Preface

Asia is the world’s largest e-commerce market, generating over USD 1 trillion in annual sales and accounting for more than half of global online retail. Growth is powered by mobile-first consumers, a fast rising digital-native middle class, and trends like “shoppertainment”. Yet opportunity comes with complexity: the region’s fragmented payment landscape—from digital wallets to cash-on-delivery—creates operational trust challenges. As real-time payments and Open Banking expand, innovation is breaking down barriers and unlocking new growth across Asia’s dynamic and diverse digital economy.

Key Insights

- Asia’s e-commerce market has surpassed the trillion-dollar mark, driving more than half of global online retail sales.

- 88% of consumers in Thailand complete purchases via social platforms, highlighting the shift towards “shoppertainment”.

- The payment ecosystem is highly diverse: digital wallets, Buy Now Pay Later (BNPL), and cash-on-delivery (COD) dominate in different markets, with COD holding a 19% share in the Philippines.

- Open Banking is emerging as a solution to high transaction costs and fraud, facilitating cost-effective and secure “account-to-account” payments.

- Government-led digital infrastructure projects, including National QR Codes and real-time payment systems, are accelerating across the region.

- The increasing sophistication of fraud and high transaction costs present critical challenges for merchants managing cross-border payments.

- Asia’s e-commerce market is poised for continued growth, driven by digital adoption, an expanding middle class, and innovative payment solutions.

Unlocking opportunities in eight fast-evolving Asian economies

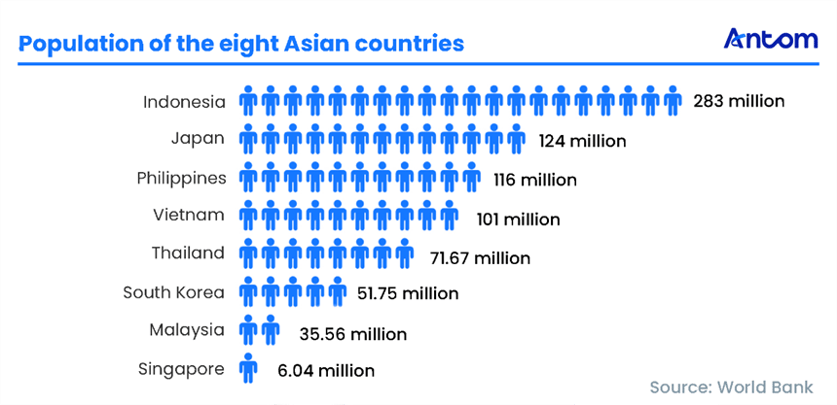

Among the eight Asian markets, Indonesia stands out with a population of 283 million in 2024, making it the world’s fourth most populous nation and giving its e-commerce sector an enormous demographic advantage. Other members of the “hundred-million population club” include Japan, the Philippines, and Vietnam.

Japan, with a population of 124 million, is a mature consumer market with strong purchasing power and well-established retail behaviour, while the Philippines and Vietnam are youthful economies powered by rising labour forces and emerging digital consumers.

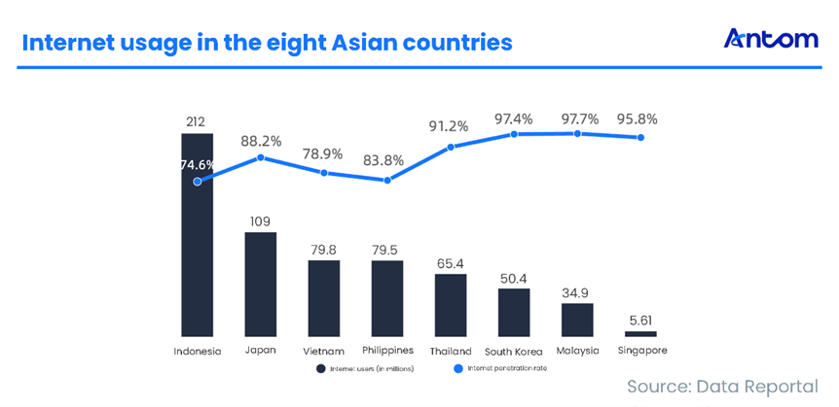

Indonesia also leads in total number of internet users. Meanwhile, South Korea, Malaysia, and Singapore demonstrate exceptionally high levels of digital maturity: internet penetration exceeds 95% in all three markets, signalling near-universal online connectivity.

