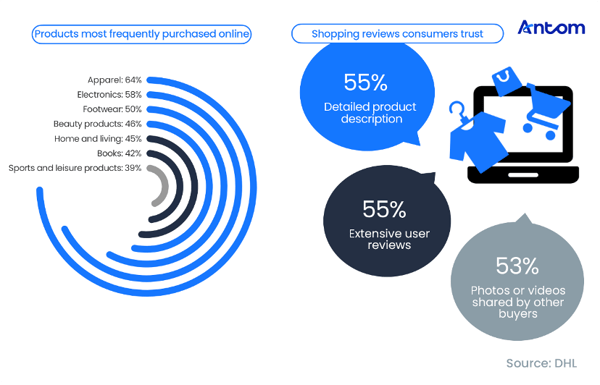

Global online spending is concentrated in lifestyle categories, dominated by apparel (64%) and electronics (58%). However, converting interest into actual purchases hinges on trust. Consumer confidence has shifted from brand-led messaging towards peer-led validation. While detailed product descriptions (55%) remain fundamental, extensive user reviews (55%) and authentic photos or videos shared by other buyers (53%) have become decisive factors influencing purchase decisions.

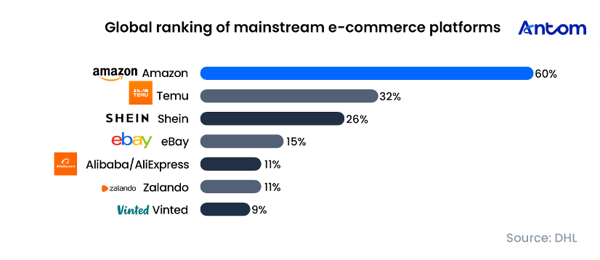

The global e-commerce platform landscape follows a “one dominant, many strong” pattern. Amazon leads with 60% usage rate, supported by its deep trust ecosystem, underpinned by FBA and Prime — delivering “fast, free delivery” and “hassle-free returns” that create a powerful service moat. Meanwhile, Asian challengers such as Temu (32%) and Shein (26%) are reshaping competition through value-driven, cross-border models. Their Customer-to-Manufacturer (C2M) supply chain enables extreme price efficiency, drawing a vast number of price-sensitive consumers worldwide. ECDB’s 2025 Global E-commerce Survey confirms this trend, with Shein surpassing traditional retailers to become the world’s largest online fashion platform. Meanwhile, focused vertical players continue to succeed: Germany’s platform Zalando thrives through category specialisation, while Lithuania’s second-hand platform Vinted reflects the rapid rise of the circular economy as a mainstream commercial sector.