Preface

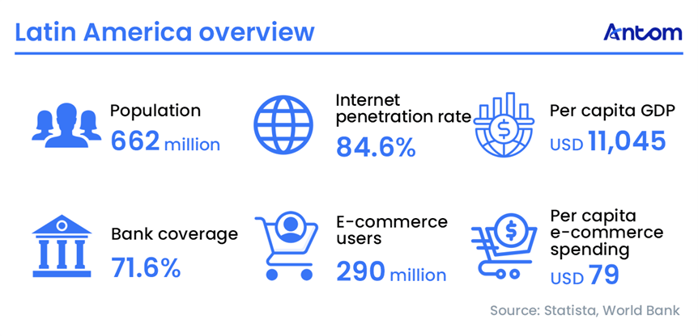

Latin America is emerging as e-commerce's next growth engine, combining a vast 662 million population with accelerating digital transformation and rising consumer wealth. Here in this report, we are examining how the region’s expanding internet penetration—now exceeding 84%—and youthful working-age majority are fuelling rapid online adoption. E-commerce sales are projected to grow at a 9.43% CAGR through 2029, yet online retail still counts for just 12–15% of total spending, underscoring vast untapped potential. As digital payments diversify and cross-border trade strengthens, Latin America is poised to evolve from an emerging digital frontier into one of the world’s most dynamic, high-opportunity commerce markets.

Key Insights

- Latin America is projected to grow at a CAGR of 9.43% in e-commerce between 2025 and 2029, making it the second fastest-growing region globally.

- E-commerce penetration is still low, with online sales comprising just 12–15% of total retail, compared to 45% in China and 25–30% in mature markets.

- Market competition is intense on platforms like Mercado Libre, while independent sites are gaining traction as merchants seek control over their customer relationships.

- Social media and influencer marketing play a critical role in building consumer trust, with WhatsApp-based conversational commerce now widespread.

- Last-mile logistics, especially in urban areas, rely heavily on motoboy courier networks, which directly influence customer satisfaction.

- Payment systems are highly fragmented, requiring merchants to adopt localised solutions tailored to each country.

- Brazil’s Pix has become a nationally adopted instant payment platform, exemplifying rapid digital payment adoption.

- Instalment payments are a widespread consumer norm, extending beyond high-value purchases to everyday transactions.

- Merchants must closely monitor currency volatility, particularly in countries like Argentina, where exchange rate shifts can significantly impact profitability.

Why Latin America is the next frontier for cross-border e-commerce

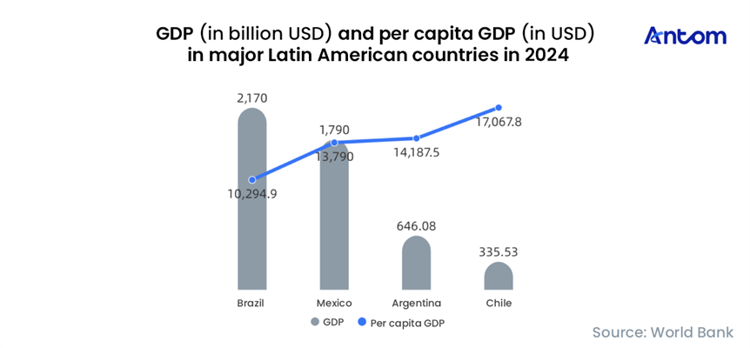

Latin America — supported by a large population and fast-moving digital transformation — is emerging as a high-potential ‘blue-ocean’ for global e-commerce. Compared with Southeast Asia, where competition has intensified, Latin America offers unique structural advantages and strong long-term growth potential. The region has around 662 million people, creating a vast consumer market. Per capita GDP has already surpassed USD 10,000, significantly higher than most Southeast Asian countries, underscoring stronger purchasing power.

Internet penetration has reached 84.6%, laying a solid foundation for digital economy expansion. Today, Latin America has around 290 million e-commerce users, indicating considerable headroom for further growth as more internet users convert into online consumers.

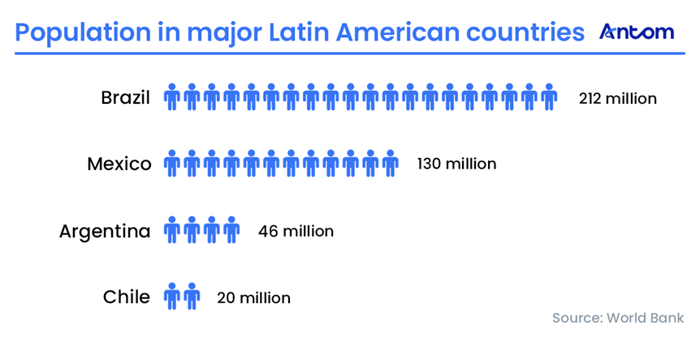

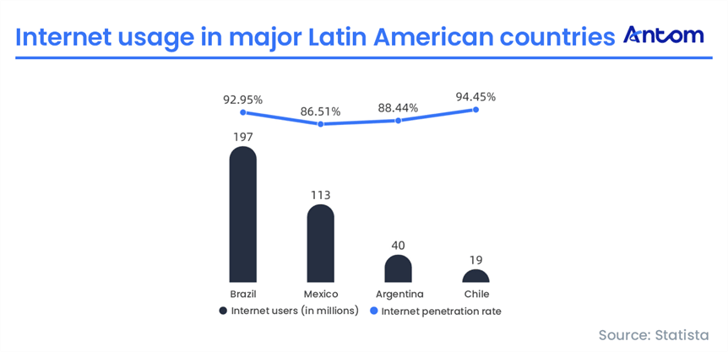

Among major economies, Brazil leads the region with a population of 212 million. Combined with Mexico, Argentina, and Chile, these four countries represent 408 million people — roughly 60% of the regional total — and form the core target markets for cross-border merchants. Brazil is also the largest digital economy, ranking first in both internet users and e-commerce sales.

