DuitNow is Malaysia's real-time payment system designed to simplify the way people and businesses transfer money and complete transactions. Operated by Payments Network Malaysia (PayNet) and regulated by Bank Negara Malaysia (the country's central bank), DuitNow offers a range of digital payment services, including DuitNow Transfer, DuitNow QR, and DuitNow Requests.

As Malaysia moves toward a fully digital economy, DuitNow has set the foundation for inclusive, real-time, and reliable financial transactions. With its integration into nearly all major banks and e-wallets, DuitNow is the payment method of choice for millions of Malaysians.

For e-commerce merchants who want to expand into Malaysia, accepting DuitNow payments is crucial. Read on to learn more about DuitNow's key features and benefits, and how online merchants can accept it as a payment method.

What Is DuitNow?

Launched in 2018, DuitNow is an electronic transfer service that facilitates money transfers within Malaysia using mobile phone numbers instead of bank accounts. By doing this, DuitNow aims to boost financial inclusion in Malaysia by enabling digital transactions for people without bank accounts. The service assigns each user a DuitNow ID, such as a mobile number, national ID, or email address. Individuals with bank accounts can also link these accounts to their DuitNow ID, making money transfers quicker and more seamless.

DuitNow has since expanded its service offerings, including QR code payments and electronic payment requests.

Key features of DuitNow

DuitNow streamlines the transaction process for customers and businesses by using innovative, easy-to-use payment methods:

1. DuitNow Transfer

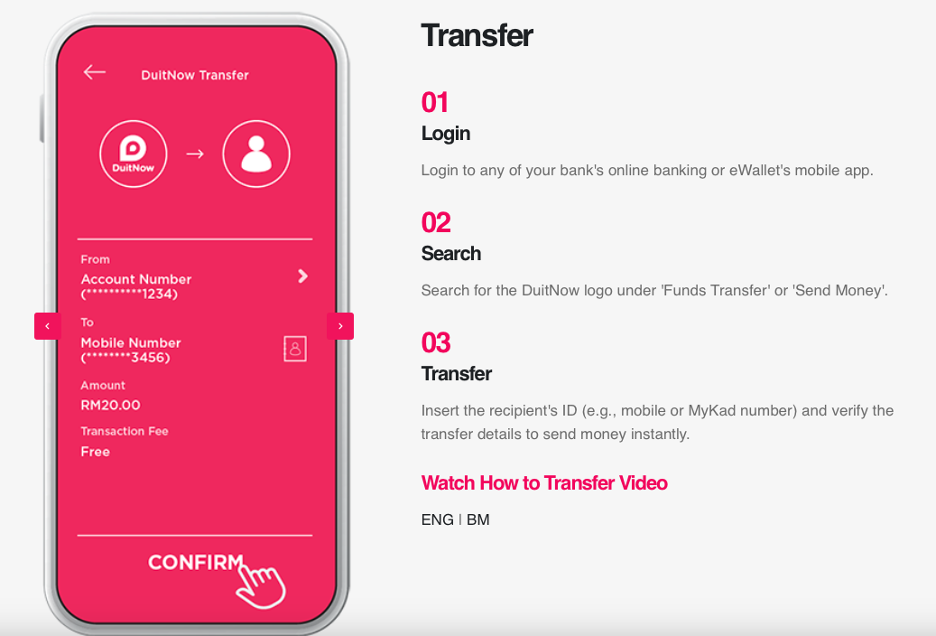

DuitNow Transfer is the platform's most commonly used feature, allowing users to transfer money to friends, family, or businesses. All you need is the recipient's DuitNow ID, such as their mobile number, email, or national ID. Alternatively, you can send money directly to a bank account if you have the account number.

Steps to use DuitNow Transfer:

- Log in to your mobile banking app or online banking portal.

- Select "DuitNow Transfer".

- Enter the recipient's DuitNow ID or account details.

- Verify the transaction details.

- Confirm the payment and receive a payment notification instantly.

2. DuitNow QR

DuitNow QR is a standardised QR code payment system that enables users to make payments to merchants or peers by simply scanning a QR code. It's widely accepted across Malaysia, from retail stores to e-commerce platforms.

As of December 2024, over 40 bank and non-bank players have adopted DuitNow QR. DuitNow QR transactions have more than doubled — from 125 million transactions valued at RM5.5 billion in 2022, to 360 million transactions valued at RM14.6 billion in 2023.

How DuitNow QR works:

- Merchants display a DuitNow QR code at their checkout counters or on invoices.

- Customers scan the QR code with their banking app or e-wallet.

- Enter the payment amount (if not pre-filled), confirm, and complete the transaction.

3. DuitNow Request

DuitNow Request allows individuals or businesses to send requests for money to other users. This feature is especially useful for invoicing or splitting bills among friends and colleagues.

How DuitNow Request works:

- The requester initiates a payment request by entering the payer's DuitNow ID or mobile number.

- The payer receives a notification and approves the request.

- Once approved, the requested amount is transferred instantly.

4. DuitNow Online Banking/Wallets

DuitNow Online Banking/Wallets is a service that provides app-to-app, app-to-web, web-to-web redirection from online shopping carts to payment apps. Customers on e-commerce and m-commerce sites can select the DuitNow Online Banking/Wallets option upon checkout. The service automatically redirects the customer to their preferred online bank or e-wallet app.