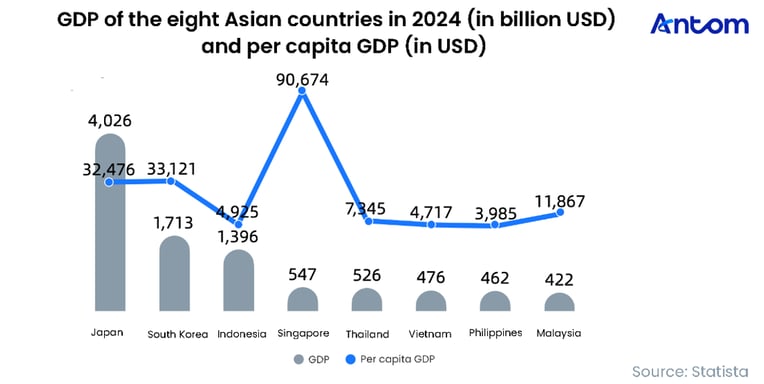

Economic capacity varies widely. Japan, with a GDP of $4 trillion, serves as the region’s economic anchor. In per-capita terms, Singapore stands apart with GDP exceeding $90,000, forming the top-tier consumer market alongside Japan and South Korea — both high-income economies with strong spending power.

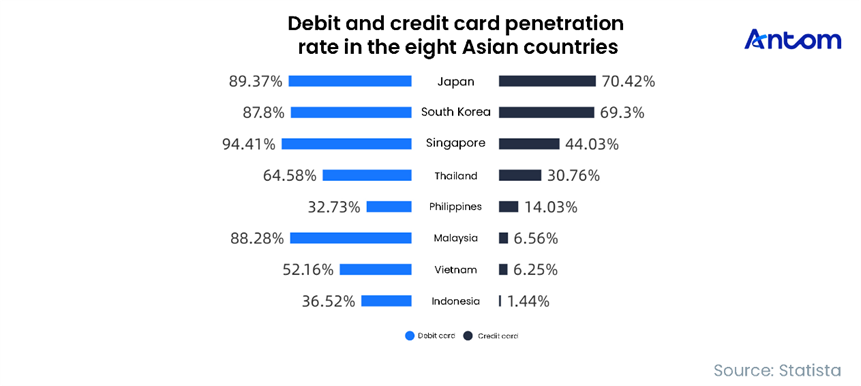

Financial adoption also differs significantly. Japan and South Korea have credit card penetration rates around 70%, reflecting mature consumer finance cultures. In contrast, Malaysia, Vietnam, and Indonesia show strong debit card ownership but low credit card penetration — less than 2% in Indonesia. Strict credit approval process and lack of formal income or credit records widen this “credit gap”, creating fertile ground for fintech innovation. Digital wallets have solved everyday payment convenience, while Buy Now Pay Later has met instalment needs for consumer who “have savings but lack credit”.