Internet penetration across Brazil, Mexico, Argentina and Chile has surpassed 85%, with Chile reaching 94.45%, demonstrating mature digital infrastructure. Together, these markets form a digital population of more than 360 million Internet users, offering substantial opportunities for the e-commerce growth.

From a macroeconomic standpoint, Brazil recorded a GDP of $2.17 trillion in 2024, the largest in the region. Although Argentina and Chile have smaller economies overall, their per capita GDP is higher. According to Credit Suisse’s 2019 Global Wealth Report, Chile is the wealthiest country in Latin America, with per capita wealth more than five times that of Argentina and more than double that of Brazil.

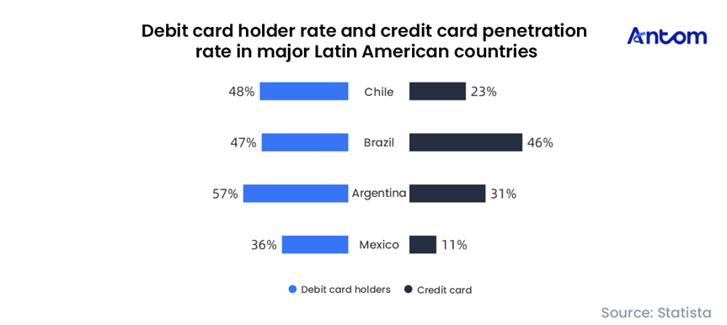

Financial inclusion varies across markets. Brazil is the most mature, where debit card ownership (47%) is on par with credit card penetration rate (46%), supported by the rapid rise of instant payment systems such as Pix. Brazil also leads the region in credit card usage. Mexico, however, has comparatively lower penetration of financial services with large disparities between urban and rural populations. Strict credit approval requirements have also further limited credit card issuance.

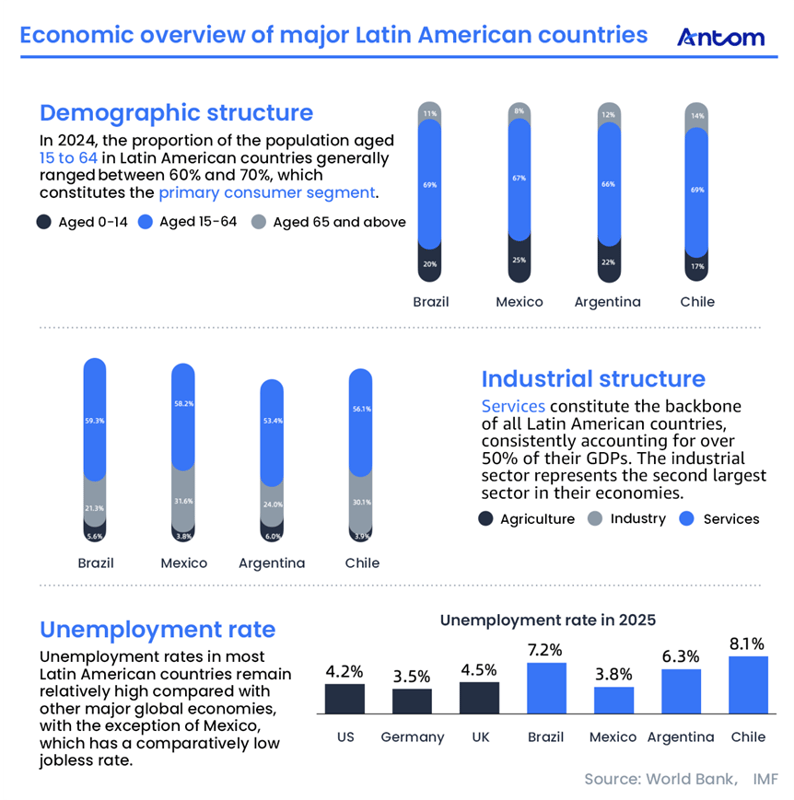

The working-age population (15–64) drives regional consumption. In Brazil, Mexico, Argentina and Chile, this group accounts for 60% to 70% of the total population, reflecting a youthful demographic structure. The service sector consistently accounts for over 50% of GDP, forming the backbone of these economies. Labour market conditions vary: Mexico’s unemployment rate in 2025 remains relatively low, while other markets face higher levels compared with major global economies.

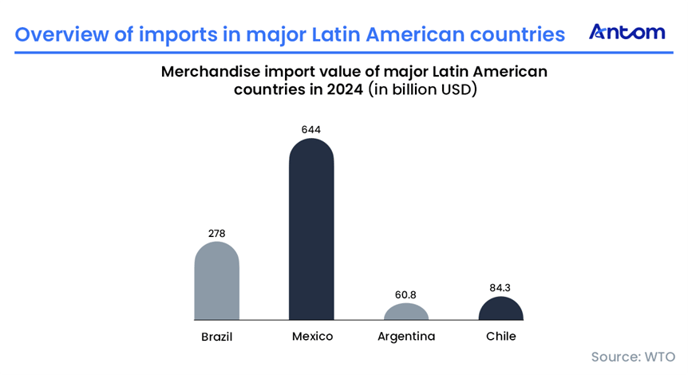

In goods imports, Mexico leads Latin America, reaching $644 billion in 2024, driven by proximity to the United States and trade agreements such as NAFTA. Mexico imports large volumes of mechanical and electrical products and automotive parts, while categories such as textiles, furniture, toys, and sporting goods have also gained a strong market penetration.