5. DuitNow AutoDebit

Through this service, merchants can collect recurring payments from customers after the customer provides their consent. The customer only has to give consent once, when they initiate the payment; the subsequent monthly collections are done automatically. DuitNow AutoDebit enables payment collection from current accounts, savings accounts, line of credit accounts, and e-wallets.

6. Cross-border QR payment

Malaysians travelling to Indonesia, Singapore, Thailand and China can use their mobile wallets or apps to scan QR codes from selected payment service providers. Alipay+ global merchants also accept DuitNow QR payments.

Conversely,travellers with Alipay+ partner e-walletsfrom China, Hong Kong SAR, Philippines, Mongolia, Macau SAR, Japan, South Korea and Thailand can also pay via DuitNow QR codes at merchant outlets in Malaysia. In fact, payments made through Alipay+ make up more than 80% of inbound QR paymentsvia DuitNow in the country.

Benefits of DuitNow

Both businesses and consumers can benefit from DuitNow's rich feature set and advantages over traditional cash payments.

For customers

- Pay in different ways: No need to remember lengthy bank account numbers. Payments can be made using just a DuitNow ID, mobile number, or QR code.

- Complete payments faster: DuitNow offers real-time payments, ensuring funds are transferred immediately.

- Avoid high transaction fees: DuitNow transfers are either free or come with minimal charges for most transactions.

- Gain peace of mind with security measures: Transactions are protected with encryption and multi-factor authentication, ensuring secure fund transfers.

For businesses

- Reach more consumers without credit cards: DuitNow QR eliminates the need for cash or card machines, making it ideal for Malaysian merchants and small businesses.

- Access funds quickly: With instant fund transfers, merchants and businesses receive their funds instantly, improving cash flow.

- Offer a better customer experience: Businesses can offer their customers a simplified checkout process and access to their preferred payment method. This is important as the lack of a preferred payment method is one common cause of cart abandonment.

- Scale your business faster: DuitNow works for both small businesses and large organisations by supporting bulk payments, invoicing, and customer payment requests.

Security Features

DuitNow places a strong emphasis on ensuring secure transactions for users:

- Encryption:All DuitNow transactions are encrypted, protecting sensitive transaction details.

- Authentication:Multi-factor authentication ensures that only authorised users can initiate payments.

- Regulatory oversight: DuitNow operates under the supervision of Bank Negara Malaysia, ensuring compliance with national regulations.

Transaction limits and fees

First-time DuitNow users should be aware of key limitations on transactions.

Transaction limits:

- DuitNow has daily transaction limits and MYR per transaction caps, which vary based on the bank or service provider. Customers can adjust these limits within their mobile banking apps.

Fees:

- DuitNow transfers are typically free for personal users, while businesses may incur minimal charges depending on the transaction volume and provider.

How to register for DuitNow

Getting started with DuitNow is quick and straightforward for customers and merchants alike.

For customers:

- Log in to your preferred bank app or e-wallet.

- Go to the DuitNow registration section.

- Select your DuitNow ID (e.g., mobile number, email, or national ID).

- Link your DuitNow ID to your bank account.

- Confirm registration and start using DuitNow for seamless payments.

For merchants:

- Register with a participating DuitNow merchant service provider.

- Generate and display your unique DuitNow QR for customers to scan.

- Start accepting payments and receive instant funds into your linked account.

Why should international merchants accept DuitNow payments?

DuitNow simplifies payments for individuals and businesses, combining speed, security, and convenience. Its wide acceptance and real-time capabilities make it ideal for fast, cashless transactions — whether you're accepting payments, paying suppliers, or transferring money across banks.

The interoperability provided by DuitNow also encourages financial institutions and consumer companies to keep up with digital finance technology, driving innovative product offerings for various merchant segments.

DuitNow's QR code payments also lower costs for merchants, since it doesn't require them to rent point-of-sales terminals needed to accept credit card payments. Through its connection to other international payment systems like Singapore's NETS, Thailand's PromptPay, and Indonesia's QRIS, it also allows merchants to accept paymentsin different currencies.

By accepting DuitNow payments, merchants gain the following benefits:

- Real-time payments: Transfers are completed instantly, 24/7, regardless of the recipient's bank. The appetite for real-time payments in Malaysia is growing. Real-time payment transaction value in the country is expected to grow from USD495.5 billion in 2023 to US$928.8 billion in 2028, according to the How Southeast Asia Buys and Pays 2025 reportby IDC.

- Ease of use: Users can make payments using mobile apps or online banking without needing to provide bank account details. With the DuitNow Online Banking/Wallets redirection service, you can also offer your customers a simplified checkout process.

- Wide acceptance: DuitNow is supported by all major banks and e-wallets in Malaysia.

- DuitNow QR: This unified QR code system allows quick and secure merchant payments.

Simplify payments with DuitNow

DuitNow is transforming the way money moves in Malaysia by offering quick, secure, and seamless payment solutions. From instant fund transfers to unified QR code payments, DuitNow caters to the needs of both consumers and businesses.

With its strong backing by Bank Negara Malaysia and nationwide acceptance, DuitNow is a step toward a more efficient and connected financial future.

Whether you're managing personal finances or running a business, DuitNow provides a trusted and innovative way to handle all your transactions. Reap competitive benefits by integrating DuitNow into your online store via a payment platform like Antom. Contact us to learn more about DuitNow and other payment methods around the world: https://www.antom.com/contact-us