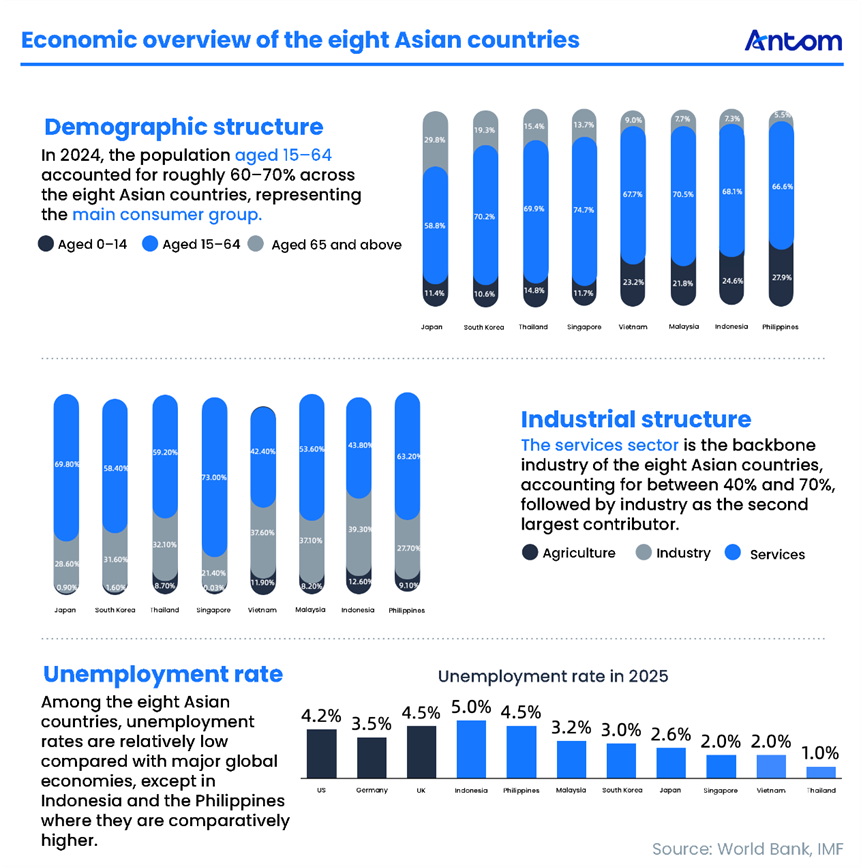

Demographic structure is another key differentiator. Vietnam, Indonesia and the Philippines have large, youthful populations — the engine of future consumption and labour growth. Japan, in contrast, is heavily affected by ageing demographics. Across all eight markets, the services sector forms the backbone of economic output. In Singapore and Japan, services account for around 70% of GDP, supporting relatively stable employment markets and mature consumer economies.

Import demand also varies sharply. Japan leads with $743.5 billion in imports, reflecting both its vast domestic demand market and outward-oriented economy. South Korea ranks second, with strong reliance on imports from mainland China. Among the Southeast Asian markets, Singapore functions as a regional trade hub due to its free-port status, while Vietnam’s rapid industrialisation has driven rising demand for raw materials, machinery and consumer goods — signalling sustained momentum.

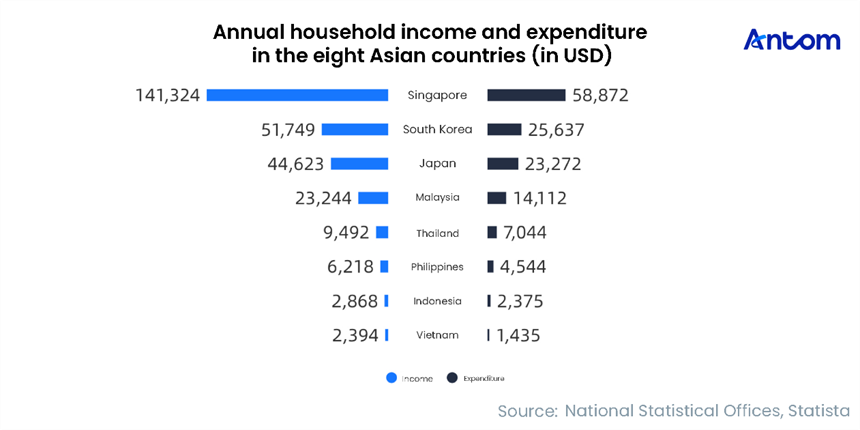

Household income and expenditure patterns reveal another layer of competitiveness. Singaporean households demonstrate the strongest purchasing power in the region. In contrast, although households in Japan and South Korea also rank high in nominal income, consumer sentiment is challenged: in Japan, inflation has eroded real incomes and constrained spending, while in South Korea, widening income disparity has weakened overall consumption vitality.

Household income and expenditure patterns reveal another layer of competitiveness. Singaporean households demonstrate the strongest purchasing power in the region. In contrast, although households in Japan and South Korea also rank high in nominal income, consumer sentiment is challenged: in Japan, inflation has eroded real incomes and constrained spending, while in South Korea, widening income disparity has weakened overall consumption vitality.