Mobile payments are rapidly gaining popularity in Asia, transforming countries into cashless markets and global leaders in e-wallet use. For international merchants entering Asian markets, understanding the top e-wallets across the region is crucial for gaining insights into local payment behaviors.

In the Philippines, one e-wallet option is the BPI app by the Bank of the Philippine Islands (BPI), established in 1851 as the first bank in Southeast Asia.

Today, BPI is one of the widely-used main banks in the Philippines, and its mobile banking app is one of the most popular in the country. This makes the BPI app a must-know for merchants looking to tap into the Philippine market. Here's what you need to know about the app and its capabilities.

Features of the BPI app

The BPI app is the mobile banking platform for BPI customers. It allows users to view and manage their BPI bank accounts, loans, credit cards and online payments. Other capabilities include transferring funds, paying bills, and making cashless payments both in-store and online.

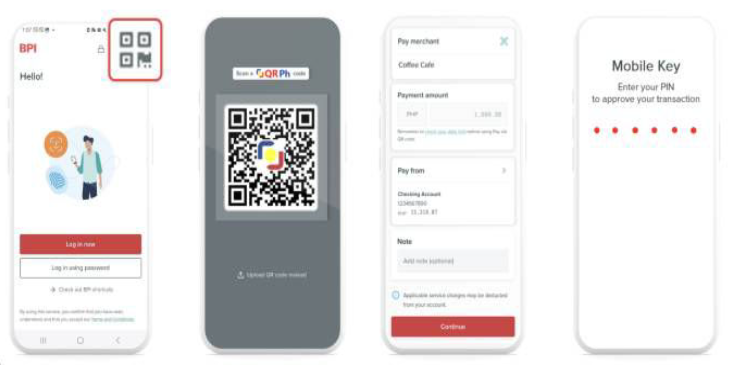

The app prioritises security with features like mobile key and biometric authorisation, SMS PIN, and transaction limits for fund transfers. In cases of loss or fraud, users can temporarily or permanently block their credit cards directly from the app.

Payment methods offered by BPI

For international merchants looking to understand payment options in the Philippines, the BPI app offers a suite of digital payment features catering to a wide range of customer needs. These include:

- Mobile wallet top-ups: Users can use the app to top up their mobile wallets and super apps, including popular options like GCash, Maya, Grab, and more, supporting seamless integration with other digital payment platforms

- Bill payments: Customers can pay bills to over 1,000 local billers by inputting a payment reference number or enrolling frequent billers. Payments can be scheduled in advance, and the Auto Debit Arrangement ensures timely payments.

These features highlight the app's capability to handle various cashless payment needs, making it a versatile tool for managing transactions in the Philippine market.

QR codes: From fund transfers to payments

Those interested in exploring payment options in the Philippines will see that QR codes within the BPI app are a highly adaptable solution. The Pay via QR function enables users to make direct payments to merchants using QR Ph standard codes, using the balance from their BPI bank accounts for entirely cashless transactions.

- Merchant payments: By integrating QR code functionality, customers can tap the Pay via QR option in the app to complete transactions online and in-store seamlessly. This feature simplifies the payment process, making it more attractive to tech-savvy shoppers

- Fund transfers: QR codes aren't just for payments. BPI app users can generate a unique QR code linked to their specific savings account, allowing them to receive funds quickly. They can share this code with anyone for an easy and secure way to receive money

- Inter-bank transfers: Users can scan QR codes from other BPI users or even from other local banks to transfer funds, adding another layer of convenience and flexibility to the app's offerings

By accepting QR code payments, merchants can provide a fast and efficient payment method, reducing friction at checkout and enhancing the overall customer experience.

Accepting payments from the BPI app

Furthermore, with BPI's Alipay integration, overseas merchants can now accept payments from Philippine shoppers using the BPI app, facilitating cashless global shopping payments.

The advantages of this integration include:

- Seamless checkout: When a Philippine shopper opts to pay via BPI, the payment is redirected through Alipay at checkout. This streamlined process makes it easier for international transactions to be completed without hiccups

- Wide reach: With over four million downloads and the backing of BPI's trusted reputation, the app is a crucial digital payment option in the Philippines. By offering this local payment method, you can tap into a large customer base

- Reduced cart abandonment: Providing preferred payment options like the BPI app can significantly reduce cart abandonment rates - by as much as 32%. This can translate into higher conversion rates and increased sales

Accepting payments outside the Philippines via the BPI app

Expanding into the Asia Pacific market means navigating a complex landscape with diverse payment preferences. Merchants must offer local payment methods to improve conversion rates and meet customer expectations, because there are strong local payment preferences in every market. These challenges make it essential to partner with a payment service provider with an established network in the Asia Pacific, including Southeast Asia and the Philippines.

A single integration with Antom provides access to 1.7 billion consumers. By offering a wide range of APAC's most widely-used payment methods, including prevalent e-wallets for each market, Antom can enhance your payment success rates in the Asia Pacific. This enables you to offer the local payment methods most used by shoppers and accept payments across the region.

Interested in unlocking growth in this region? You can contact us by completing the form below: