South Korea's rapid shift toward a cashless economy is transforming how people pay, with cashless payments in South Korea now standard across digital and physical retail. In this dynamic landscape, Toss Pay is emerging as a trusted digital wallet, praised for its intuitive design, robust security measures, and seamless fit within South Korea's tech-savvy retail ecosystem.

Whether you're a global e-commerce lead eyeing market expansion, a fintech strategist tracking payment trends, or a digital entrepreneur navigating Korea's local preferences, this guide will help you understand why Toss Pay is becoming an essential part of South Korea's modern payment stack—and what it means for your business growth in the region.

The rise of digital payments in South Korea

The rise of digital payments in South Korea is driven by a hyper-connected population and one of the world's most advanced digital infrastructures. Several pivotal dynamics are shaping this transformation:

- Widespread smartphone adoption: With approximately 95% of South Koreans owning smartphones, mobile-centric payment solutions are not optional—they're foundational.

- Accelerating e-commerce sector: Online retail continues its double-digit ascent, expanding at an annual rate of 22.5%, with platforms like Coupang and Gmarket setting the pace.

- Decline of cash in favour of contactless: From QR code-based transactions to mobile wallets, modern payment methods in Korea are rapidly displacing conventional cash and card usage.

In step with these shifts, localised payment methods such as Toss Pay are fast becoming integral to participating—and succeeding—in South Korea's digital economy.

What is Toss Pay?

Toss Pay (aka Toss) is a dynamic digital payment service developed by Viva Republica, the fintech innovator behind the Toss super-app. Originally launched as a peer-to-peer money transfer tool, Toss has rapidly evolved into a multi-functional financial ecosystem encompassing banking, investment management, credit profiling, and digital payments. Toss Pay serves as the app's core payment interface, designed to simplify transactions across both online and physical retail environments—helping define the future of mobile wallets in South Korea.

As of 2024, Toss boasts over 19.1 million active users and commands a market valuation estimated between 15 and 20 trillion Korean won (approximately US$11–15 billion). Since February 2024, the platform has processed more than 30 trillion won (US$20 billion) in cash transfers—highlighting its expansive reach and trusted adoption.

Toss Pay equips users with a friction-light and feature-rich payment experience, including:

- Streamlined checkout journeys: Execute seamless, cashless transactions via QR and barcode payments—accepted at over 100,000 merchants domestically and across 42 international markets.

- Built-in risk mitigation: Bolstered fraud detection capabilities proactively flag suspicious accounts before any transaction is completed.

- Loyalty-driven value: Tap into Toss Points, exclusive coupons, and lifetime zero-fee transfers to maximise spend efficiency and drive ongoing engagement.

Why Toss Pay is gaining traction in South Korea

Embedded in a holistic financial ecosystem

Toss Pay functions as more than a standalone payment utility—it is tightly interwoven into the broader Toss platform, a multifunctional app that millions of South Koreans rely on for end-to-end financial management. This includes:

- Toss Bank: A fully digital bank that caters to both domestic users and foreign residents, offering streamlined onboarding and integrated financial services.

- Toss Securities: A unified trading interface enabling users to access diverse asset classes from a single account.

- Toss Mobile: A mobile virtual network operator (MVNO) offering competitively priced mobile plans embedded within the Toss ecosystem.

- Toss Place: An in-store payment and POS system for merchants, designed to centralise transaction management through Toss Pay's infrastructure.

Rapid, resilient payment execution

Users can seamlessly link their bank accounts or cards, removing the need for repeated data input. Toss Pay employs biometric validation and end-to-end encryption, ensuring robust security without sacrificing speed.

Engaging incentive architecture

Toss Pay incorporates cashback mechanisms and merchant-linked discounts, enhancing transactional value and fostering user retention. A standout example is the partnership with leading convenience chain CU, where users transact via barcode payments linked to their bank or credit card—and earn both Toss Points and CU rewards, redeemable across over 17,000 locations nationwide.

Purpose-built for a mobile-driven market

With one of the globe's highest 5G adoption rates—45% of the population as of 2022—South Korea exemplifies a mobile-first payment culture. This makes cashless payments in South Korea not just common—but culturally expected. Even before the pandemic, digital payments had already outpaced cash, with just 14.6% of transactions in 2021 made using physical currency. Toss Pay aligns with and accelerates this behavioral shift.

Multi-channel, cross-border utility

Toss Pay supports a wide spectrum of domestic and international use cases. It is accepted on major platforms such as Coupang—South Korea's dominant e-commerce force—and across Alipay+ affiliated networks in 42 countries, including the U.S., Japan, Australia, the U.K., and Singapore. For overseas purchases, funds are debited in Korean won and settled instantly, eliminating the complexity and friction of manual currency exchange.

How Toss Pay works

Here's a streamlined overview for professionals newly exploring the Toss Pay ecosystem:

Account configuration

- Download the Toss application and navigate to the Toss Pay module.

- Tap "My Toss Pay" at the top of the screen, then select a preferred payment method and proceed with "Add."

- Choose the specific payment method and supply the requisite account credentials.

- Confirm the user agreement to successfully connect your banking or card account.

Transaction modalities

- Immediate payments: Execute purchases directly via pre-linked accounts for rapid checkout.

- Deferred payment options: Choose instalment-based terms, allowing users to apportion expenditures over time.

- Offline payments via QR: Transact at physical merchants by scanning dynamic QR codes through the app.

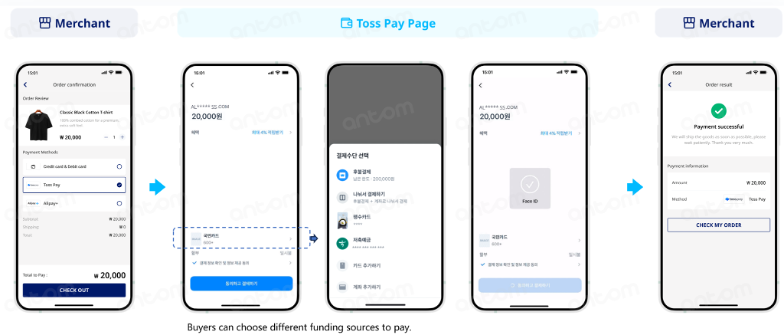

Paying on e-commerce sites using Toss Pay:

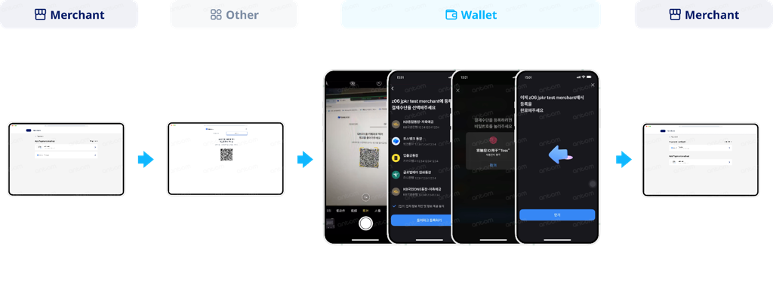

Scanning a QR or barcode using Toss Pay:

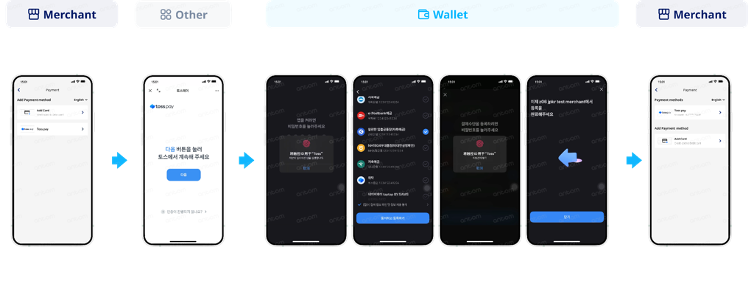

Authorisation process of Toss Pay:

Images from Antom Docs

Security architecture

Toss Pay integrates biometric verification, advanced encryption standards, and real-time fraud detection to safeguard every transaction and reinforce trust in the platform.

Loyalty and incentive mechanics

Users enjoy curated cashback rewards and merchant-exclusive deals, turning everyday purchases into opportunities for added value and increased engagement.

The strategic role of Toss Pay in South Korean e-commerce

For digital merchants, embedding Toss Pay into the payment flow can serve as a significant accelerator in South Korea's fiercely competitive online retail environment. Key advantages include:

- Seamless cross-border currency handling: Toss Pay streamlines the payment experience by bypassing the need for third-party currency conversion tools. Customers can complete purchases in Korean won directly from their linked accounts, minimising checkout friction and mitigating cart abandonment rates.

- Expanded consumer access: With a user base exceeding 24 million individuals, businesses integrating Toss Pay unlock immediate exposure to a broad and digitally engaged audience—an essential lever for growth in a saturated marketplace.

- Elevated brand trust: Toss Pay benefits from the strong reputational capital of its parent company, Toss—one of South Korea's highest-valued fintech unicorns. As the nation's third-largest digital wallet, Toss Pay is perceived as secure, stable, and user-centric—attributes that bolster consumer assurance and drive higher conversion rates in digital storefronts.

How Toss Pay stands apart from alternative payment methods

While operating within a highly competitive landscape, Toss Pay distinguishes itself through the following strategic advantages:

- Holistic financial convergence: As a core component of the Toss ecosystem, Toss Pay grants users seamless access to a suite of financial management tools—ranging from budgeting analytics and expense tracking to investment insights. It functions as a centralised financial command centre, offering consolidated visibility into account balances, loan obligations, and portfolio performance. Additionally, it empowers users to monitor and enhance their creditworthiness in real time.

- Market-calibrated design: Engineered specifically with South Korea's digital behaviours and commerce environment in mind, Toss Pay is tailored to align with localised consumer expectations. Given South Korea's position as one of the largest and most digitally advanced e-commerce markets globally, Toss Pay's deep integration with leading platforms like Coupang is a deliberate, market-informed decision that enhances relevance and transactional efficiency.

Why e-commerce operators should pay attention to Toss Pay

Integrating modern payment platforms like Toss Pay can deliver strategic advantages for e-commerce enterprises operating in South Korea:

- Engage emerging digital-native consumers: Toss Pay resonates strongly with South Korea's younger, mobile-first demographic—users who prioritise speed, simplicity, and seamless digital interfaces over cumbersome manual checkouts. Supporting Toss Pay can capture this highly engaged, conversion-oriented audience segment.

- Strengthen post-purchase retention: By leveraging Toss Pay's built-in loyalty architecture—including wallet-native rewards and the potential for bespoke incentive programs—merchants can foster habitual purchasing and build long-term brand affinity.

- Maintain competitive relevance: As Toss Pay continues to expand its footprint, offering it at checkout has become a differentiator. Merchants that enable Toss Pay align themselves with prevailing user preferences, improve payment UX, and position themselves to convert more high-intent traffic into revenue.

Capturing South Korean digital consumers through frictionless payments

Toss Pay is redefining the trajectory of digital transactions in South Korea. By emphasising fortified security protocols, streamlined usability, and high-engagement incentives, this e-wallet is not only reshaping consumer payment behaviour but also unlocking meaningful growth levers for merchants.

For e-commerce leaders, integrating Toss Pay is more than a technical enhancement—it's a strategic move toward cultivating stronger alignment with South Korea's mobile-first, digitally fluent shopper base.

As digital payments in South Korea continue to evolve, platforms like Toss Pay are central to how merchants connect with new generations of mobile-first consumers.